Commodity Supercycles: Go Long, Stay Longer?

Caleb Mah

Commodities, the wild west among the asset classes, is a fickle beast. Having tradeable assets that are directly tied to the physical underlying complicates matters. They react to changing economic dynamics in ways that are drastically different than stocks and bonds. For instance, commodities tend to benefit from rising inflation – increased prices of commodities act as a hedge.

Commodities trading, much like other asset classes, follows the fundamental rules of supply and demand in economics. On a seasonal basis, the stars may align to form the perfect storm of commodities: a supercycle.

What is a supercycle?

A supercycle is characterized by long periods where commodities trade above their long term price trends.

A commodities supercycle has two defining elements: duration and breadth of assets affected. It differs from typical price movements in that supercycles may last longer than the business cycle, upwards of well over a decade. Also, commodity prices tend to move together like a big family through bullish and bearish markets.

How do supercycles form?

Conventional wisdom tells us that supercycles are formed by both demand and supply shocks. For demand shocks, when demand increases while supply lags behind, commodity prices soar. This lag in supply adjusting to meet demand is worsened due to large start-up costs for certain projects (mostly energy and metal related – agriculture production adjusts much quicker). For instance, producing firms may delay investing until they become confident of the long-term prospects of reacting to the demand shock.

For supply shocks, unexpected events could severely change supply, resulting in sudden changes in price. Crude oil comes top of mind when it comes to suffering from supply shocks. Embargos and sactions that dampen supply with demand remaining constant drive prices up. Case in point: The Russian invasion of Ukraine. Electricity and gasoline prices skyrocketed as a result.

Case Study: Post Covid Demand

The world practically got turned inside out when COVID-19 first struck. Consumers changed their spending habits and companies had to overhaul their business models.

Now that the world has begun its return to normalcy for more than a year now, it is probable that the demand recovery has sparked the onset of a new supercycle.

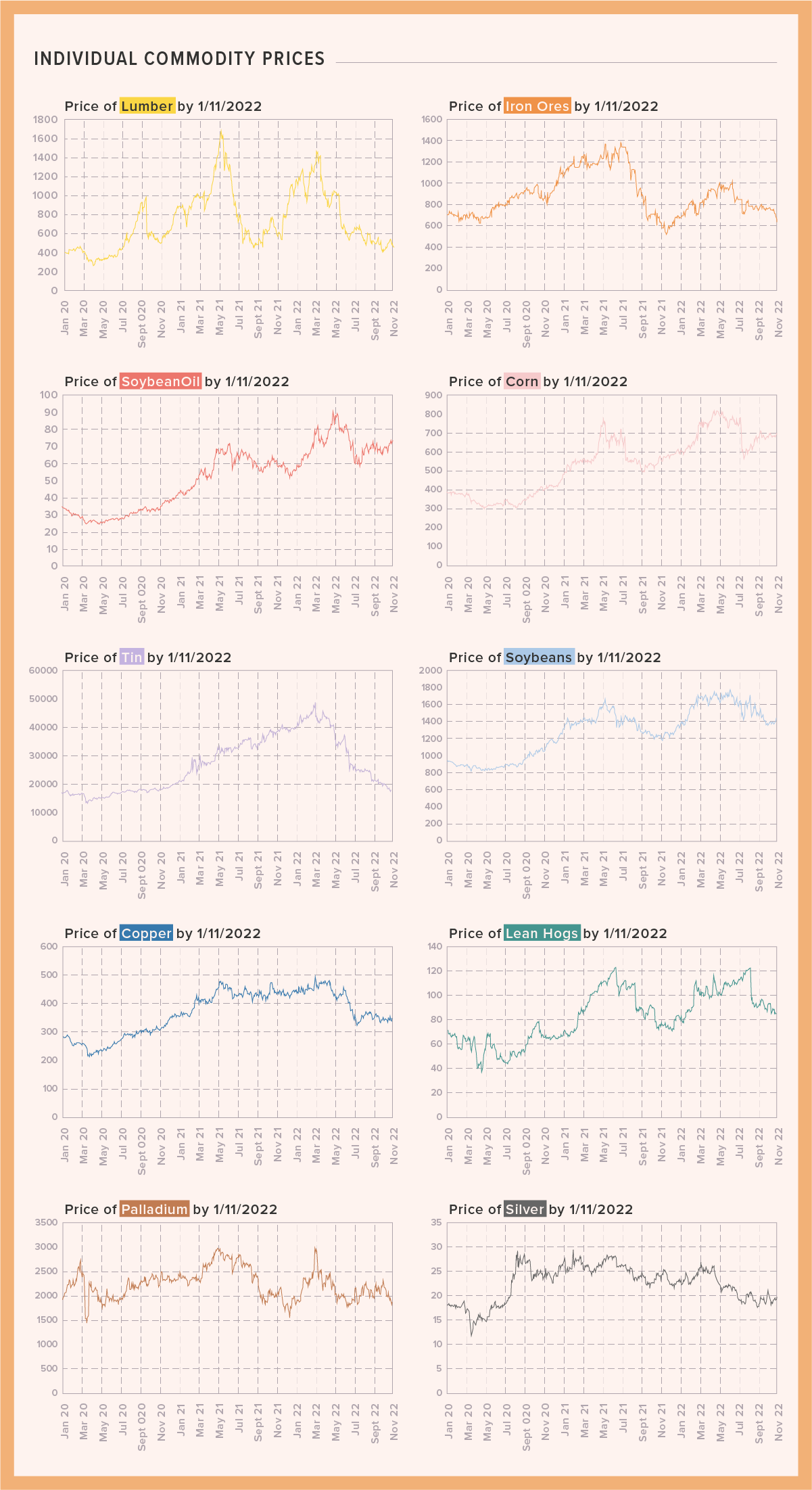

In line with economic theory, as demand for commodities like crude oil and metals increased as restrictions were lifted, both demand and price recovered. In fact, prices did more than just “recover”, as the infographic below shows.

However, having updated the graphs with the latest available futures data, we see that many commodities have fallen back down close to their initial starting point. This goes to show how hard it is to establish the presence of a supercycle.

Where are we now?

With the Feds coming down hard on inflation, fears of recession arise among investors. When recession comes, all asset classes crumble. Perhaps the post COVID supercycle indicators were wrong after all?

However, given the time lag of monetary policies (anywhere from 6 to 9 months), it’s likely that commodity traders could still capitalize on a window of opportunity where commodities stand to benefit from inflation.

In any case, recession or not, don’t let this distract you from the persistent macro themes that will continue drive demand for certain commodities. A key theme that has been ramping up is of course, a drive towards sustainability through the energy transition. Perhaps accelerated demand is in the cards for metals like copper and nickel used in the batteries of electric vehicles and their charging infrastructure. Compounding on this, underinvestment in these metals could indicate a risk of supply shortfalls. Although capex estimates have improved for 2022 and 2023 (20.8% and 14.3% respectively) across the top 25 metal miners, it is believed that increased energy prices and cost of infrastructure are the main causes of the increase. Not new projects or additional investments in existing operations. If the world really ends up unprepared for this surge in demand, it could be that the green transition carries metals, and possibly other commodities, into the next supercycle.

Disclaimer

Please refer to our terms and conditions for the full disclaimer for Stoic Capital Pte Limited (“Stoic Capital”). No part of this article can be reproduced, redistributed, in any form, whether in whole or part for any purpose without the prior consent of Stoic Capital. The views expressed here reflect the personal views of the staff of Stoic Capital. This article is published strictly for general information and consumption only and not to be regarded as research nor does it constitute an offer, an invitation to offer, a solicitation or a recommendation, financial and/or investment advice of any nature whatsoever by Stoic Capital. Whilst Stoic Capital has taken care to ensure that the information contained therein is complete and accurate, this article is provided on an “as is” basis and using Stoic Capital’s own rates, calculations and methodology. No warranty is given and no liability is accepted by Stoic Capital, its directors and officers for any loss arising directly or indirectly as a result of your acting or relying on any information in this update. This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.