Stormy Seas for Commodities – Cross Currents Ahead

Anastasia Lais

Background

The current complexities we face now in the financial markets, the binary expectations of how risk assets will perform from here on as well all the almost consensus view on the impending recession all have their roots in the unexpected Covid-19 pandemic that ambushed the world in 2020.

To battle the vaporisation of aggregate demand and economic activity back then in 2020, central banks and governments worldwide unleashed both fiscal and monetary stimulus. Led of course by the US Federal Reserve (FED) who cut rates from 1.50% to 0.25%. The uneasy and complex relationship that developed between the Fed (led by Powell) and the Treasury (led by ex Fed Chair Yellen) was confusing to all except the most forensically inclined accountants. Suffice to say, the Fed balance sheet ballooned in tandem with stimulus checks which most attributed to the phenomenal recovery in risk assets, especially equities. It was not until almost a full 2 years later in March 2022 that we started to hear whispers of quantitative tapering and rate hikes, precipitated no doubt by the Russia-Ukraine conflict which led to a temporal (hindsight) spike in energy prices which in turn sparked the battle on inflation.

Any hints from history?

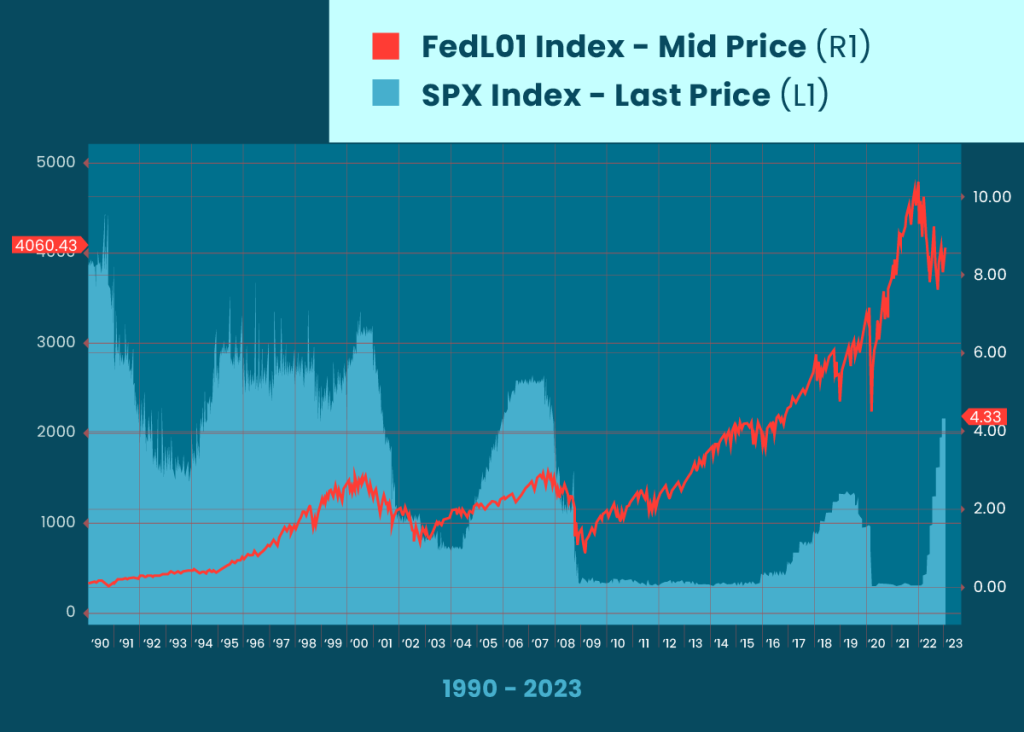

Historically, underperformance (read selloff) in equities prima facie appears to begin once the Fed pauses hikes (now it’s called pivot). This was the case in the early 2000s and during the Global Financial Crisis in 2008 (Refer to Figure 1). Unsurprisingly given the lag in monetary policy – believed to be 6-9 months. But how long will the Fed pause this round and will this time be any different? Well, the circumstances now are certainly very different.

While the stimulus effects from a low-interest rate environment and outright stimulus checks were well documented, the supply chain complexities were completely unforeseen. How many could have predicted the timing of container ships getting stuck in the Suez or Panama Canal? Or that a pandemic outbreak would lead to a labour shortage at ports causing never before experienced ship lineups? Or that falling labour participation rates could bring trucking logistics to a standstill? Even Putin’s ambitions were unexpected, except allegedly by Xi. The perfect storm of consumer stimulus and supply chain bottlenecks, created the perfect environment for inflation.

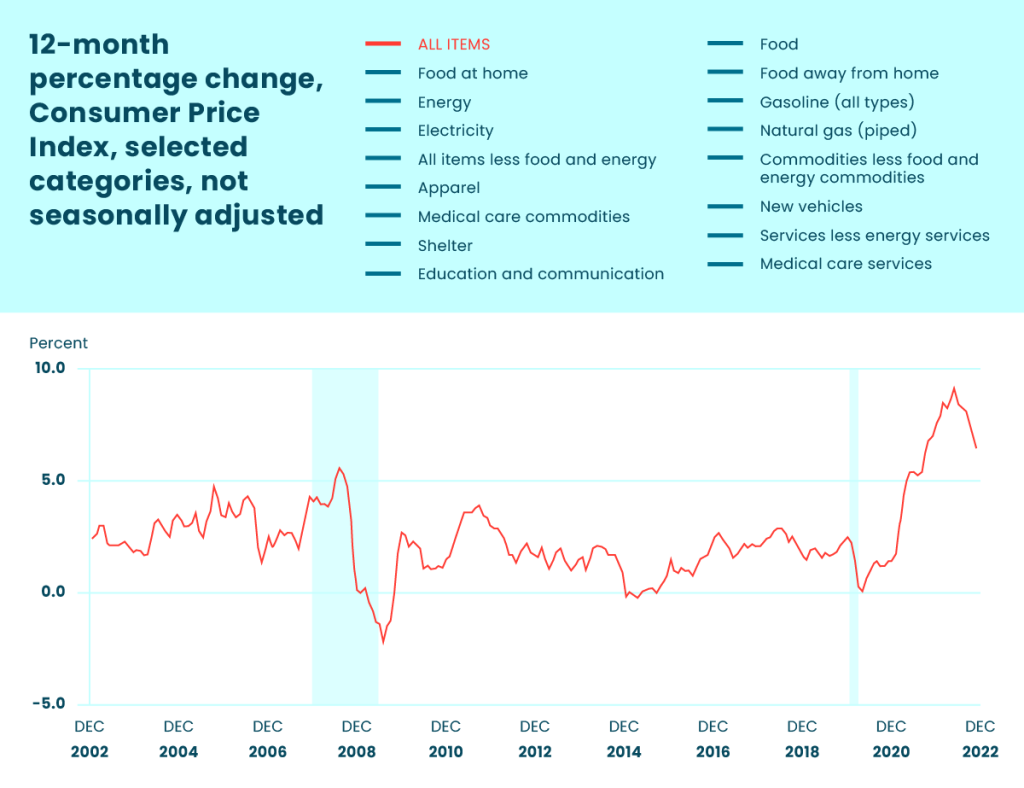

The YoY consumer price index, jumped from 1.4% in January 2020 to 9.1% in June 2022 (Refer to Figure 2). It’s been 10 months since the first hike in16 March 2022, as the Fed in an almost global concerted effort hiked to battle inflation. Is relativity relevant this time round? We’re standing nervously at 4.5% now since 14 December 2022. The last peak in Fed rates was in 2007 at 5%, but then the LAST round was different with the GFC. Pile on the politically charged discussions on windfall tax on oil producers and the drawdown on the SPR, and the situation facing the Fed is as complicated as it gets.

All good things must come to an end

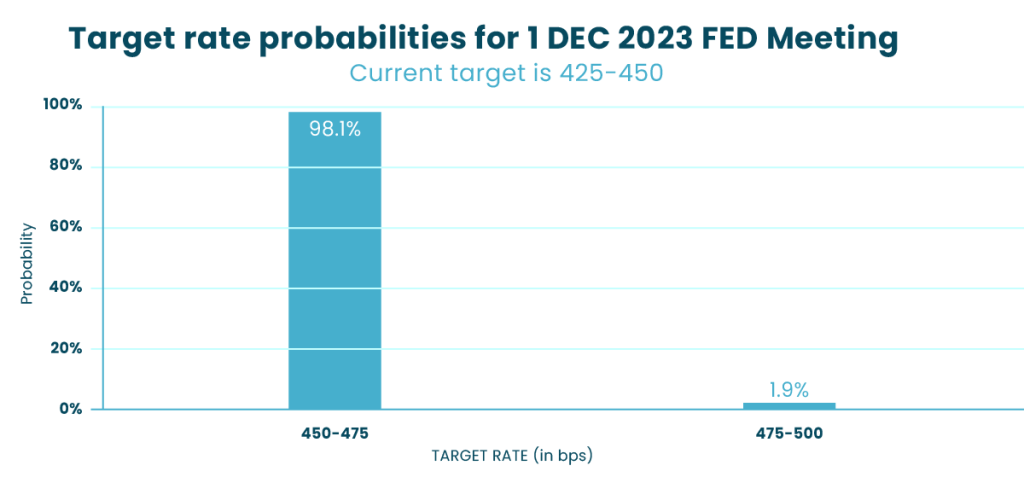

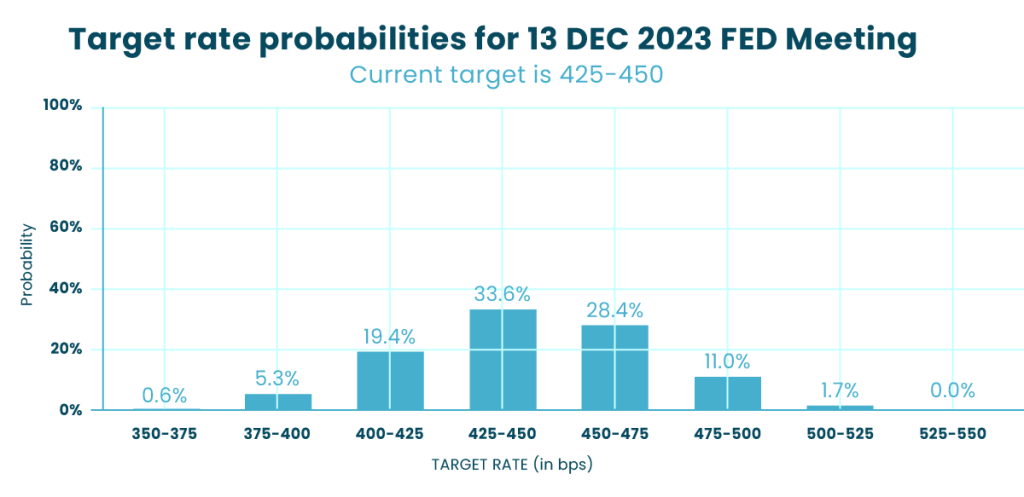

Perhaps we’re already starting to see the rate hikes finally taking effect – CPI softened down to 7.1% on December 13, 2022. Everyone on the street is expecting a recession, but no one has really explained what that means this time round. In Jan 2023, Powell mentioned continued tightening, while Waller, along with other policymakers, has said that he favours a 25bp rate hike in February – pretty much in line with market expectations (98.1%) of a 450-475 target rate in Feb and 425-450 by end 2023 (Refer to Figure 3 and 4). Clearly, the street is expecting a rate pause and an almost immediate cut into 2024. Really? There is still a considerable way to go towards the Fed’s 2% inflation goal.

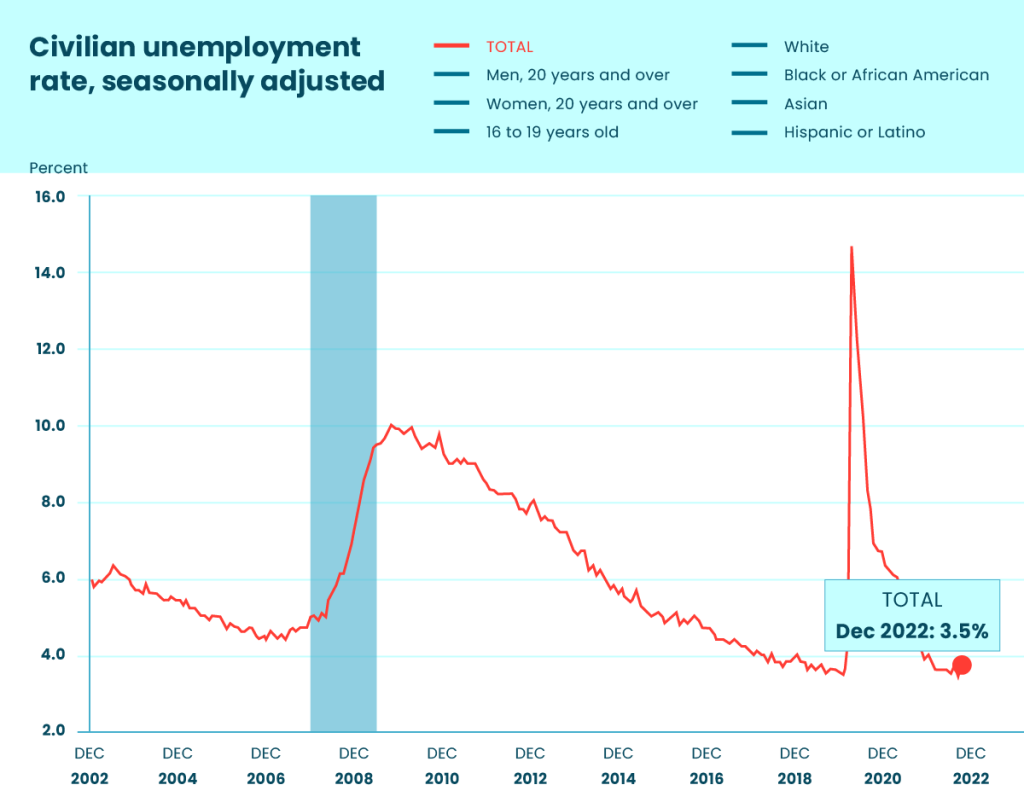

Adding to the complexity is the view that economic activity is holding up well, with Q4 GDP YoY around 2%. U.S. Unemployment rate has remained at all time lows around 3.5% for November & December 2022 (Refer to Figure 5), NFP has maintained at healthy levels >200k, and wage growth is positive yet we’re starting to see extensive job cuts across tech giants. Housing starts have declined as expected amidst the talk of record high mortgage rates not just in the US, but residential valuations remain lofty whereas defaults in the commercial real estate space have gotten some worried about REITs. Maybe a healthy job market is all that’s holding up all those mortgage payments.

Future Outlook

Market expectations appear to have priced in a 5% rate and a CPI print of 2% for this year. Almost everyone seems to expect a recession, but the lean seems to be for a soft(er) landing and a short(er) burst of pain. For us, it seems the only shoe left to drop remains in the job market but even that seems uncertain given widespread anecdotal shortages. Here in Singapore, the F&B sector has resorted to sign on bonuses to deal with the shortage – ever wonder where all this money is coming from? Commodities prices have declined 30-50% from the peak in most instances. While it’s not been as dramatic has tech stocks, the lagged stimulatory effect on consumption should not be brushed aside. Any departure from the two numbers above is sure to spark some excitement, but we’ll be watching commodities and jobs for sure.

Disclaimer

Please refer to our terms and conditions for the full disclaimer for Stoic Capital Pte Limited (“Stoic Capital”). No part of this article can be reproduced, redistributed, in any form, whether in whole or part for any purpose without the prior consent of Stoic Capital. The views expressed here reflect the personal views of the staff of Stoic Capital. This article is published strictly for general information and consumption only and not to be regarded as research nor does it constitute an offer, an invitation to offer, a solicitation or a recommendation, financial and/or investment advice of any nature whatsoever by Stoic Capital. Whilst Stoic Capital has taken care to ensure that the information contained therein is complete and accurate, this article is provided on an “as is” basis and using Stoic Capital’s own rates, calculations and methodology. No warranty is given and no liability is accepted by Stoic Capital, its directors and officers for any loss arising directly or indirectly as a result of your acting or relying on any information in this update. This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.