Meat Your Maker: The Move Towards Alternative Proteins

Caleb Mah

Livestock and The Environment

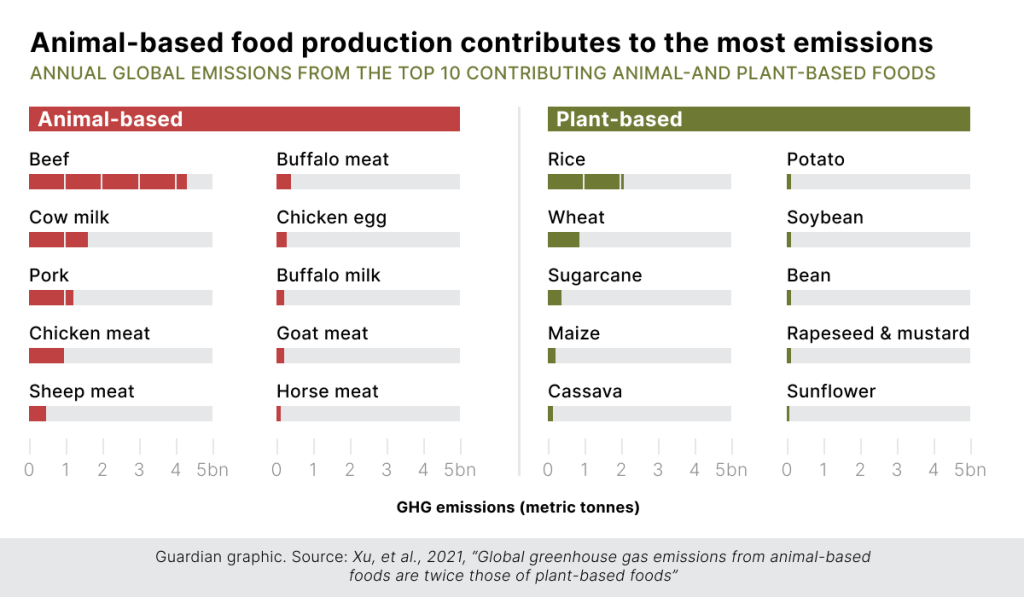

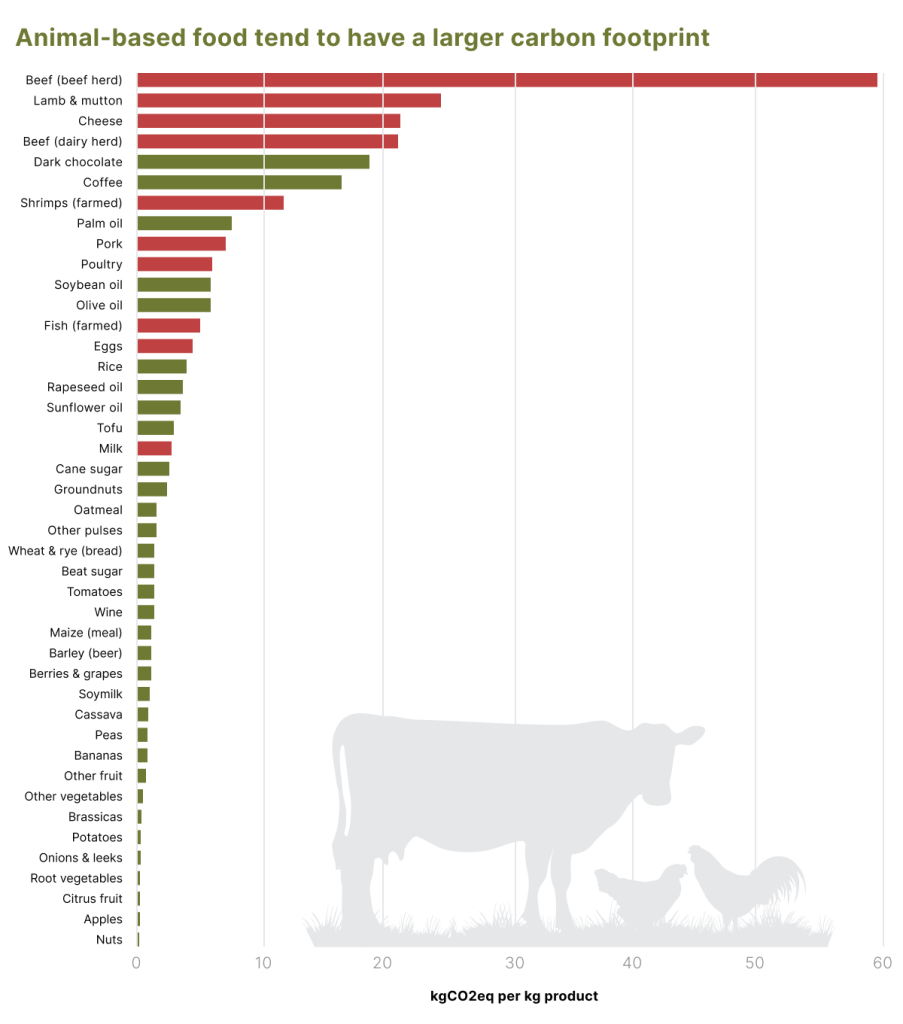

The status quo that is the mainstream food system hardly aligns with the grandiose sustainability goals that we have. The environmental costs of livestock production is no secret at this point. According to thorough research from a team of climate scientists, livestock production including livestock feed accounts for 57% of all food production emissions. Contrast this with only 29% coming from the cultivation of plant-based foods, it’s no surprise that the environmentally conscious have been up in arms about dietary change.

Veganism As An Alternative?

Among other reasons like personal health and animal rights, veganism has emerged as a counter to the environmental costs associated with livestock production. Veganism involves the exclusion of all animal products for food, clothing, and any other purpose.

Veganism advocates cite a multitude of environmental benefits of going plant-based. Such benefits stem (haha) from the efficiency of cultivating plants and include: conservation of water, reducing energy consumption, and protecting habitats due to reduced land usage.

However, there are undeniable limitations to it. The vegan lifestyle is difficult to adapt to and could lead to health problems. According to research conducted by medical researchers summarizing multiple research papers on vegan and vegetarian diets, omitting meats invariably leaves one susceptible to various vitamin deficiencies. For instance, vegans need to supplement with Vitamin B12 because it’s not practical to derive enough of it from a plant based diet alone.

In addition to this, there have been criticisms on how vegan options are often more costly than non-vegan alternatives, leading people to believe that veganism is a largely privileged option for the financially stable.

We don’t have a vendetta against the vegan diet, but it’s evident that the vegan diet may not be suitable for everyone.

A Counteroffer That’s Easier To Stomach?

What if there were a way to avoid drastic dietary changes to what we’re used to as a society? Alternative proteins are meats, eggs, or dairy products that are plant-based, cultivated, or fermentation derived. The core idea is to produce meats that are nutritionally equivalent to the products of animal agriculture without incurring the various environmental and health costs. For instance, by cultivating meats outside of a farm environment, no antibiotics are required which could result in fewer incidences of foodborne illnesses and antibiotic resistance.

Alternative proteins may just be the way to avoid the pitfalls of veganism while addressing the costs of traditional livestock production. For our purposes, the scope will be restricted to just cultivated meats.

Industry Growth Over Time

From the early 1990s to the late 2000s, cultured meats were largely contained as scientific experiments and small scale productions to explore the pragmatics behind the idea. At the time, it was unfathomable that there would be potential for cultured meats to sustain human life at larger scales. An idea straight out of science fiction.

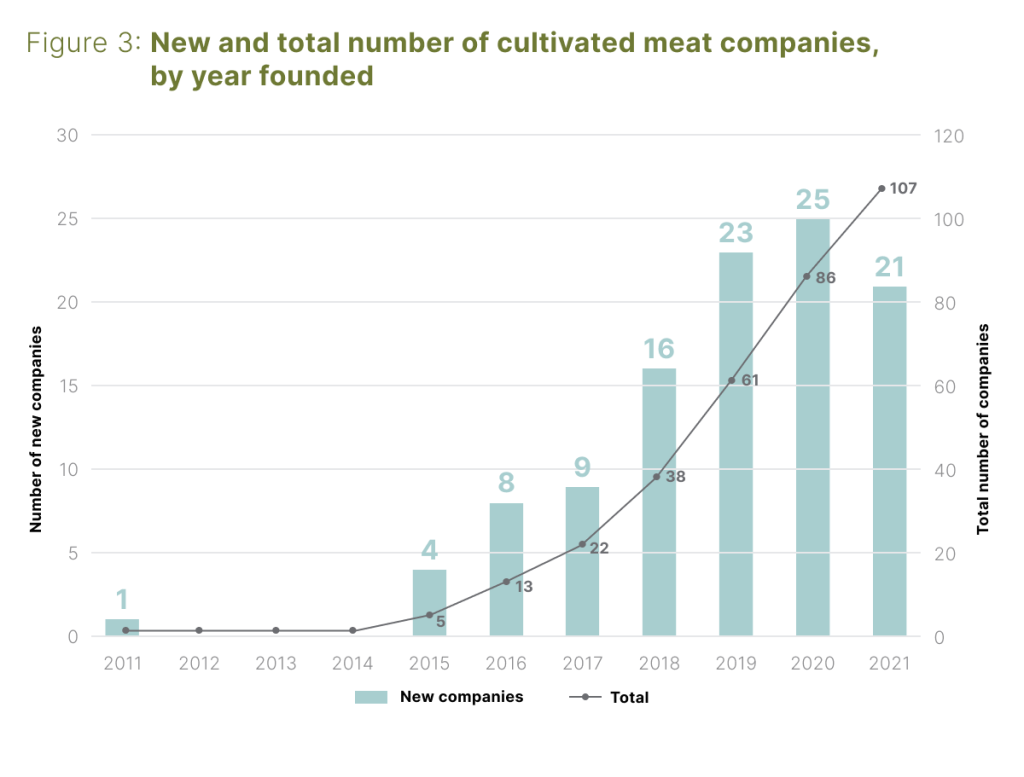

Within the last three years, this industry has seen some massive growth in the number of startups entering the space. According to the Good Food Institute’s State of the Industry Report for Cultivated Meat and Seafood, the industry is in the midst of producing the initial wave of salable products. Thereafter, we can expect to see the industry expand as key production processes are better understood and as scalability accelerates.

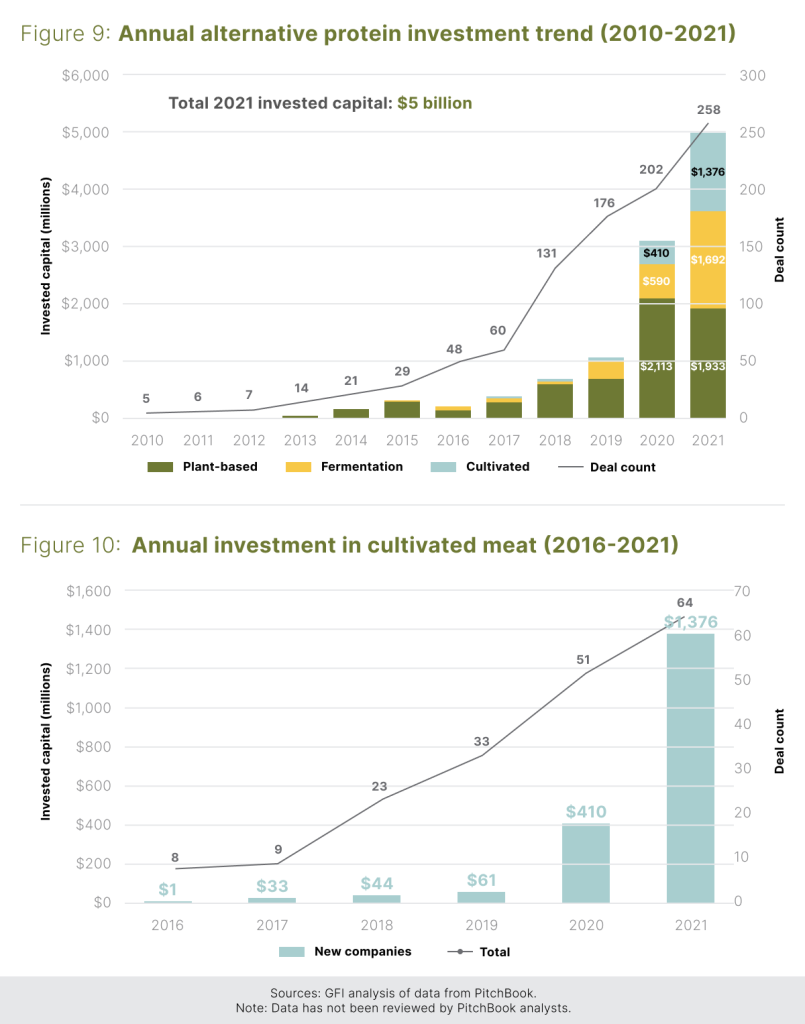

In terms of investment growth, we observe from the trends that investment has seen strong growth from starting from 2019. There is much speculation about the possible factors involved. Perhaps the most salient factor is a global pandemic disrupting supply chains related to food, shifting investor focus towards food security solutions.

Technological Challenges and Advancements

To appreciate the innovations that are revolutionizing the industry, it’s crucial to get a baseline understanding of the science behind cultivated meats. We also look at current limitations that need to be overcome for mass production and adoption to be possible.

The first step is to acquire and store stem cells from an animal. The cells are matured in cultivators at high volumes. Cultivators work similarly to egg incubators; they are controlled environments designed to support biological activity.

The cells are fed nutrient-rich cell culture medium (basically cellular superfood). This medium, combined with cues from a scaffolding structure (think of it as a mould or template), cause immature cells to differentiate into the different components of meat like muscle, fat, and connective tissue like ligaments.

What this all boils down to are three fundamental challenges for cultivated meats outlined below. For each challenge, we also briefly look at the advancements made in 2021.

- What kind of cells should we extract from animals?

- Challenge: There are a myriad of cells that can be used for cultivating meats, with different characteristics and tradeoffs. However, there is a lack of research for animal species that are used in cultivated meat.

- Advancements in 2021: Significant progress has been made to improve research in cells from different animal species like Atlantic salmon, cows, and pigs. Grants are continuing to be issued worldwide to further this effort. However, more work needs to be done to possibly develop open-access cell lines to increase innovation in the industry.

- How do we formulate the best cell culture medium to optimize for cost and efficacy?

- Challenge: The ingredients (especially proteins and other growth factors) are high cost, causing cell culture medium to be a large cost driver for cultivated meats.

- Advancements in 2021: Industry partners have established nonexclusive agreements to supply the industry with growth factor proteins that can help researchers and companies cut costs in their cell culture medium formulations.

- How do we scale cultivator technology such that they become commercially viable?

- Challenge: The industry has only been exploring small scale productions as proofs of concept for the past decade. More experience and research is needed to explore ways to overcome bottlenecks.

- Advancements in 2021: New companies like Unicorn Biotechnologies and Ark Biotech explicitly hone in equipment development and workflow improvement for cultivated meats. A highlight is introducing increased flexibility and modularity to the cultivator system. This would enable both small and large scale productions to be equally financially viable.

Industry Outlook and Potential Challenges

In the past three years, the industry has seen massive development in areas of R&D, commercial partnerships, and regulatory precedent. In late 2020, Singapore was the first country to greenlight the sale of a cultivated meat product: Eat Just’s cultivated chicken bites. Since then, multiple firms have received approval to continue manufacturing and sales from regulators in the country. This is a positive signal for the cultivated market here in Singapore.

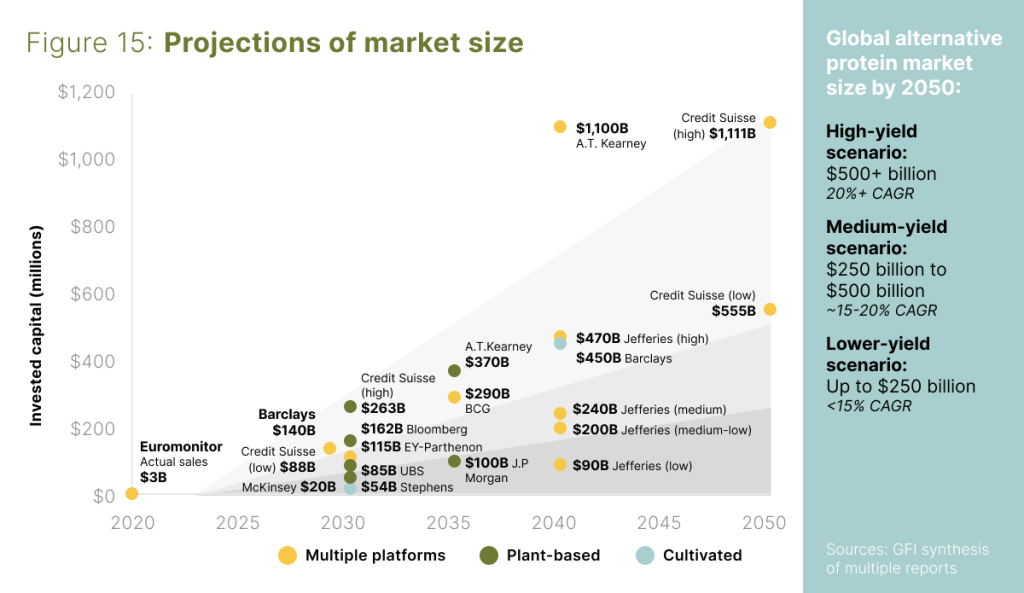

The question now is how to grow these operations to supply these alternative proteins en masse at a reasonable price to consumers. To accomplish this on the supply side, a synergy between governments, investors, and companies is required. In an ideal world, governments would invest in open access R&D and pave a clear regulatory path for private companies. Naturally, companies would then leverage off the government’s effort and push hard towards advancing their R&D. Investors being the final piece of the puzzle, would continue to propel the industry through various financing means. Currently, although interest has evidently been growing in cultivated meats, investments in this nascent field have been pennies on the dollar compared with other ESG investments like in electric vehicles and renewable energy.

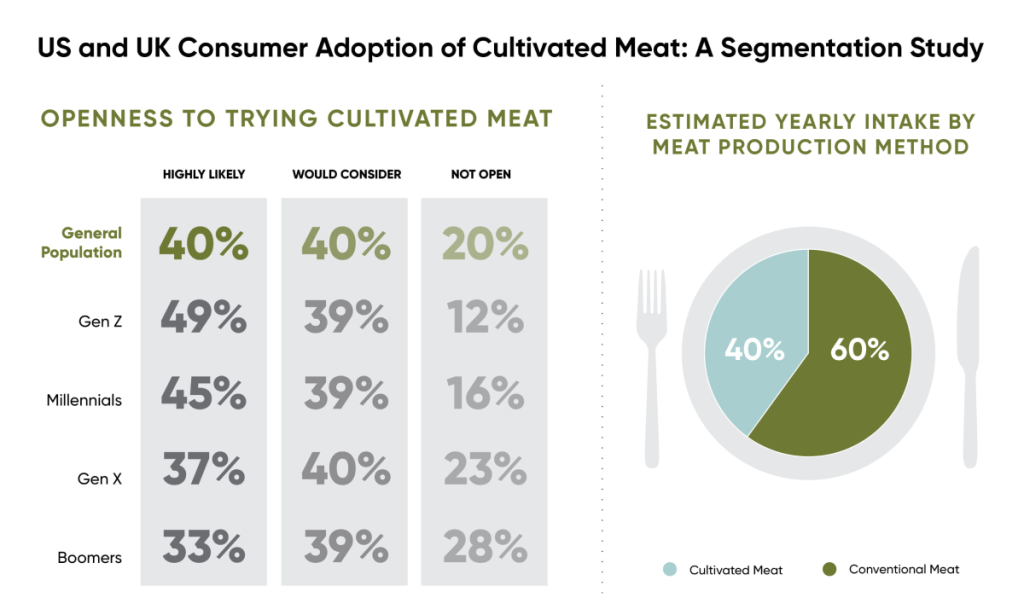

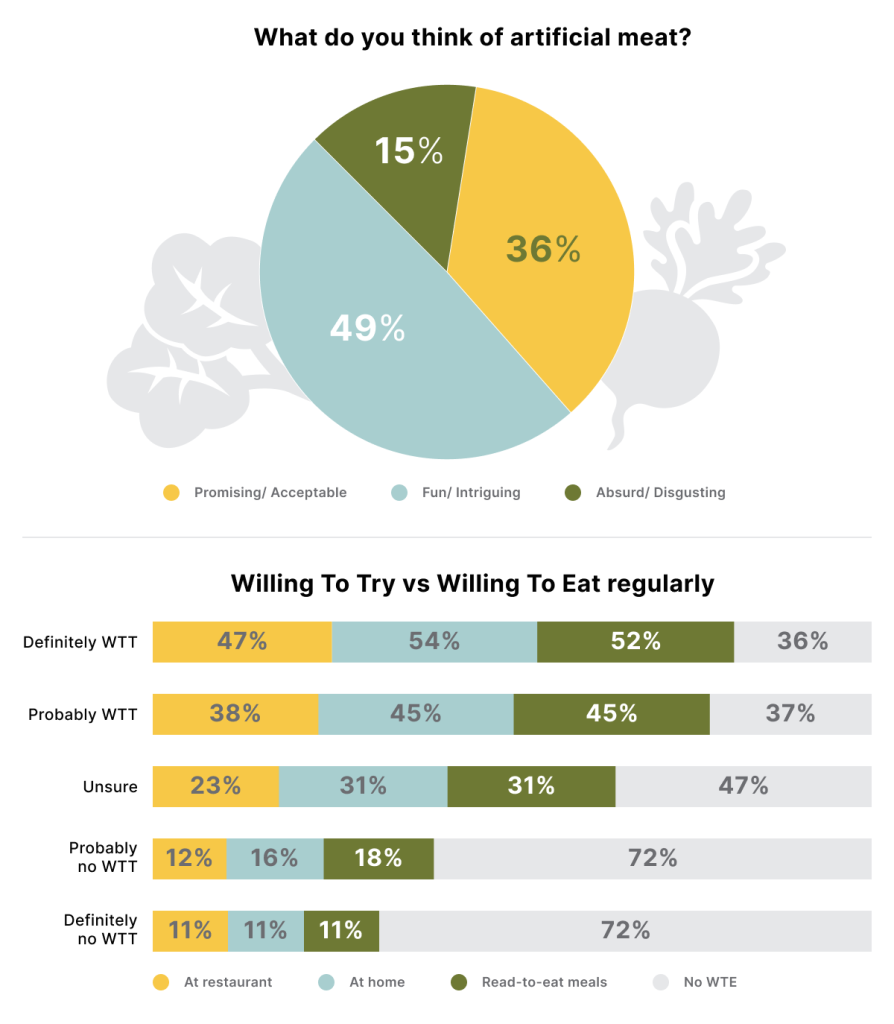

On the demand side, consumers would need to be open to experimenting with alternative proteins. Survey results of 4052 participants in Western countries show decent promise – majority of the population are at least open to trying cultivated meats.

In China, survey results show that sentiments are also broadly positive, with only 15% of the 4929 individuals indicating an explicit negative response to the idea of cultivated meat. There is also a positive association between willingness to try (WTT) and willingness to regularly eat (WTE) cultivated meats. Even for respondents with no WTE for cultivated meat regularly may experiment with trying it.

All in all, as an investment firm that believes in emerging technological trends, the industry of alternative proteins/cultured meats shows decent promise based on patterns observed in the past 5 years. We look forward to staying abreast of potential breakthroughs and opportunities and tasting it for ourselves.

Disclaimer

Please refer to our terms and conditions for the full disclaimer for Stoic Capital Pte Limited (“Stoic Capital”). No part of this article can be reproduced, redistributed, in any form, whether in whole or part for any purpose without the prior consent of Stoic Capital. The views expressed here reflect the personal views of the staff of Stoic Capital. This article is published strictly for general information and consumption only and not to be regarded as research nor does it constitute an offer, an invitation to offer, a solicitation or a recommendation, financial and/or investment advice of any nature whatsoever by Stoic Capital. Whilst Stoic Capital has taken care to ensure that the information contained therein is complete and accurate, this article is provided on an “as is” basis and using Stoic Capital’s own rates, calculations and methodology. No warranty is given and no liability is accepted by Stoic Capital, its directors and officers for any loss arising directly or indirectly as a result of your acting or relying on any information in this update. This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.