Mobility Aids – Out and About in Singapore

Ken Chan

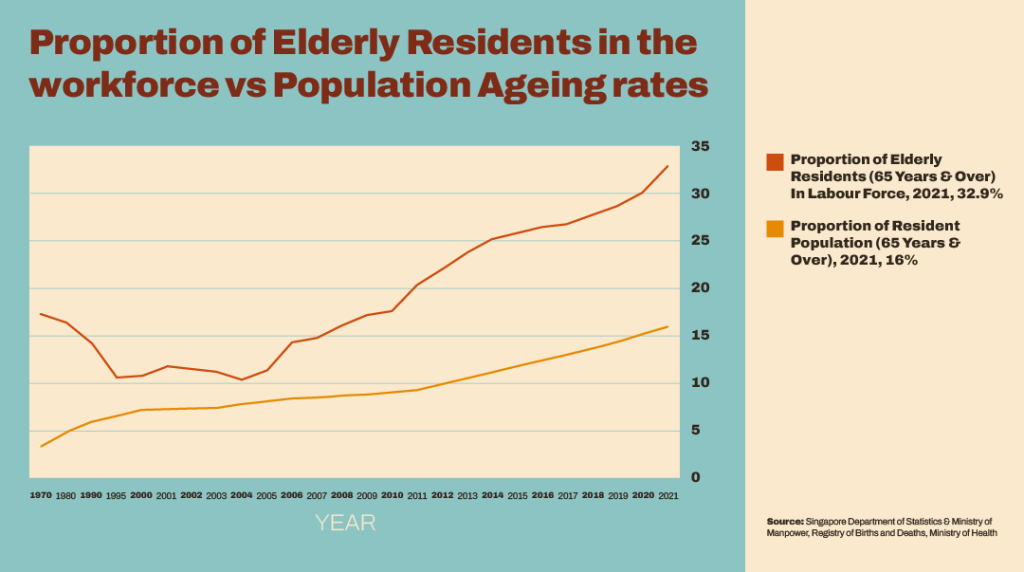

Arguably, Singapore has always preferred the option of a continuous stream of human imports to deal with the our ageing population. So much so that non-residents now comprise 27% of the population, and of the balance, local citizens are a rapidly declining proportion of 64%. (Remaining 9% of population are permanent residents) Still that has not stopped the oncoming wave, with the proportion of our population aged 65 and above rising from 9.3% in 2011 to 16% in 2021. While the trend may seem trivial to some, it would be less of a laughing matter if the Fed hiked rates in a similar magnitude over the same period. Perhaps even more stark has been the steady increase in the labour participation rate of this segment of the population – rising from 20.4% to 32.9% over the same period. Not only is our population getting older, we’re working harder, and retirement is slowly slipping away.

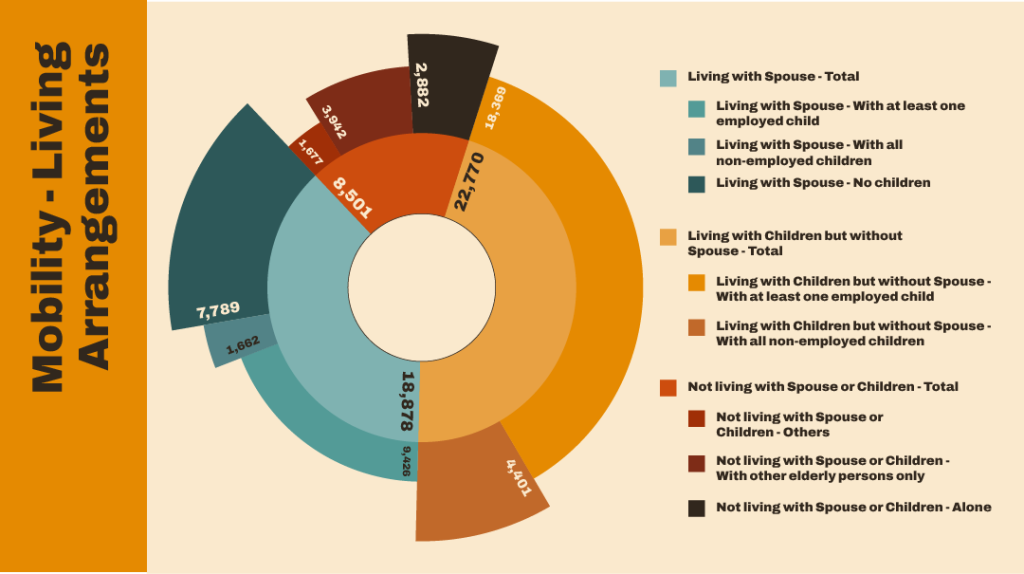

While not all forms of work involve manual labour, would it not be a safe assumption to make that a reasonable amount of mobility is required? According to the Ministry of Health, the number of Singaporeans aged 65 years old and above with mobility issues doubled from around 25,500 to 50,000 between 2000 and 2020. Also, the number of Singapore resident aged 65 years old and above who lived alone has increased from 47,000 in 2016 to 67,600 in 2019.

Bear in mind that the term mobility here is but a smaller subset of a broader statistical definition of “performing basic activities”. To illustrate, of the population aged 65 and above, the proportion of those unable to perform/perform only with a lot of difficulty at least one basic activity is 11%. And within this group, those with mobility issues comprise 72%. The remaining 28% stems from difficulties pertaining only to sight, hearing, memory, self care or communication – presumably challenges in any of these areas could in fact preclude meaningful employment. Family support is crucial in such instances, yet a proportion lives on their own ~ 9%.

With age, the body loses calcium density and muscle mass. Osteoporosis is an acute issue for females, which partly explains the high proportion of females (67%) with mobility issues vis-a-vis males (33%) for those aged 65 and above. Healthcare demand for an ageing population is changing in scope and nature, but mobility remains the key issue to address in this space, thereby giving rise to the demand for mobility aids.

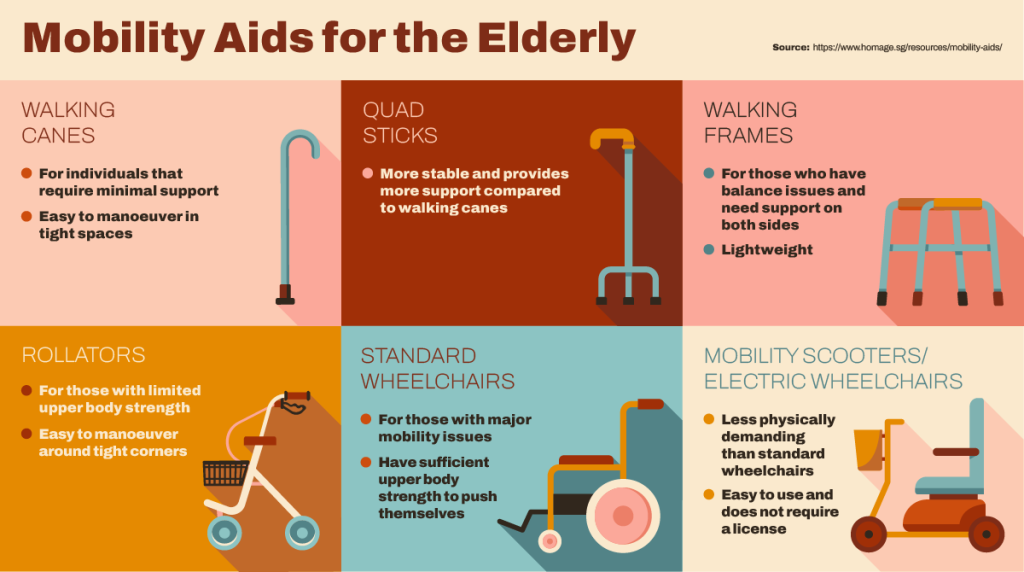

The basic range of mobility aids as laid out above remains within financial reach of the general population. We believe the potential for robotics is huge in this space, albeit ahead of its time (we’ve always thought Cyberdyne was interesting but its stock performance says otherwise). While affordable, the prevalent range of mobility assistive devices provides limited support by merely redistributing the gravitational force of the user’s weight to improve mobility. The overall strain on the bone structure remains undissipated although less concentrated on the knee joints. Devices such as simple non-motorised wheelchairs address this problem, but rely heavily on upper body strength and are less suitable for the 20% of this population segment that live alone. Motorised solutions such as personal mobility aids (PMA) do provide the closest mobility solution, but have their limitations in terms of accessibility – notably in public transport or narrow walkways, given that mechanised or motorised solutions necessarily weigh more and require more intricate maintenance. In Singapore, the entry price for a medium sized PMA is around S$1,500. Affordable on most counts, thankfully after taking into consideration the expansive range of government grant options of up to 90% available to those above the age of 65. This of course, assumes the older segment of our population can and know how to avail themselves of the requisite grants as we bulldoze our way in our “digitalisation” push.

Government grant options

Disclaimer

Please refer to our terms and conditions for the full disclaimer for Stoic Capital Pte Limited (“Stoic Capital”). No part of this article can be reproduced, redistributed, in any form, whether in whole or part for any purpose without the prior consent of Stoic Capital. The views expressed here reflect the personal views of the staff of Stoic Capital. This article is published strictly for general information and consumption only and not to be regarded as research nor does it constitute an offer, an invitation to offer, a solicitation or a recommendation, financial and/or investment advice of any nature whatsoever by Stoic Capital. Whilst Stoic Capital has taken care to ensure that the information contained therein is complete and accurate, this article is provided on an “as is” basis and using Stoic Capital’s own rates, calculations and methodology. No warranty is given and no liability is accepted by Stoic Capital, its directors and officers for any loss arising directly or indirectly as a result of your acting or relying on any information in this update. This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.