Agriculture Commodities – The road ahead 2H 2021

Stoic Capital

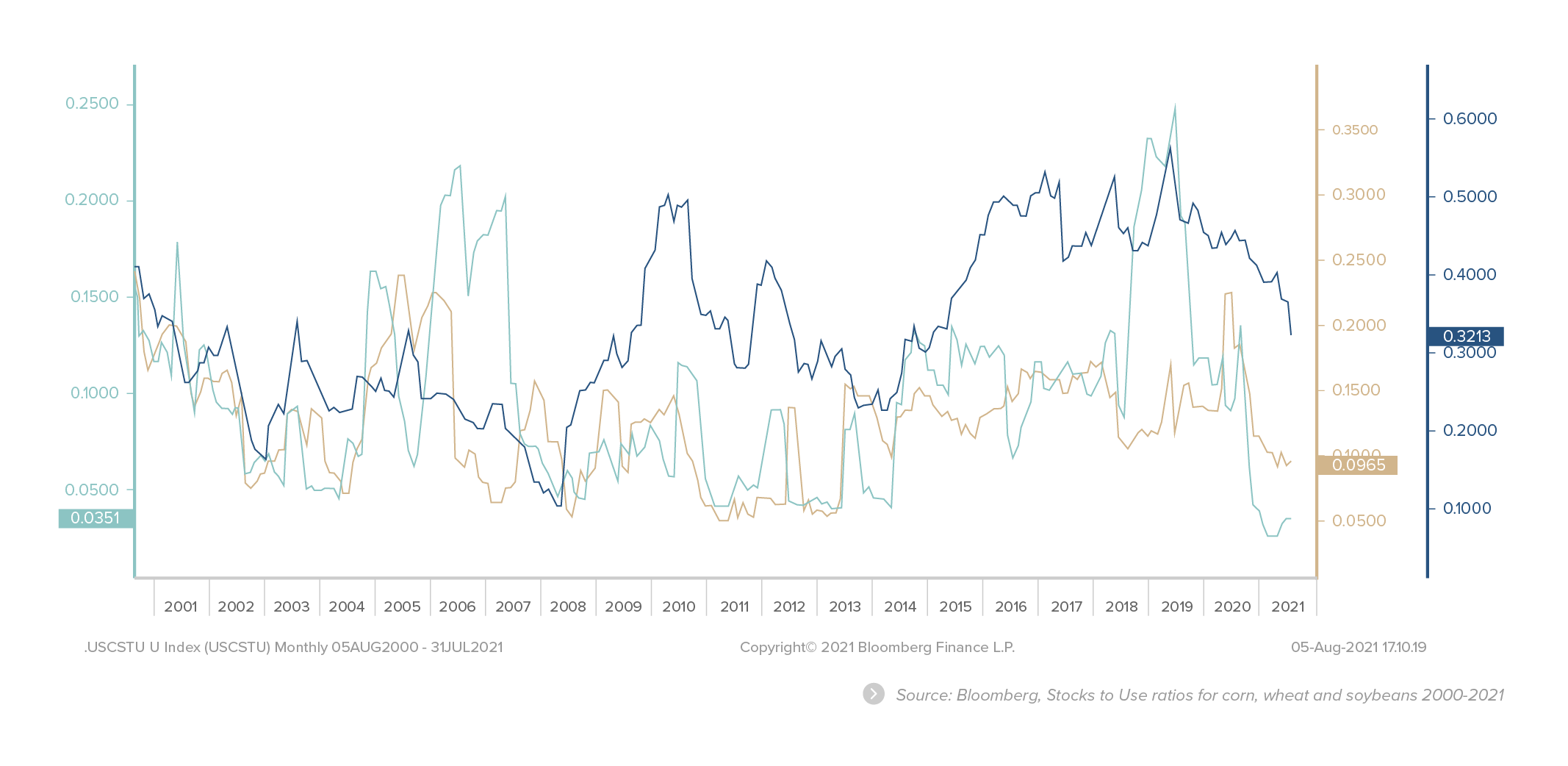

Volatility is par for the course in agriculture futures markets, even more so for soft commodities. 1H 2021 has been exceptionally so, with volatilities tracking upwards for most of this year, interspersed with spikes around February and June.

With renewed talk about the commodities supercycle – a forgotten and long discarded notion following the meteoric rise in 2006-2008 – it’s timely to do a quick back in time comparison.

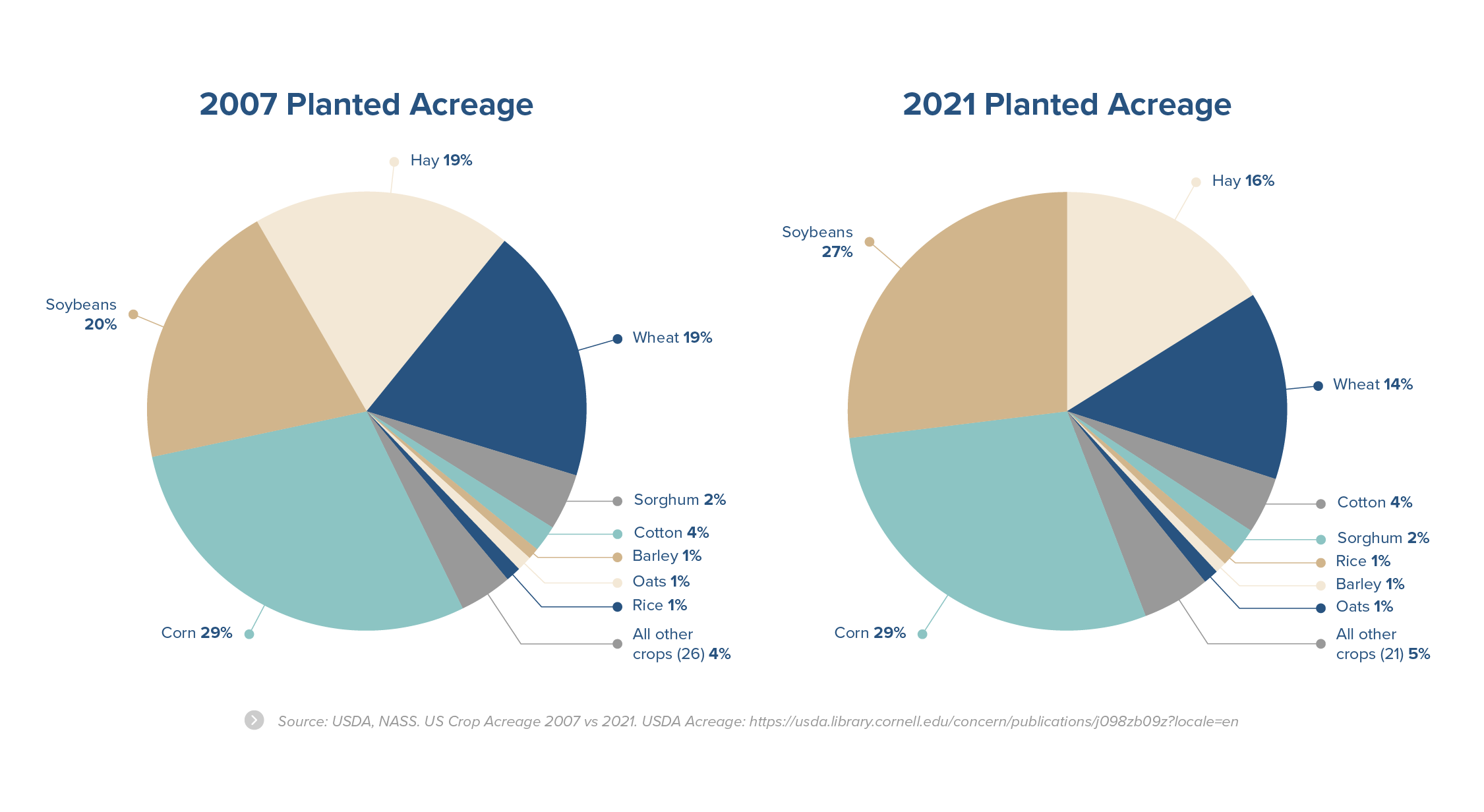

The US crop acreage mix for hasn’t changed much in the past 15 years, with the same row crops taking centrestage amidst all the US-China posturing. Cropland acreage has remained fairly stable across the years, and similarly so for the main row crops of corn, beans and wheat. Much of the volatility in acreage if any over the years, has been in the year to year changes in acreage mix.

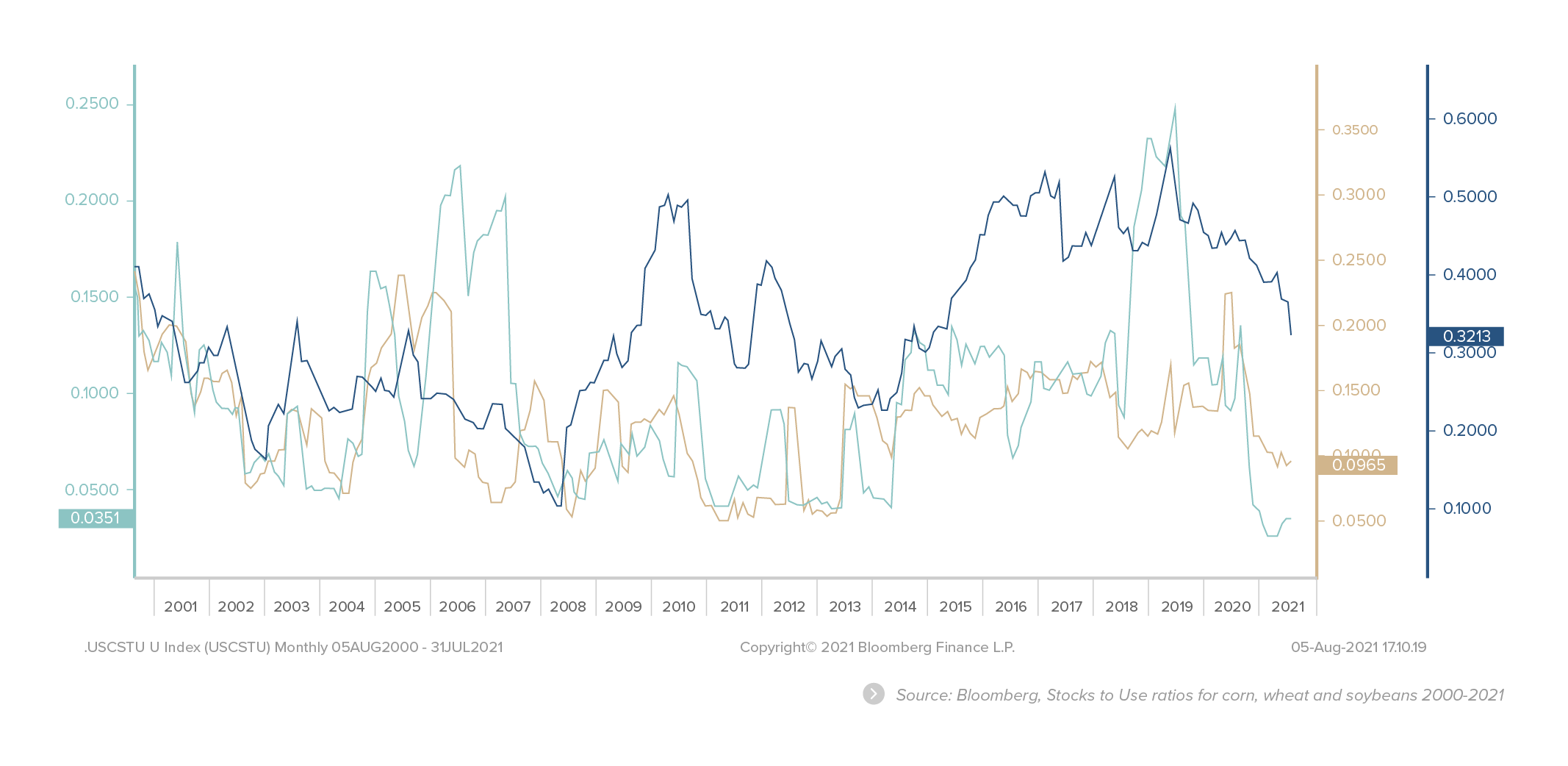

The dramatic shift over the past year from an oversupply scenario across most agricultural commodities into a drought-ravished-supply-shortage-driven scenario. With stocks to use at 5-year lows across the 3 main row crops this year, volatility has naturally spiked this year.

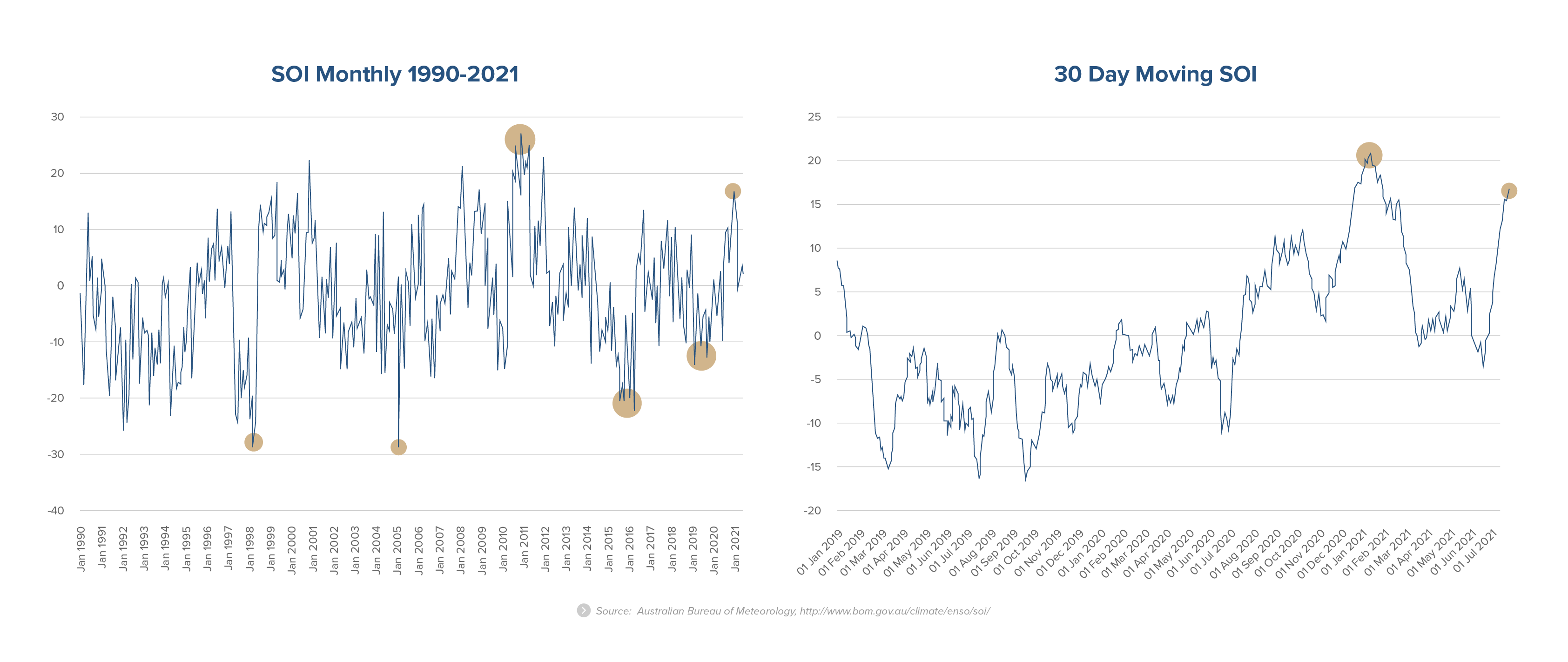

Much of the shift has been attributed to the impact from El Nino and the resulting drought in South America and dryness in Canada’s canola crop. The sudden onset of frost (not so sudden since we’re into frost season after all) which spurred a manic rally in coffee prices? Arguably also an after effect from El Nino.

Stocks to use ratios across the major row crops are hitting 5 year lows, and more so in the case of beans. But with the rally seemingly behind us, was that really it for the agriculture commodities supercycle? Déjà vu.

“This time, it’s different.”

“The world’s always changing, and the only constant is change.”

Maybe. As the charts below tell a somewhat different story now, we need to be mindful of the evolution of changes that brought us here. While there’s no guarantee historical price action will repeat itself, we’ve highlighted some of the key charts below for each of the row crops.

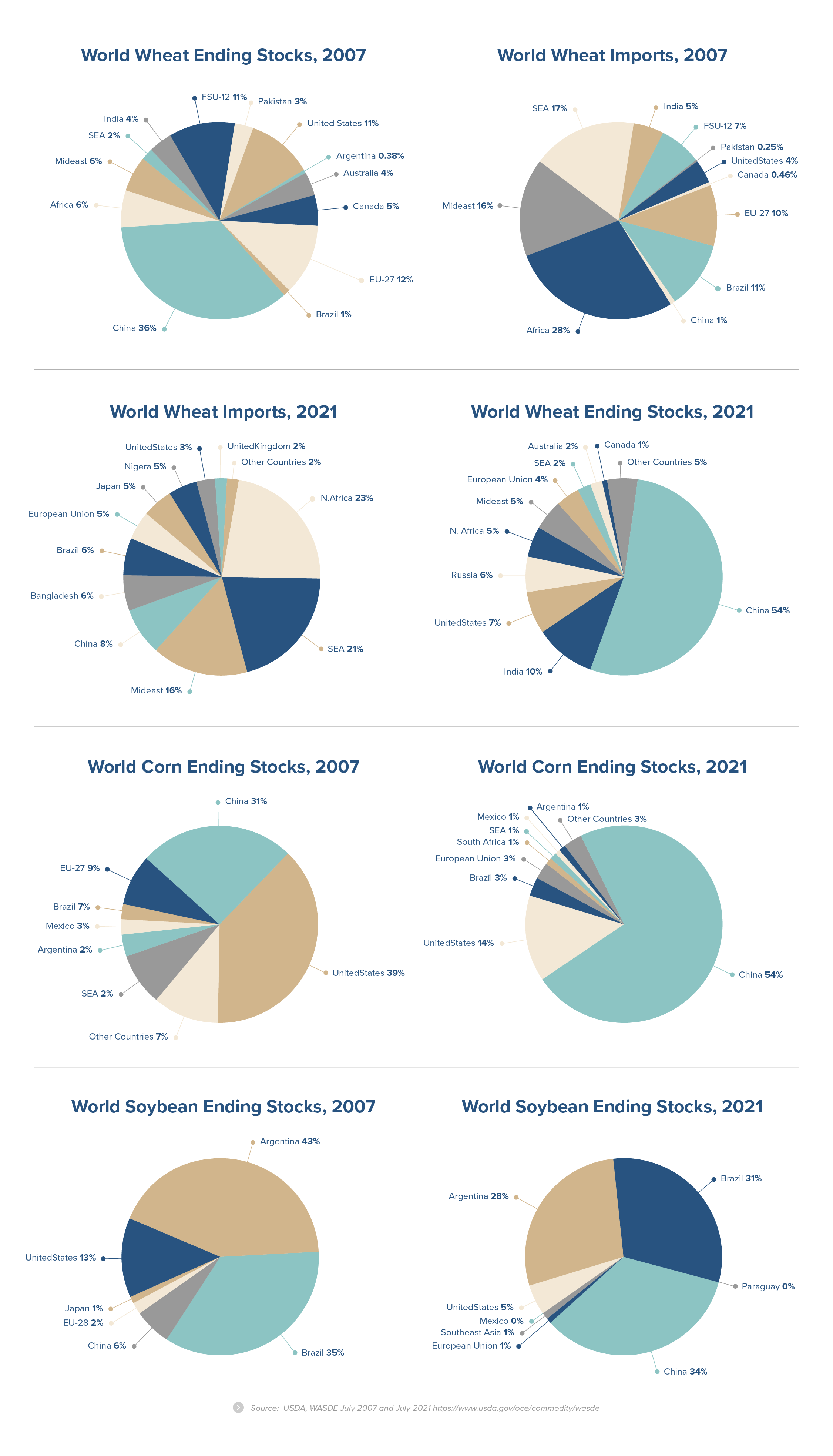

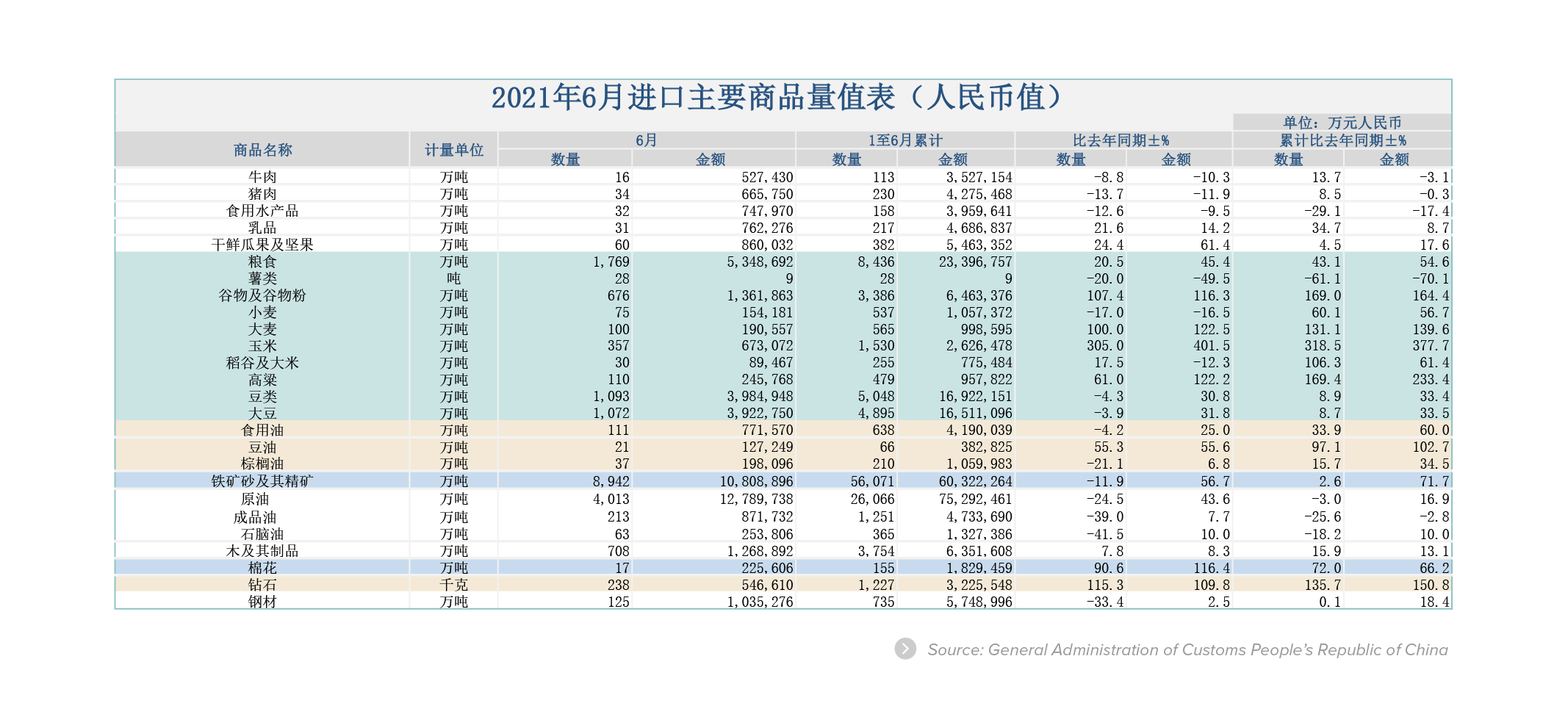

China has been a major importer for all things commodities related. Changes in import patterns from China do more than swing the needle. The mammoth proportion globally in ending stocks that China has grown across the row crops, compels a keen watch on China’s handling of crop reserves in H2 2021. The massive YoY growth in import numbers have been baffling, but are consistent with the significant build up of buffer ending stocks.

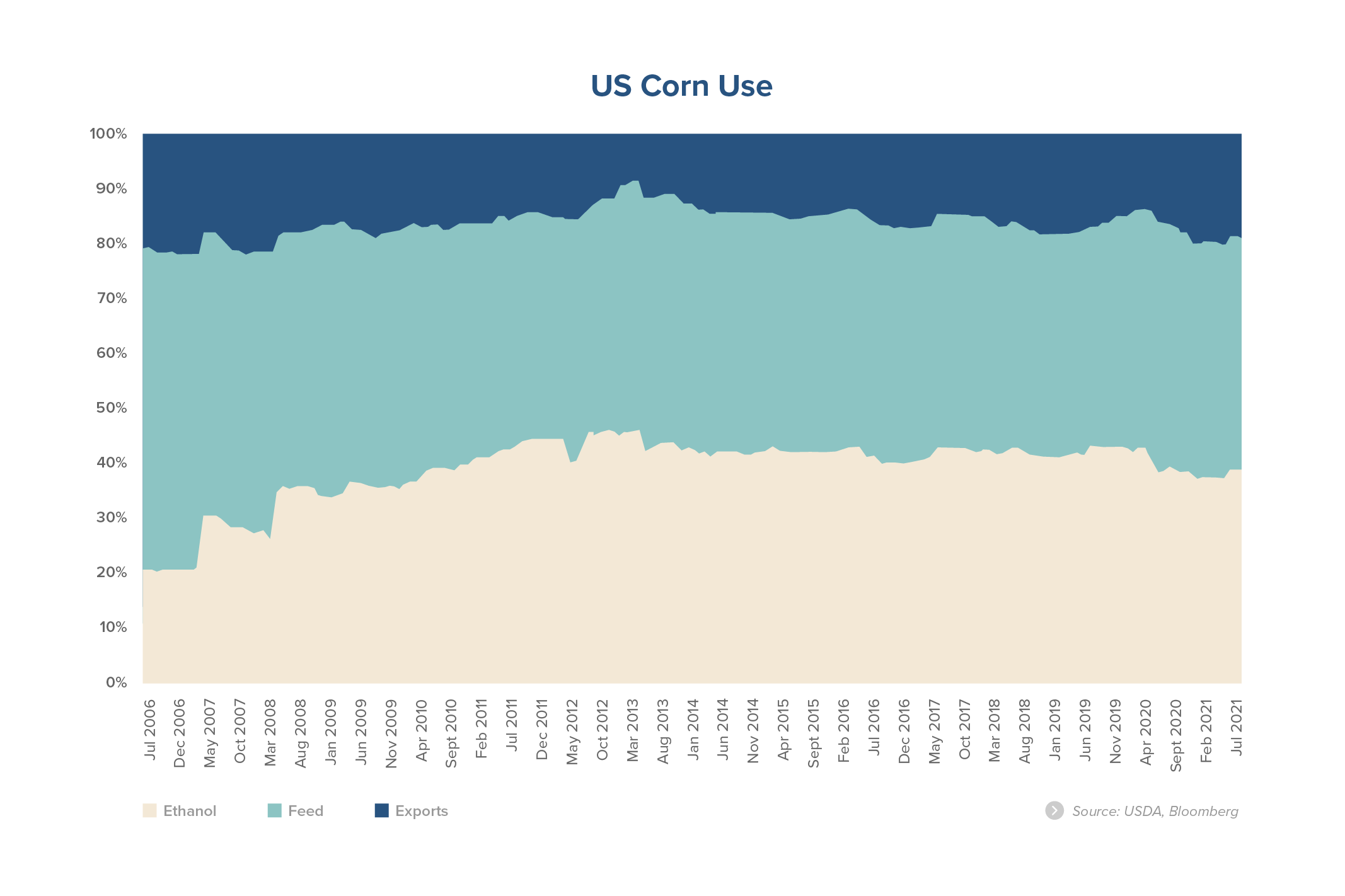

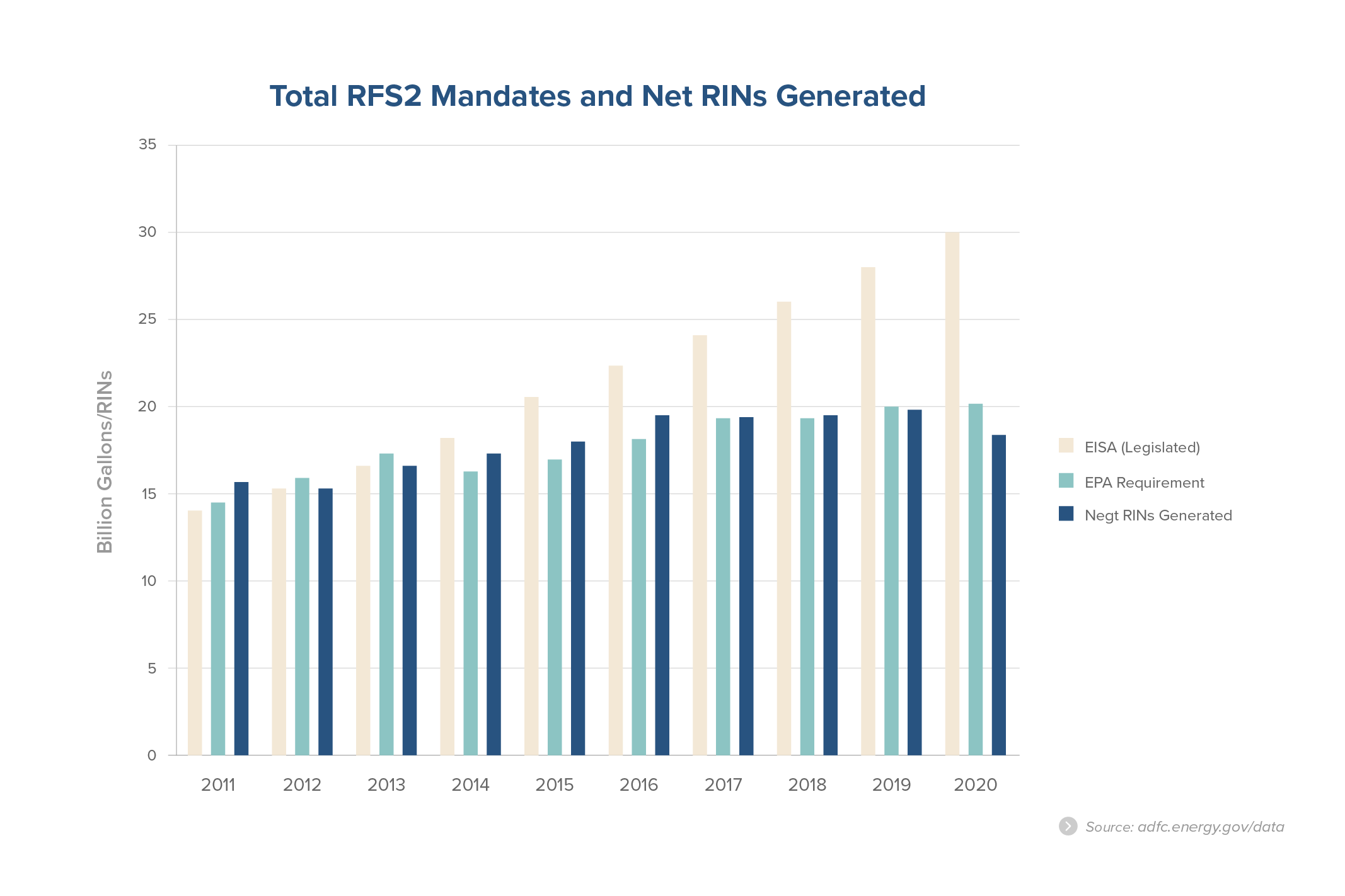

China’s role in global corn imports has grown massively. The confluence of activities back in 2007 overshadowed rumours of Chinese imports, but these eventually came to fruition. While in the US, the RFS program – established in 2005 and expanded in 2007 – which drove ethanol demand for corn use, has been choked on its review. The program has been fraught with compliance problems (only conventional biofuel and biomass-based diesel have met the annual targets) and faces uncertainty in its implementation next year (whether to allow the EPA to mandate targets going forward). Yet, corn use for ethanol has crept upwards from 32% of total domestic use in 2007 to 42% in 2021. All in the face of increasingly massive China imports.

With a risk of a stalling in the EPA mandate hanging over corn demand, the other downside risk ahead, is feed usage. Per capita consumption has been heading upwards steadily, but so has the frequency of demand shocks caused by not just viruses on humans but also livestock. ASF wiped out the hog herd in China, which in turn caused a massive bank run on US hog suppliers in 2020. Whether it’s bird flu or ASF, the risk is more real now than ever, especially with the risk of damage and transmission brought on by the floods in Henan.

Finally, the other significant risk on the horizon for H2 2021? Weather.

The somewhat milder El Nino in 2020 was sufficient to cause a revival in agriculture markets, but not quite the upheaval in 1997 and 2007. As the SOI starts trending positive, La Nina risk remains something to look out for despite the current neutral indications. While the implications are not quite drought related in this region or South America, the risk is to the upside for grains in the FSU region and downside for oilseeds with a wetter than expected Southeast Asia in the coming months.

In the meantime, learn more about what we do or keep a lookout for our next feature article or drop us an email at if you’d like to discuss some trading ideas!

Disclaimer

Please refer to our terms and conditions for the full disclaimer for Stoic Capital Pte Limited (“Stoic Capital”). No part of this article can be reproduced, redistributed, in any form, whether in whole or part for any purpose without the prior consent of Stoic Capital. The views expressed here reflect the personal views of the staff of Stoic Capital. This article is published strictly for general information and consumption only and not to be regarded as research nor does it constitute an offer, an invitation to offer, a solicitation or a recommendation, financial and/or investment advice of any nature whatsoever by Stoic Capital. Whilst Stoic Capital has taken care to ensure that the information contained therein is complete and accurate, this article is provided on an “as is” basis and using Stoic Capital’s own rates, calculations and methodology. No warranty is given and no liability is accepted by Stoic Capital, its directors and officers for any loss arising directly or indirectly as a result of your acting or relying on any information in this update. This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.