An Outlook on the EVs market

Javier

Swift, futuristic, and slick. Electric Vehicles (EVs) have emerged from the realms of futuristic concepts to become a force to be reckoned with in the automotive industry. With a surge in technological advancements, growing environmental concerns, and shifting consumer preferences, EVs have revolutionized the way we think about transportation. Demand for EVs has been growing at an exponential rate since the Covid-19 pandemic. Is Singapore observing something similar?

The big swingers

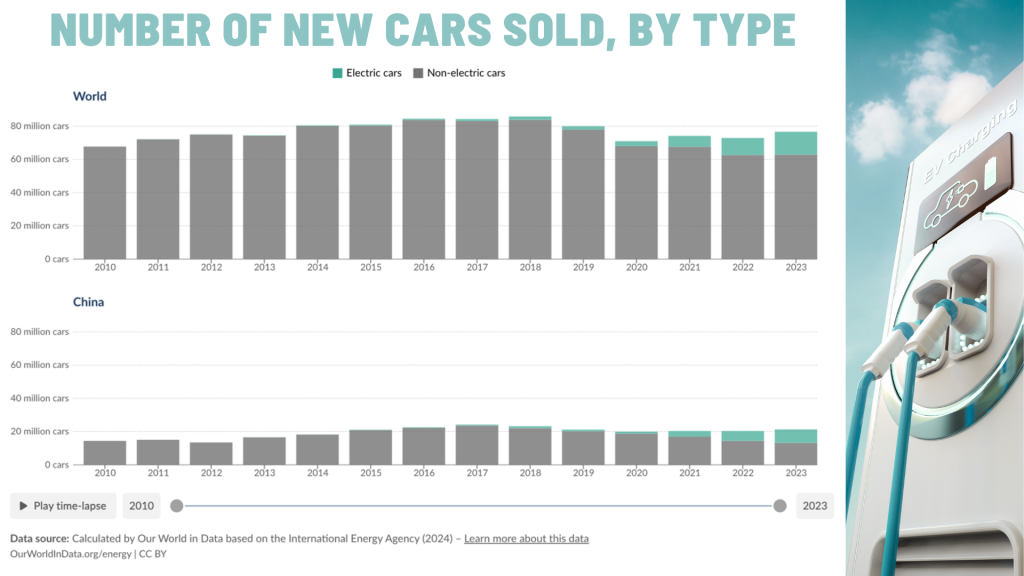

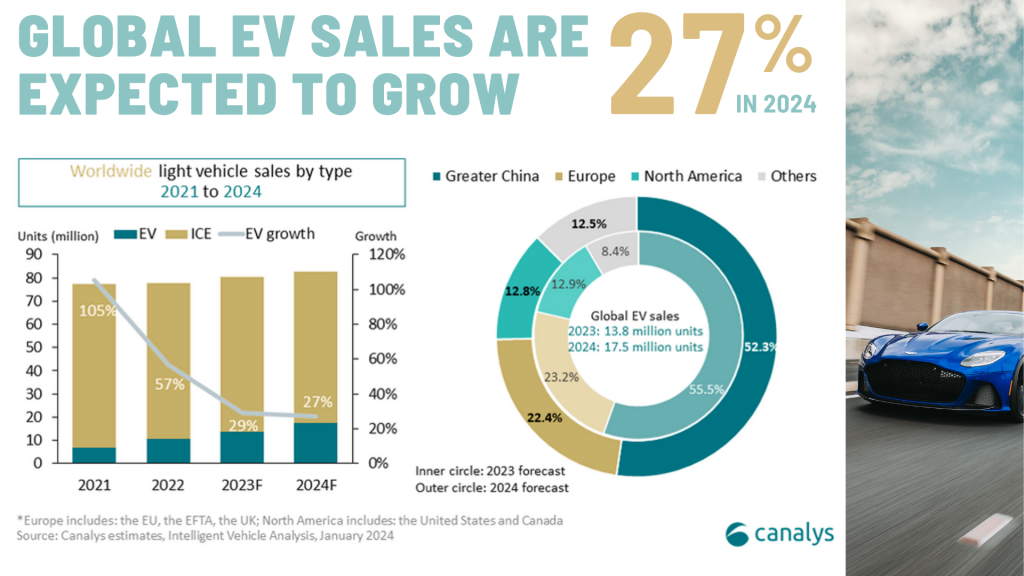

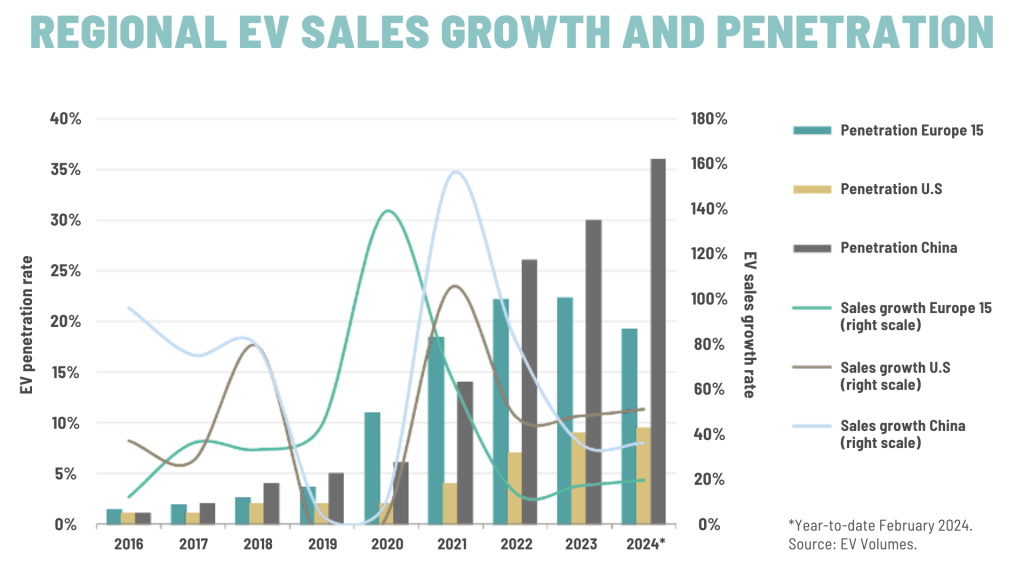

In the world of EVs, there are three main actors that are pushing the growth of global sales and adoption. The US, China, and the EU. These three powerhouses dominate the global EV industry for both consumption and production, accounting for a cumulative 77.6% of global EV sales (as seen in Fig 1.2). The EV penetration rate in the US and China has been steadily increasing, while that in the EU has stagnated at 22% from 2022 to 2023 (as seen in Fig 1.3). This implies that the phenomenal growth in EV adoption that we have seen appears to be driven primarily by the US and China (as seen in Fig 1.1). Will EV adoption growth rates continue to climb?

Electrifying global demand

There are more than 400 EV makers globally, with more than 300 based in China alone. The sheer number of EV producers implies stiff and perhaps almost perfect competition unlike in the traditional automotive market dominated by huge manufacturing companies. This dichotomy is puzzling for the EV space, given the huge budgets required for R&D which raises the barrier for perfect competition. Unsurprisingly, in the face of growing competition, Tesla threw down the gauntlet in 2023 by cutting prices, creating massive impetus for China EV companies to follow suit. The high-interest rate environment has also proved equally challenging for auto financing. But is it enough? BYD, Rivian and now Xiaomi have brought to market new and attractive-looking EV models with cutting-edge technologies inching closer toward self-autonomous driving and super-fast charging rates.

NIMBY on the rise

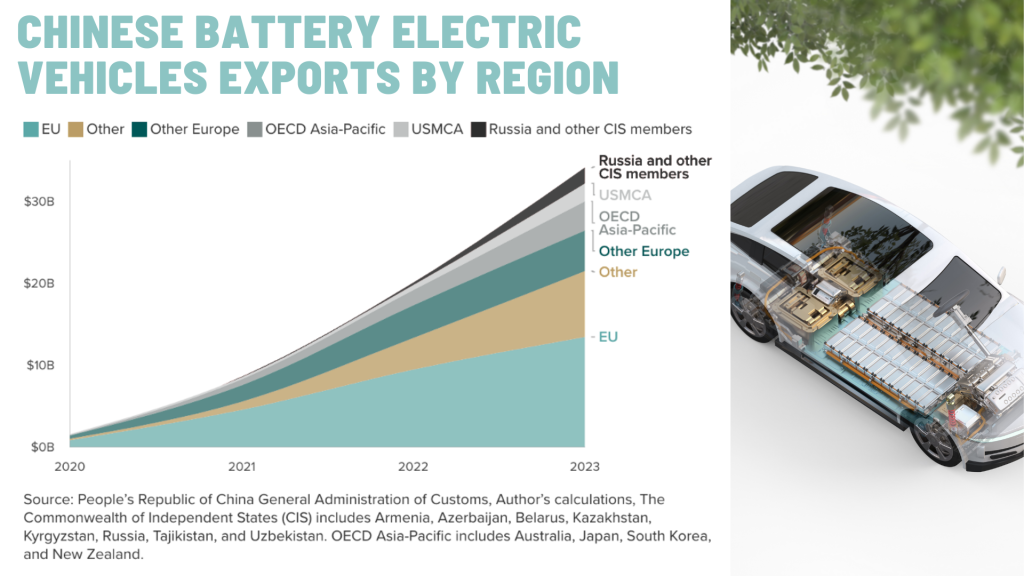

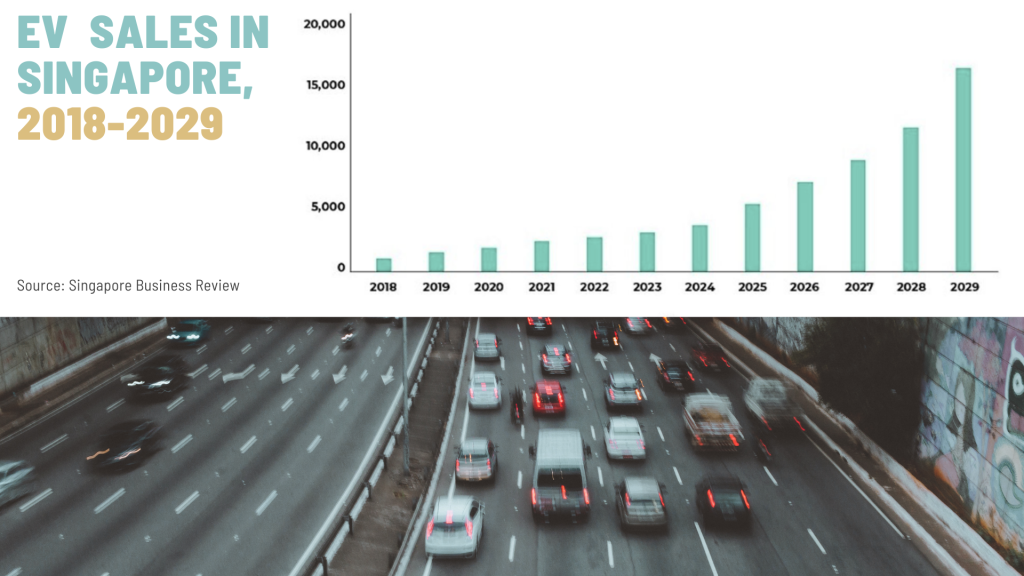

EV production has clearly been on the rise, but this doesn’t seem to have been followed suit by local adoption rates for the US and China. Is there a domestic onshore surplus? Where then are these EVs headed? China’s EV production increased 85% YoY in Jan 2024, with EV exports growing more than 30% YoY (Fig 1.4). While EV onshore adoption has been growing, a significant proportion has been exported overseas. EV adoption has been on the rise globally, and the automotive manufacturing game is reserved only for countries whose domestic markets can support such a long game. Our little red dot is no exception. However small our impact, we observe the exponential growth taking place here.

In Singapore, Everything by 2030

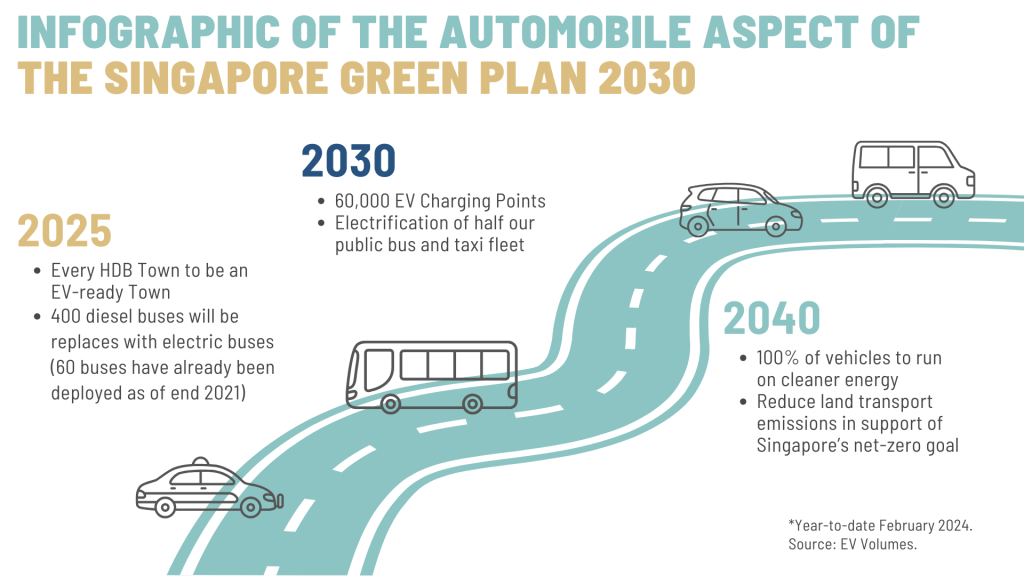

Singapore experienced a whopping 50.5% jump in EV sales in 2023. In Singapore, we neither lead nor lag – as our political masters advocate a reduction in carbon emissions, the technocracy has been busy hashing out a plan to build 60,000 EV charging points, as well as “electrifying” at least half our public bus and taxi fleet. EV adoption is crucial for the nationwide sustainability goal and providing incentives is a cornerstone to the adoption of such a public good. The Land Transport Authority (LTA) has implemented a downward revision in road tax for electric cars and provided the EV Early Adoption Incentive (EEAI) and Vehicular Emissions Scheme (VES) to narrow the upfront cost gap with ICE cars. These incentives can lower the upfront cost of owning an EV by up to an impressive S$45,000 – sparking the imagination of a massive local population of drivers already “electrocuted” by stratospheric Certificate of Entitlement prices. To put this into perspective, a BYD Atto 3 here in Singapore costs S$152,888 after subsidies. A similar specification ICE car such as the Honda HR-V would easily cost upwards of S$176,999. Furthermore, with more charging ports, refuelling/recharging concerns are gradually subsiding.

Maintenance: EV vs ICE

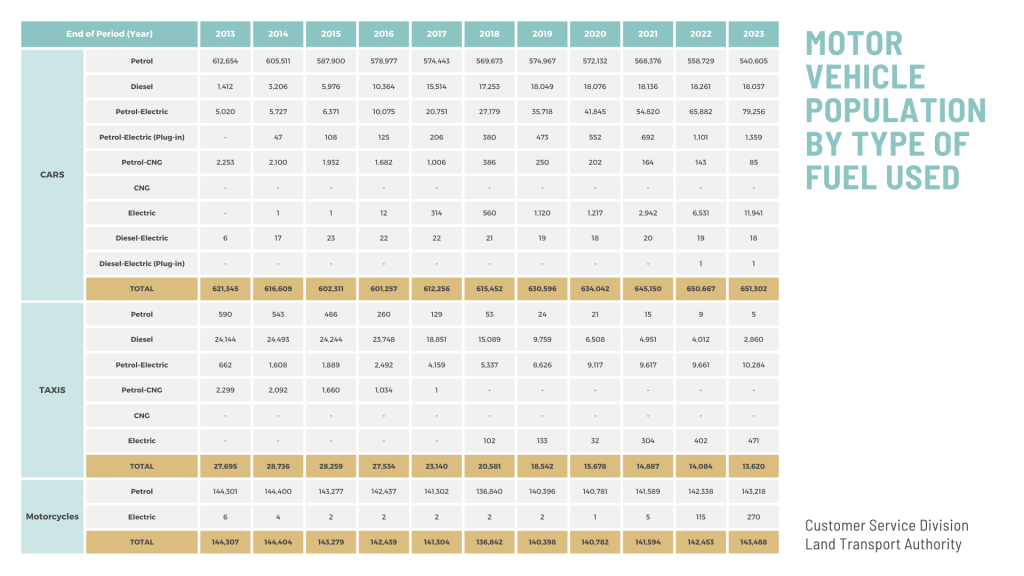

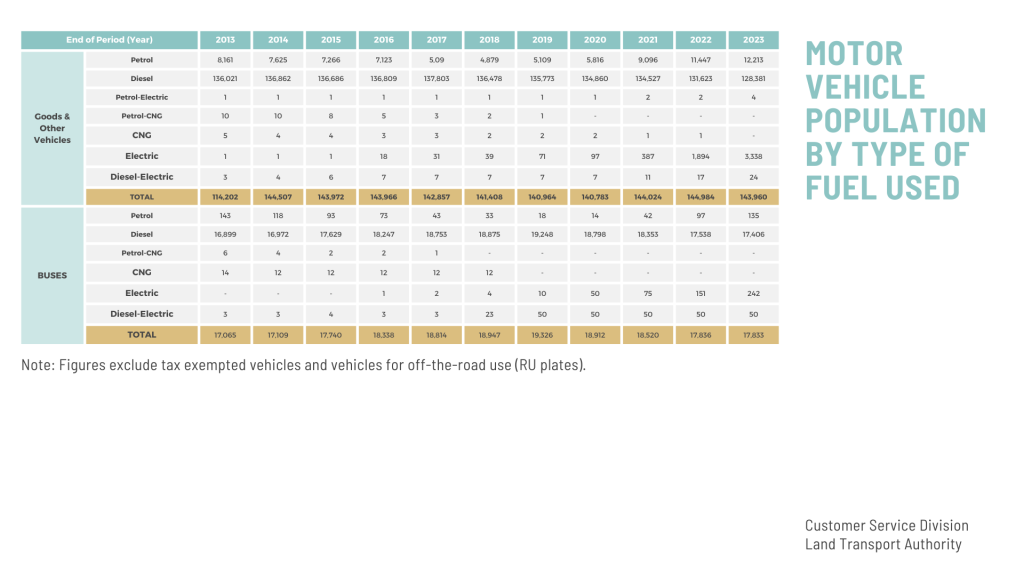

While it is hard to make an apple-to-apple comparison between EV and ICE vehicles, we tried to do an anecdotal comparison between the BMW X3 (ICE) and BMW iX3 (EV) (just for interest, we receive no marketing dollars for this), which price in the same range with similar specifications. Assuming an annual traveling distance of XXX km a year, the X3 model has a fuel cost of approximately S$3,955/year while the iX3 would cost approximately S$1,610/year, a shocking 60% savings on fuel cost alone. No laughing matter considering the general population fears over energy inflation. On the depreciation front, the comparison is less stark, with the X3 model chalking a lower depreciation of S$29,300/year as compared to the iX3 model of S$30,600/year. As the dollar and cents add up, so too has the EV population here (as seen in Fig 1.6).

*calculations are provided by sgcarmart.

Conclusion

Moving forward, we think that EV adoption in Singapore will continue to grow at a sustainable rate as the US and China produce and export more EVs overseas. Further supported by government incentives and lower running costs, EVs look to gain an edge over ICE in the battle for market share. Overall, we remain encouraged by both the global growth in EV adoption and its implications for the EV market here. Here at Stoic, we look forward to cheaper automotive options as we contemplate our very first company EV – after we find a charging point around here first. Please do check out our other ideas here as we scour the investment landscape.

References:

- https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/metals/020824-chinas-ev-sales-mark-sharp-fall-in-jan-seen-slipping-further-in-feb

- https://www.channelnewsasia.com/singapore/electric-motorcycles-motorbikes-charging-batteries-infrastructure-3336581

- https://www.sgcarmart.com/articles/features/just-how-much-can-you-save-driving-an-ev-we-do-the-science-to-find-out-1937

Disclaimer

Please refer to our terms and conditions for the full disclaimer for Stoic Capital Pte Limited (“Stoic Capital”). No part of this article can be reproduced, redistributed, in any form, whether in whole or part for any purpose without the prior consent of Stoic Capital. The views expressed here reflect the personal views of the staff of Stoic Capital. This article is published strictly for general information and consumption only and not to be regarded as research nor does it constitute an offer, an invitation to offer, a solicitation or a recommendation, financial and/or investment advice of any nature whatsoever by Stoic Capital. Whilst Stoic Capital has taken care to ensure that the information contained therein is complete and accurate, this article is provided on an “as is” basis and using Stoic Capital’s own rates, calculations and methodology. No warranty is given and no liability is accepted by Stoic Capital, its directors and officers for any loss arising directly or indirectly as a result of your acting or relying on any information in this update. This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.