Electric Motorbikes in Singapore

Isaiah Yap

Electric vehicles have been gaining traction. These substitutes for traditional Internal Combustion Engine (ICE) vehicles have seen increased presence on roads globally. In Singapore, appearance of electric cars, buses or bicycles on the road no longer cause wide-eyed stares. Where are the electric motorbikes though?

Are electric motorbikes on the road?

Since hybrid cars were first introduced, innovation in the electric vehicle space has seen much progress. There are now fully electric cars (even sports cars!), electric commercial vehicles and electric tractors. Research is ongoing for long-haul electric passenger aircrafts, but I believe it’s only a matter of time. Why, then, have we not heard or seen much of electric motorbikes?

In 2021, only 5 out of the 141,594 motorbikes in Singapore are electric. That’s a measly 0.004% compared to 0.456% of cars being electric. The number increased to 115 out of 142,453 in 2022. With a little help from Google, of the 115 electric motorbikes added to the population in 2022, 109 seems to be electric commercial 3-wheelers. Adding to that, as of January 2023 the electric motorbike population has increased to 117, but only 2 are owned by individuals. Why the low adoption rate among individuals?

Why the low adoption rate?

To be able to ride an electric motorbike in Singapore, one must possess the appropriate class of license which corresponds to the power rating of the electric motorbike. This seems fair and isn’t any different from what is required to ride a petrol fueled motorbike. That said, license to ride shouldn’t be a contributing factor to the low adoption rate.

Road tax, too, is unlikely to be the reason for the low adoption rate. In a bid to encourage adoption of cleaner vehicles, Land Transport Authority (LTA) and the Singapore Police Force (SPF) worked together to enhance the electric motorbike registration regime to facilitate the introduction of higher-powered electric motorbikes. The authorities have taken measures to ensure that road tax structure for both electric motorbikes and their petrol-powered buddies are aligned.

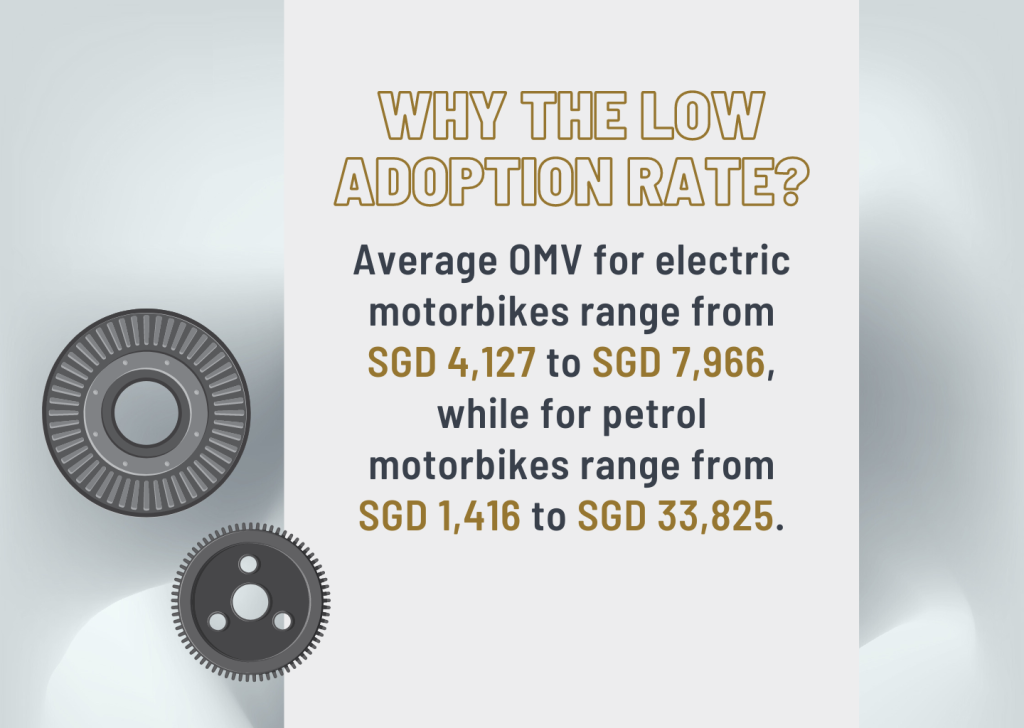

Could the price of the motorbikes be the hindrance? Looking at the average Open Market Value (OMV) of motorbikes registered between July 2022 to December 2022, my very sophisticated eyeball method tells me that average OMV for electric motorbikes range from SGD4,127 to SGD7,966. The average OMV for petrol motorbikes range from SGD1,416 to SGD33,825.

That doesn’t seem so bad but for an extra layer of comfort, I checked the prices of some of the options on offer in Singapore. BMW Singapore’s electric offering, CE 04, starts from SGD52,800 whereas their others range from SGD28,800 to SGD86,800 to the fear-inducing price tag of “Price On Application”. A quick online search shows that Honda motorbikes range from SGD3,173 for a Honda CB125e to SGD48,615 for a Honda CBR600RR.

On the electric front, price information is harder to come by. Quantum Mobility doesn’t list prices for their G2 Quantum (rated power of 3kW) but the company offers three different plans to consumers. Ion Mobility on the other hand plans to keep prices competitive against 155cc petrol models. The higher performing end there’s Energica whose models range from SGD64,000 to 75,000 as at June 25,2021 (rated power 80kW-107kW). There doesn’t seem to be sufficient price information out there to make a definite conclusion, but price may be a factor. It could be that electric motorbikes really are substantially more expensive, or it could be the lack of price transparency has kept people away.

The public infrastructure available for electric vehicles is also a concern. LTA Singapore recently made an announcement stating that they have installed over 3,800 charging points across the island. Their goal is to reach 60,000 charging points by 3030. However, it is important to highlight that these charging points are primarily designed for Electric Cars. Whether or not the charging docks can be used for motorcycles depends on two factors: compatibility between the electric motorcycle and the available charging station, and the dedicated power level required for each motorcycle model. Evidently, charge points for electric vehicles are nowhere near as readily available as petrol kiosks are. Add in the time required for charging versus a quick refuel at a petrol kiosk to hit the same range, it would not be surprising if not many are keen to make the switch. Even more so if you were a part of the gig economy and time is money.

One response to charging time is battery swapping. Instead of heading to a charge point to plug in their motorbike then waiting for it to be charged, some motorbikes have removable batteries that can be swapped out. Riders can head to a battery swap location, remove their dying battery and pop in a fresh one then be on their way. Both Singpost and Foodpanda have battery swapping vehicles. Hopefully this will help in spreading awareness and uptake of electric motorbikes.

To sum it all

The Singapore government has announced The Singapore Green Plan 2030 to advance Singapore’s national agenda on sustainable development. Among the targets listed are:

- New registrations of diesel cars and taxis to cease from 2025

- All HDB towns to be electric vehicle ready with chargers at all HDB carparks by 2025

There aren’t many electric motorbikes on the road now and although choices aren’t as varied as ICE motorbikes, there are options available in the market. As government initiatives relating to electric vehicles be more apparent to the public, it’s likely a matter of time before electric motorbikes gets their time in the sun.

Disclaimer

Please refer to our terms and conditions for the full disclaimer for Stoic Capital Pte Limited (“Stoic Capital”). No part of this article can be reproduced, redistributed, in any form, whether in whole or part for any purpose without the prior consent of Stoic Capital. The views expressed here reflect the personal views of the staff of Stoic Capital. This article is published strictly for general information and consumption only and not to be regarded as research nor does it constitute an offer, an invitation to offer, a solicitation or a recommendation, financial and/or investment advice of any nature whatsoever by Stoic Capital. Whilst Stoic Capital has taken care to ensure that the information contained therein is complete and accurate, this article is provided on an “as is” basis and using Stoic Capital’s own rates, calculations and methodology. No warranty is given and no liability is accepted by Stoic Capital, its directors and officers for any loss arising directly or indirectly as a result of your acting or relying on any information in this update. This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.