Unwrapping the Cocoa Conundrum: Analyzing the Surge in Prices

Yi Ming L.

Navigating Commodity Price Spikes

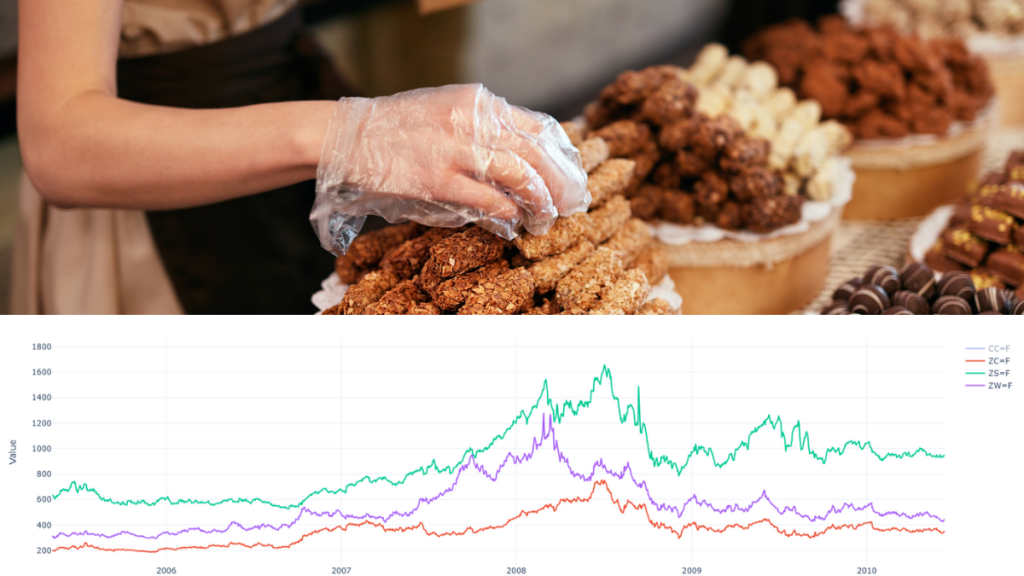

The interplay between environmental disasters, geopolitical actions, and economic policies can lead to volatile swings in commodity prices, deeply impacting global economies and the daily lives of people around the world. Events such as the 2010-2013 Southern United States and Mexico drought, the 2007-2008 world food price crisis might explain the dramatic escalation in cocoa prices present a complex landscape for understanding the multifaceted nature of these fluctuations.

The 2007-2008 World Food Price Crisis

The crisis of 2007-2008 highlighted how a combination of factors, including droughts in key producing regions such as Ukraine, Argentina and Australia, the diversion of crops to biofuel production in The United States and Europe, speculative trading, restrictive trade policies such as import and export bans on food, and the depletion of food stockpiles, can lead to sharp increases in commodity prices. This underscored the interconnectedness of environmental, economic, and policy-driven factors in the global food market.

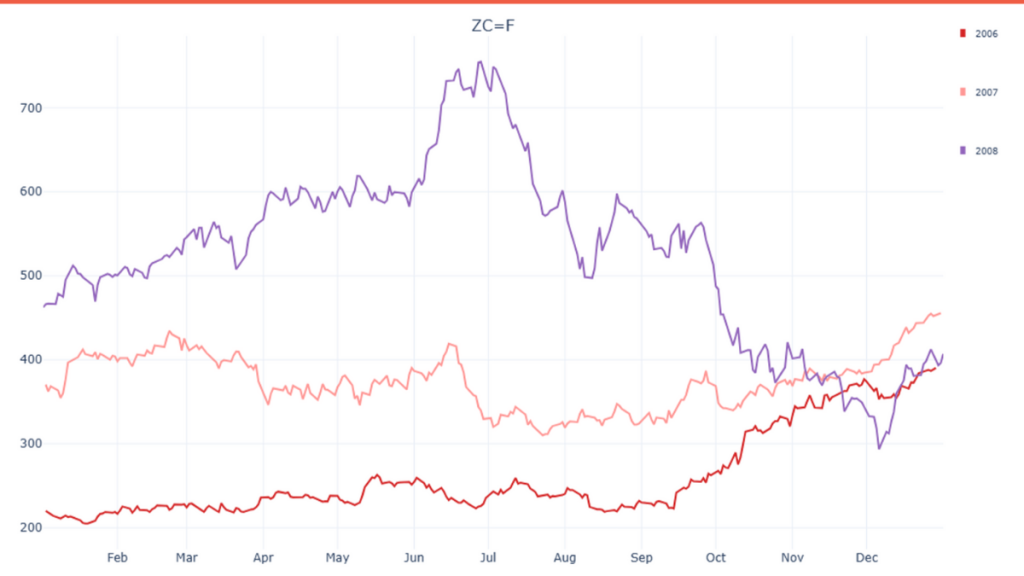

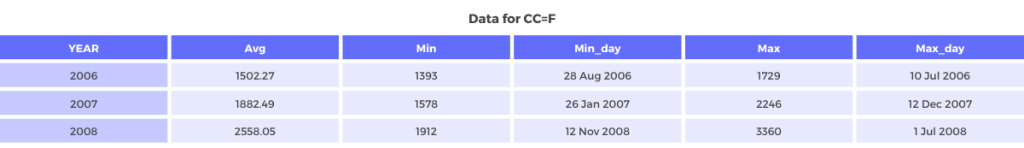

Statistics on price movements:

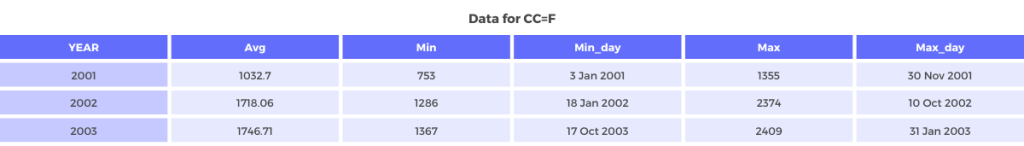

From the diagrams, a slow and steady increase for the commodity prices can be observed during the 2006 and 2007, where the prices started increasing around September and October 2006, followed by a consistent price increase throughout 2007, which led to a stronger price uptick in the first half of 2008, before going down significantly in the second half of 2008, maintaining at around early 2007 prices. This shows that price trends can be a multi-year affair due to prolonged effects of the aforementioned causes, which was resolved eventually through a multifaceted response from governments that eased trade restrictions, releasing stocks, assisting in critically affected regions and long term investments in the agricultural sector.

2010-2013 Southern United States and Mexico drought

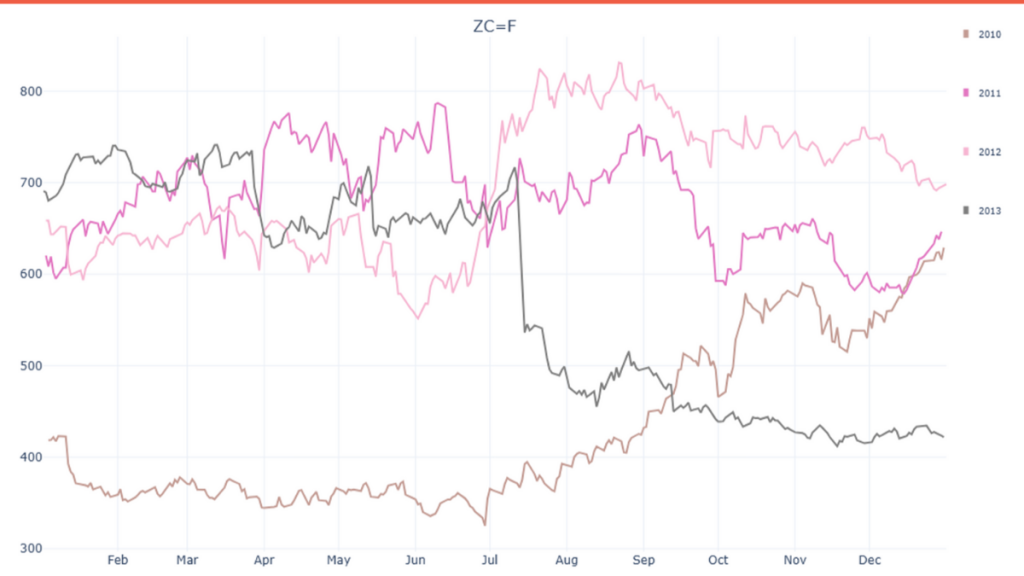

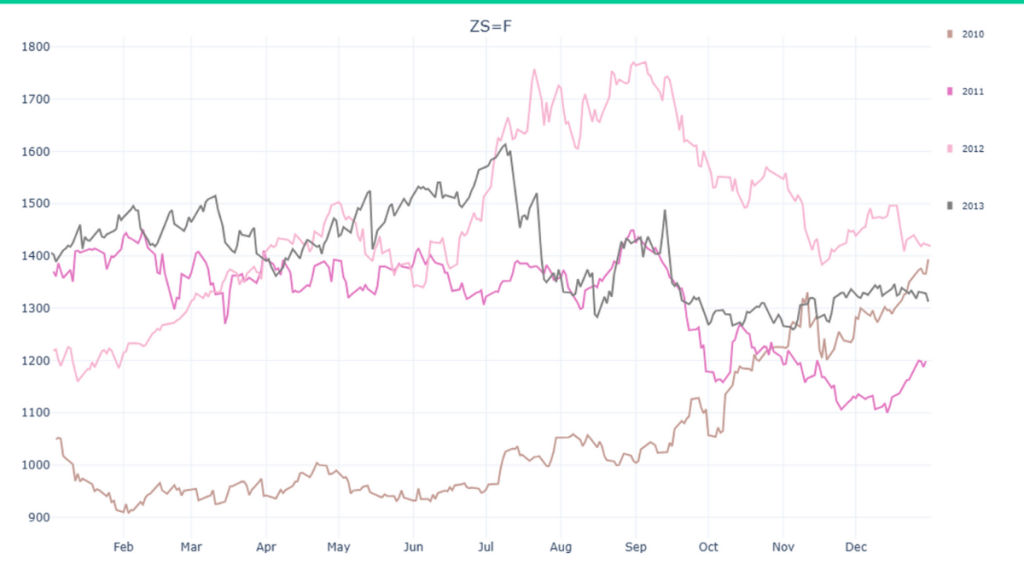

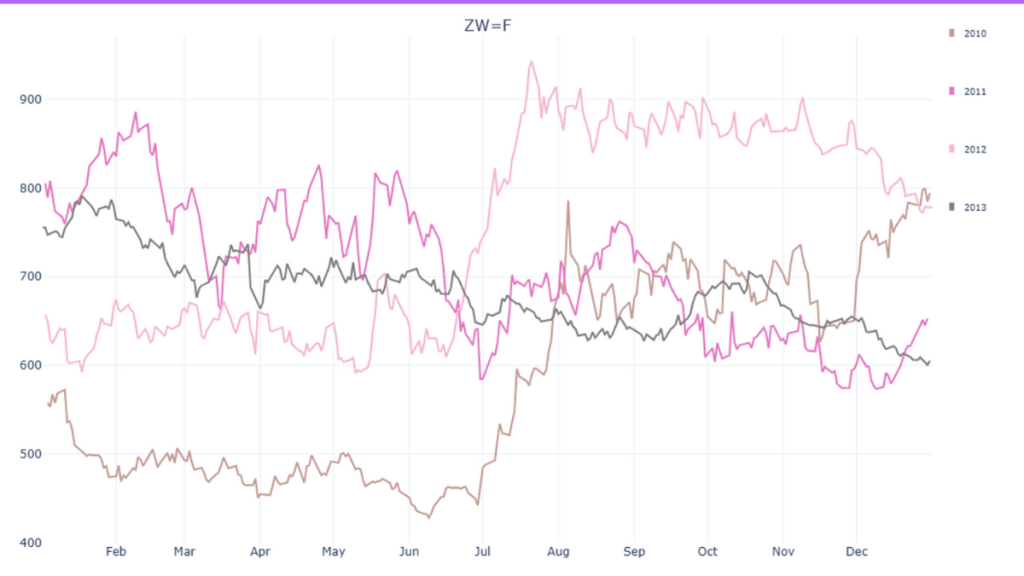

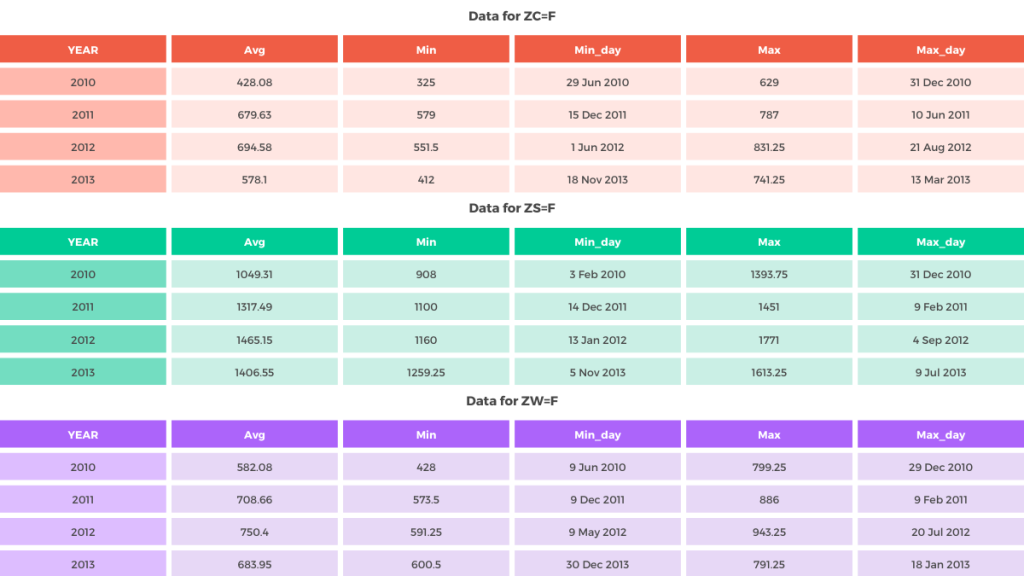

The severe drought that gripped the Southern United States and Mexico from 2010 to 2013, resulting in over $7.6 billion in agricultural damages in Texas alone, was a stark reminder of the fragility of food security in the face of environmental variability. This environmental calamity, precipitated by a strong La Niña event, reduced rainfall significantly, leading to reduced crop yields, directly affecting the prices of agricultural commodities. Additionally, the continued trends in biofuel production, consumption of animal products and rising energy prices contributed to the price spikes observed below.

The diagrams illustrate a significant surge in wheat prices in July 2010, with values nearly doubling and remaining elevated, while a steady rise is observed in the prices of other commodities throughout 2010. Prices in 2011 remained volatile but without significant movements, unlike 2012 where another surge is observed for this time all the commodities, where prices remain elevated for wheat and corn while cooling down for soybeans. in 2013, prices remain elevated for the first half of the year before dropping significantly for soybeans and corn. One thing that shows in this example is how prices can surge in a matter of a few days as a result of long term causes.

Navigating Cocoa Price Volatility

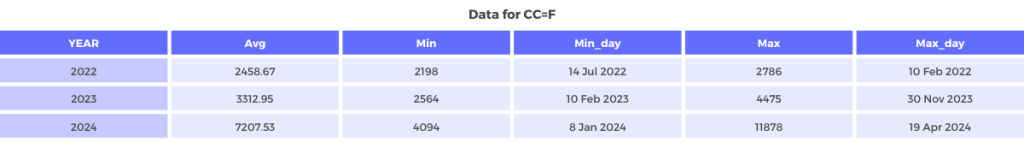

In the broader context of commodity price fluctuations, the recent dramatic escalation in cocoa prices stands out, with rates reaching historical highs of around$11,000 per metric ton in April 2024. This surge from a benchmark of around $6,000 highlights the critical challenges and opportunities facing investors, chocolate brands, and consumers alike.

As shown in the diagrams above, an unprecedended price surge for coca can be observed, following a steady price increase in 2023.

Driving Forces Behind the Surge in Cocoa Prices

The primary catalyst for the sharp increase in cocoa prices is a global cocoa shortage, spurred largely by climate change-induced droughts devastating crops in West Africa, which accounts for approximately 80% of the world’s cocoa production. This environmental crisis is expected to lead to an 11% decline in the global cocoa supply for the 2023/2024 season, as reported by the International Cocoa Organization.

Compounding the issue are structural challenges within the cocoa market, including chronic underinvestment in cocoa farms, many of which are managed by smallholder farmers struggling with low yields and aging cocoa trees. These factors, coupled with speculative trading that has seen non-commercial investors holding an unprecedented share of cocoa futures and options, have led to a frenzied increase in prices.

Historical Rallies and Selloff periods

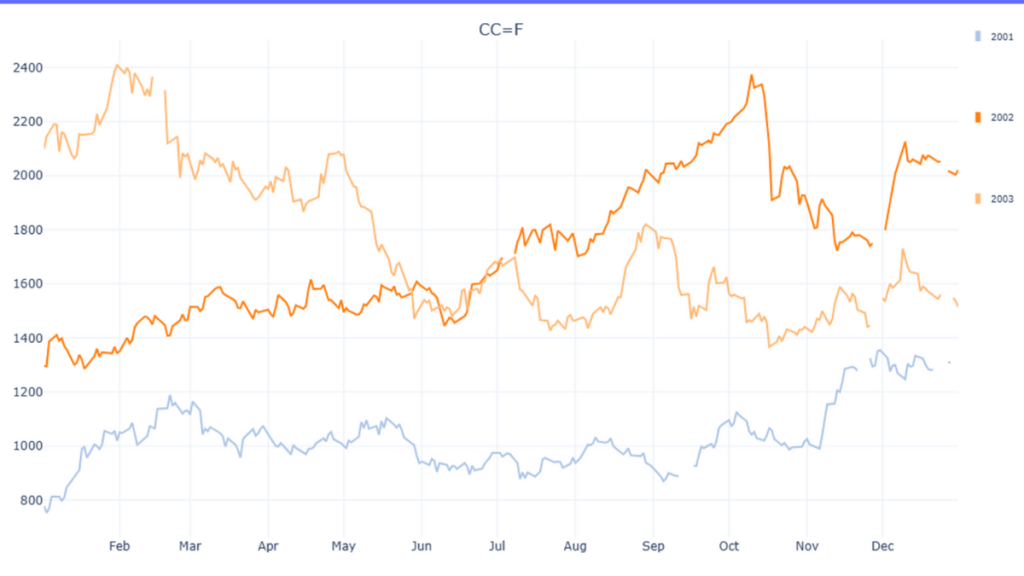

The rally began at 2001 November, prices jumping from around $1000 to $1300 and continued through most of 2002, ramping up in June and peaking at October at almost $2400, before a massive selloff period where priced tanks right after to around $1800 levels. Massive selloffs happened within a few days right after the peak, however the total selloff period lasted for around 2 months. Prices fluctuated around December and the the following year, reaching back to the $2400 levels momentarily at the beginning of Feburary 2003. The general decline continued throughout the rest of the year with big dips lasting for around a month and modest recoveries lasting for around half a month, ending at around early-2002 prices.

This rally began right at the start of 2007, with the prices generally increasing steadily throughout the year from around $1600 to $2000. at the start of 2008, prices ramped up from around $2100, with a peak at mid-March at around $2800 before tumbling within a few days to around $2300. Prices rebounded back up the next 3 months, surpassing the previous peak with a new high at the start of july at around $3400, before trending back down to 2007 price levels in the span of 4 months. Prices started rallying again around november up to the end of the year from around $1900 to $2600, all the while prices remain volatile.

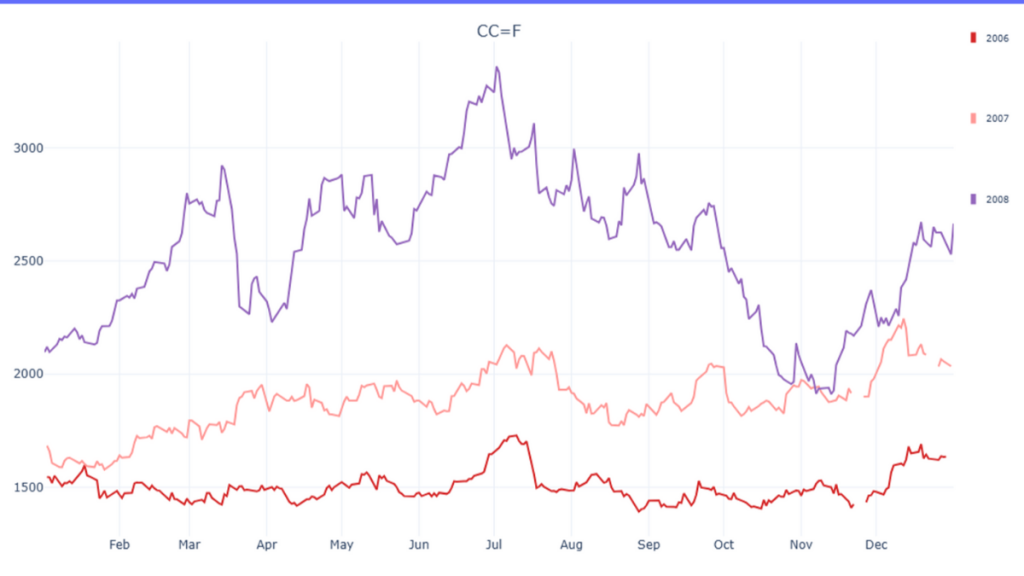

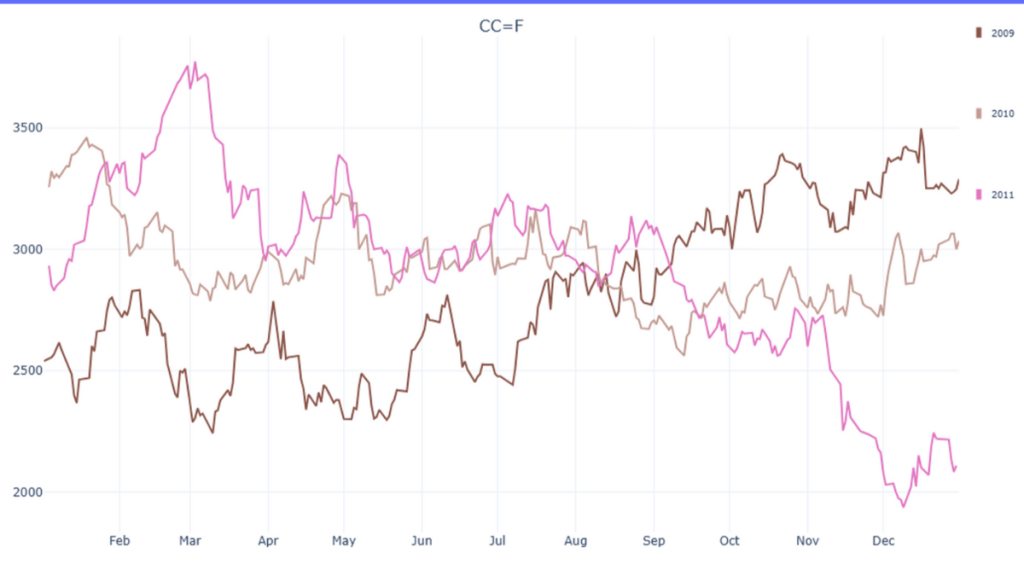

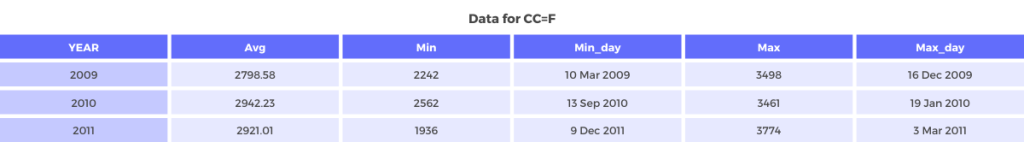

Prices remained highly volatile right after 2008, with 3 two-month cycles of up and downs around the $1800 and $2800 band in the first half of 2009, before rallying in July, increasing in price up the start of the next year from around $2400 to a peak of $3400. The commodity faced a 1.5 month selloff period starting from mid January 2010 to March to around $2700. Prices bounced back up and down betwen April and May, with a 1 month selloff period between August and September following it. Prices slowly recovered throughout the rest of the year admist the volatility. A big 2-month rally started in Januray 2011 from around $2800, peaking at the start of March at $3700 before a 1-month selloff occured, ending at the start of April at around $3000. prices recovered modestly for a month before dropping again, this time trending downards steadily throughout the rest of the year, usually with short periods of recoveries before a month long selloffs, dropping prices back to around 2007 levels.

Future Trajectory of Cocoa Prices

While the immediate outlook suggests cocoa prices will remain high, analysts from J.P. Morgan Research anticipate a potential moderation in prices, projecting a stabilization around the $6,000 mark over the medium term. This adjustment could stem from improved global climate patterns, including a transition from El Niño to La Niña conditions, which may enhance rainfall and cocoa yields in key producing regions like West Africa and Asia. Additionally, efforts to increase cocoa plantings could bolster long-term supply, gradually easing the pressure on prices.

Additionally, from observing patterns on historical price movements of both Cocoa and other agricultural commodities, prices will most likely experience a massive selloff equivalent to the rally that it has experienced. However, we may also expect a series of smaller but still significant recoveries and subsequent selloffs as prices readjust itself to its new normal. Considering the severity of the production shortage from cocoa farms and the worsending weather due to climate change, we might expect prices to at the very least remain much higher than 2022-2023 levels, if not being highly volatile with 1-2 month long ups and downs, as production struggles to recover in the near future and supply chains are disrupted from anthropogenic causes. Recovery of the market might take several years as Ivory Coast seeks to remedy the situation at hand and alternative sources of cocoa such as Brazil capitalises of the shortage by ramping up production, notwithstanding further disruptions to production and supply chains.

Conclusion

The unprecedented rise in cocoa prices highlights a complex interplay of environmental, economic, and structural factors that pose significant challenges and opportunities for the global cocoa market. As the industry navigates this volatile landscape, strategic investment in agricultural technology, sustainable farming practices, and responsive market strategies will be crucial for mitigating risks and ensuring the resilience of the cocoa supply chain. For investors, understanding these dynamics and their implications for the chocolate industry and broader commodity markets is essential for making informed decisions in an increasingly uncertain global economy.

References

- https://www.businesstimes.com.sg/companies-markets/energy-commodities/why-cocoa-prices-spiked-and-what-it-means-chocolate-lovers

- https://en.wikipedia.org/wiki/2007–2008_world_food_price_crisis

- https://www.ox.ac.uk/news/2012-02-21-russian-heat-wave-had-both-manmade-and-natural-causes#:~:text=The 2010 Russian heat wave,40 degrees Celsius (104F).

- https://www.jpmorgan.com/insights/global-research/commodities/cocoa-prices

- https://www.businesstimes.com.sg/companies-markets/energy-commodities/why-cocoa-prices-spiked-and-what-it-means-chocolate-lovers

- https://www.bls.gov/opub/btn/volume-9/a-historical-look-at-soybean-price-increases-what-happened-since-the-year-2000.htm#:~:text=First spike%2C 2003–04&text=As a perishable commodity%2C soybean,from domestic or foreign buyers.&text=In 2003%2C bad weather and,an impact on soybean harvests.

- https://www.theguardian.com/food/2024/mar/31/easter-egg-prices-soar-as-cocoa-crops-are-hit-by-climate-crisis-and-exploitation#:~:text=However%2C with more frequent extreme,mining practices that degrade land.

- https://2009-2017.state.gov/r/pa/prs/ps/2011/03/157629.htm

Disclaimer

Please refer to our terms and conditions for the full disclaimer for Stoic Capital Pte Limited (“Stoic Capital”). No part of this article can be reproduced, redistributed, in any form, whether in whole or part for any purpose without the prior consent of Stoic Capital. The views expressed here reflect the personal views of the staff of Stoic Capital. This article is published strictly for general information and consumption only and not to be regarded as research nor does it constitute an offer, an invitation to offer, a solicitation or a recommendation, financial and/or investment advice of any nature whatsoever by Stoic Capital. Whilst Stoic Capital has taken care to ensure that the information contained therein is complete and accurate, this article is provided on an “as is” basis and using Stoic Capital’s own rates, calculations and methodology. No warranty is given and no liability is accepted by Stoic Capital, its directors and officers for any loss arising directly or indirectly as a result of your acting or relying on any information in this update. This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.