US Commercial Real Estate

Zhen Hao

We’ve looked at US housing as we tried to get a gauge of where the economy was heading, and we’ve subsequently made some observations relating to Singapore’s public housing. This time around, we thought we’ll explore the state of US commercial real estate.

What is commercial real estate?

Commercial real estate is property used for business purposes and includes offices, industrial units, rental and retail spaces.

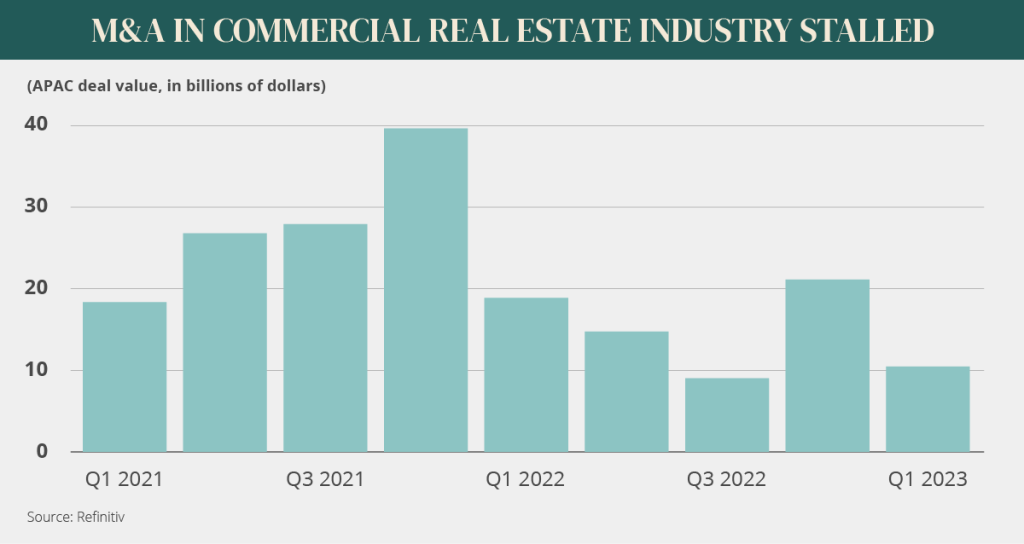

At the end of 2022, Deloitte published their 2023 Commercial Real Estate Outlook where key industry players seem to have a not very optimistic revenue expectation for 2022 and an even less optimistic revenue expectation for 2023. Let’s see how the US commercial real estate sector has been doing so far this year.

Supply and Demand

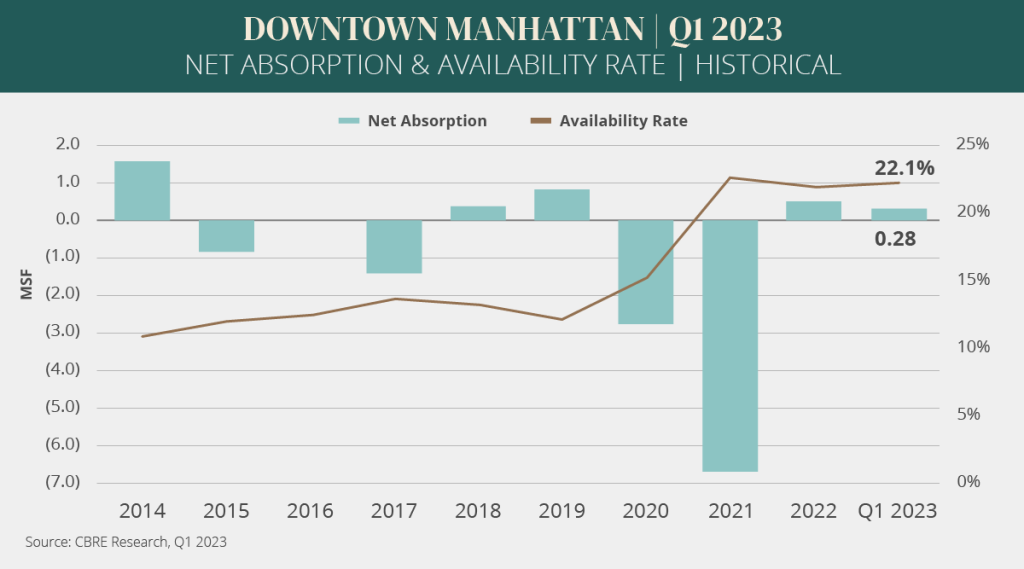

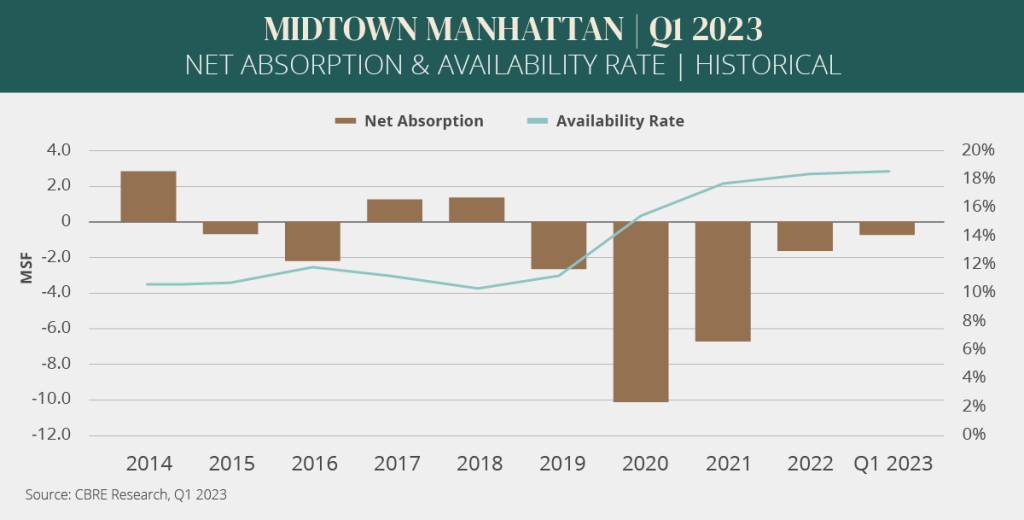

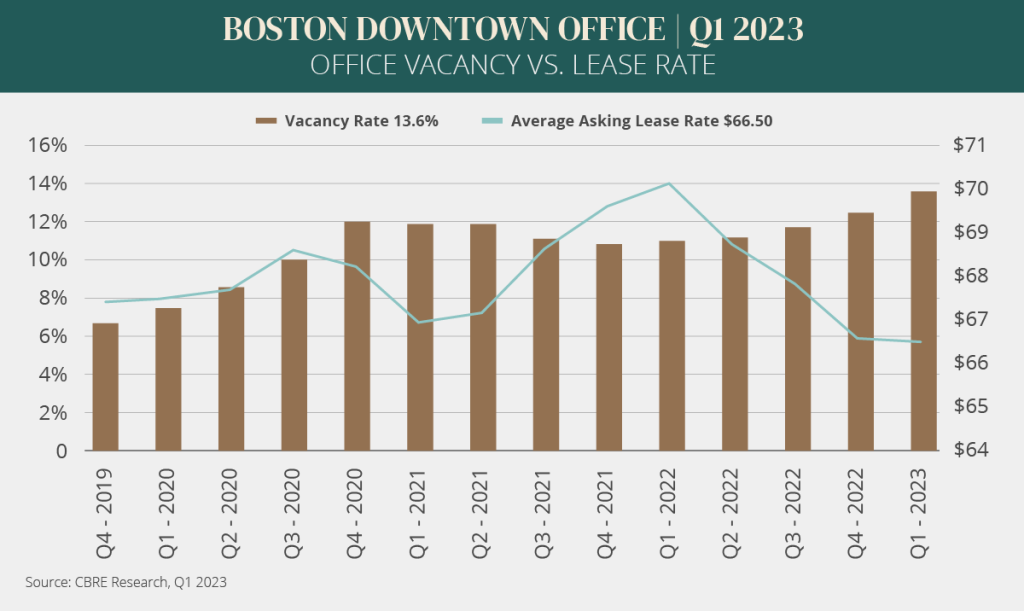

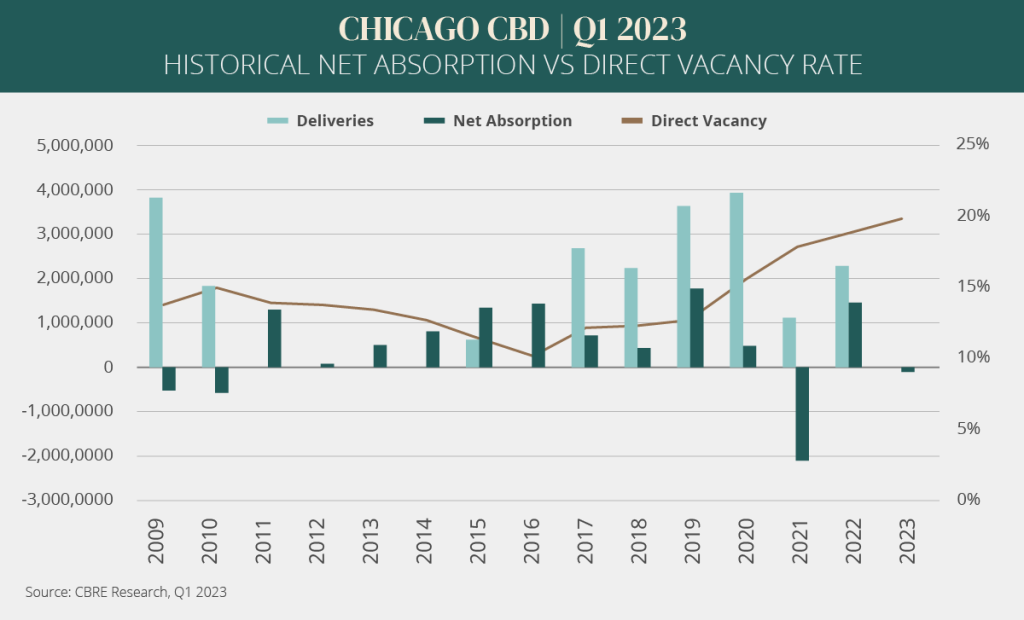

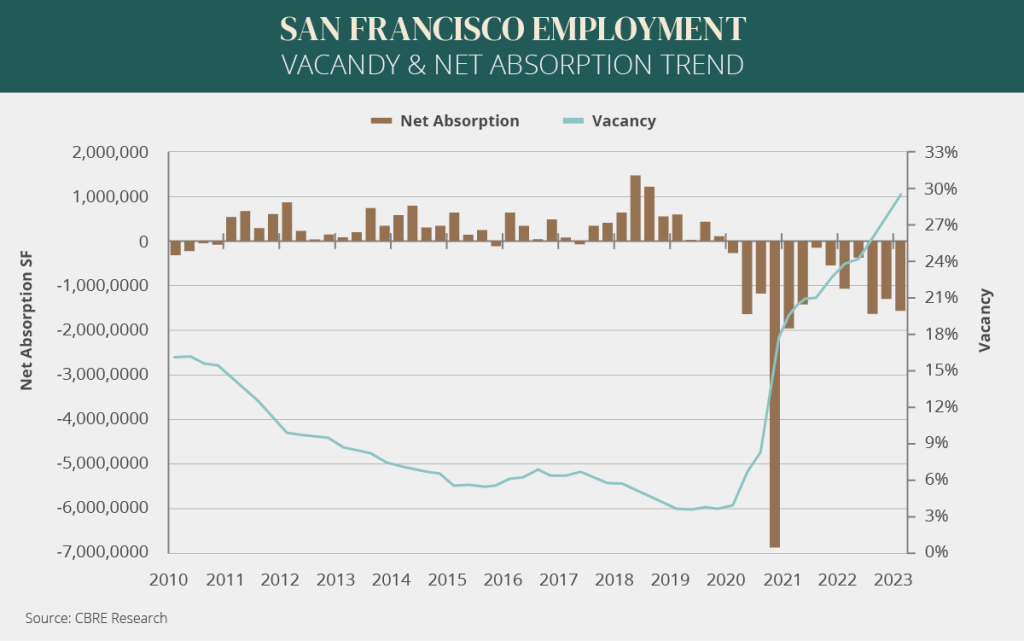

Net absorption is the change in occupied square feet (sq. ft.) from one period to the next, as measured by available sq. ft. It’s basically an indicator of supply and demand in a commercial market.

Looking at Q1 2023, Downtown Manhattan’s net absorption was positive while Midtown Manhattan had a negative absorption. Boston office market saw a negative absorption though Boston’s Central Business District (CBD) saw a positive absorption.

Looking above, Chicago’s CBD experienced its first quarter of negative absorption since Q3 2021. San Francisco saw a negative absorption of 1.56million square feet (sq. ft.).

The greater Los Angeles area also saw a negative net absorption. This means that other than Downtown Manhattan, all the other areas had more supply of office spaces than there is demand as there were less occupied space. This is hardly surprising as most companies are still on hybrid work mode where employees need not be physically in the office thereby reducing demand for office space.

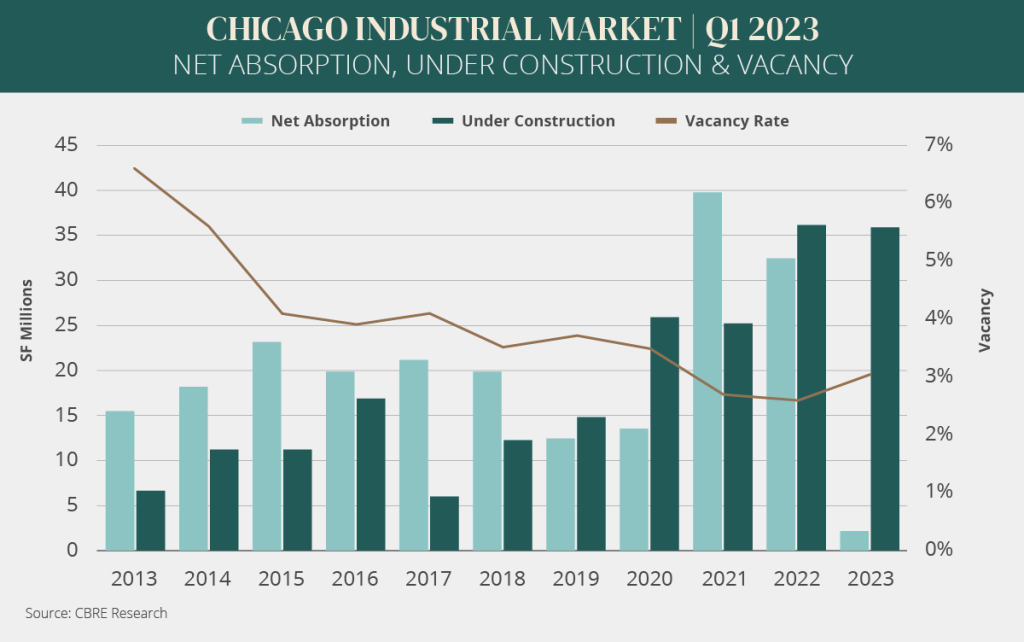

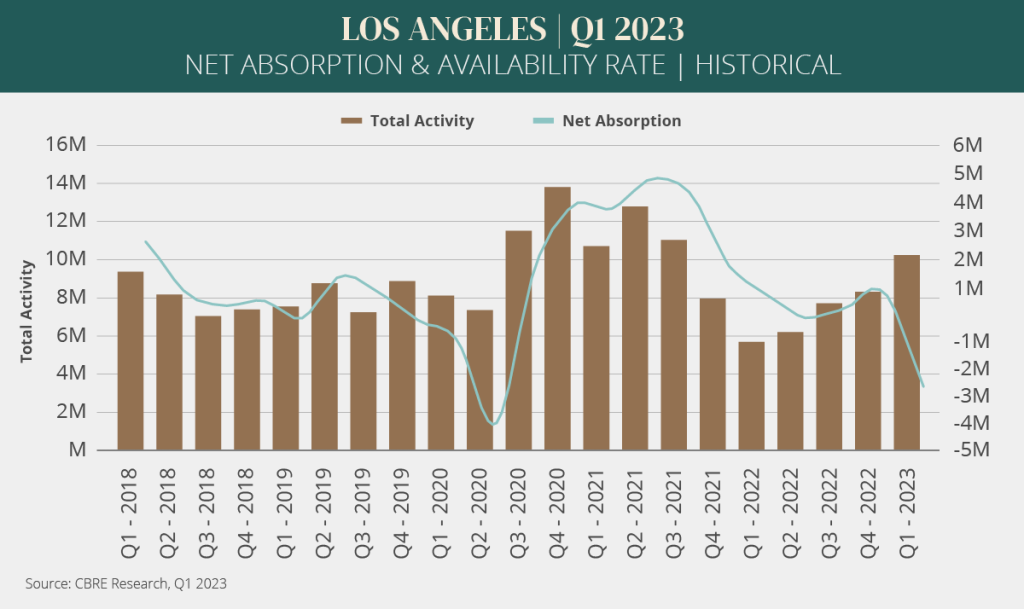

In the industrial space, Chicago saw a quarter-on-quarter increase in vacancy rate. Net absorption remains POSITIVE although it has decreased from year-end 2022 measure. Greater Los Angeles also saw an increase in vacancy rate and a negative absorption in Q1 2023. The industrial space looks to be in line with the offices.

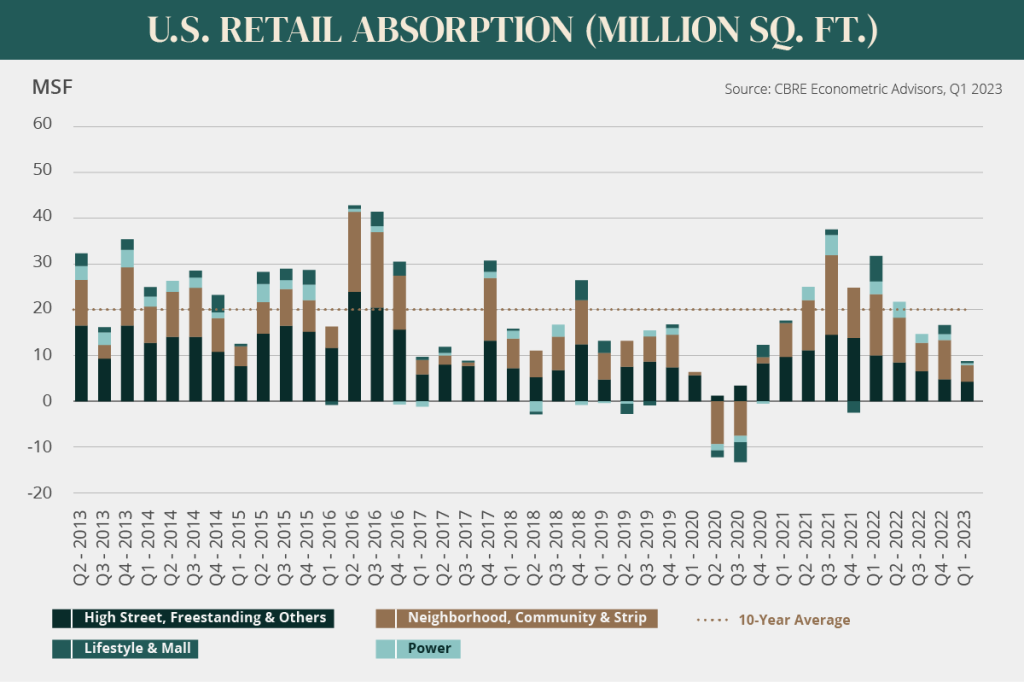

On the retail front, although absorption slowed considerably in Q1 2023, it has remained positive for the 10th consecutive quarter. Given inflation and complaints the world over on the price of goods, it is a little heartening to see that there might be some possible upside from business recovering.

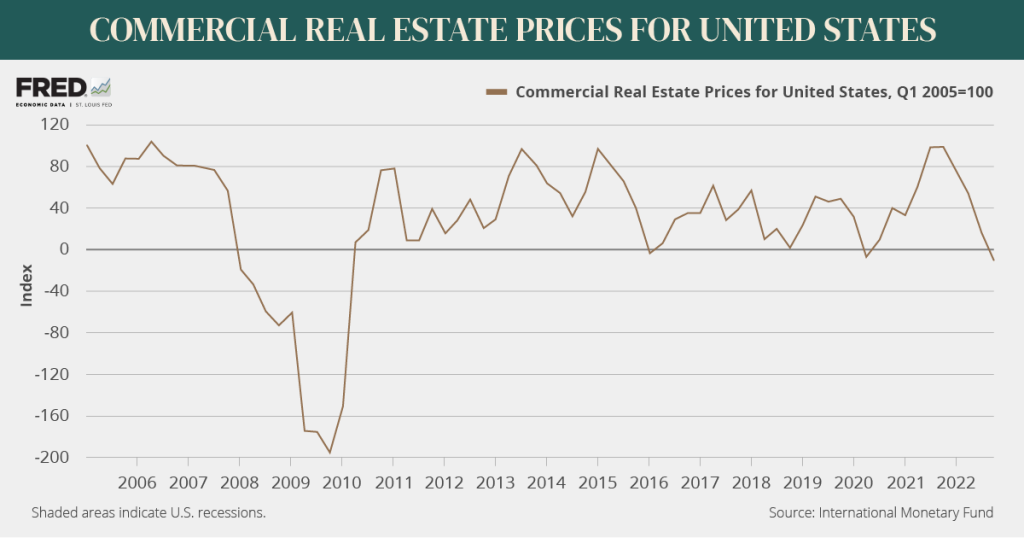

Performance of US Commercial Real Estate

Tracking US commercial real estate prices from 2005, it has had its ups and downs but nothing quite like the effect of the 2008 credit crunch. Back then, low interest rates and loose lending standards fueled a housing price bubble in the US. Banks were profusely giving out loans, even to those with poor or no credit history. These were eventually repackaged as mortgage-backed securities and traded among the large Wall Street players. As interest rates rose, borrowers had trouble meeting their mortgage payments and started to default causing the value of these securities to fall. The true value of these now-toxic mortgage-backed securities were difficult to assess and triggered a recession which also led to the fall in commercial real estate values.

Since then, there’s only been a few instances when US commercial real estate prices have dipped:

- In 2016, when macroeconomic factors were at play

- In 2020, when the pandemic hit and almost everyone was confined indoors

- And most recently, Q4 2022

Will there be a repeat of the 2008 crisis?

The decline in US commercial real estate prices in 2022 is partly due to the lack of demand as most companies continued with the hybrid work mode, allowing most of their staff to work from home instead of in the office. The rising prices of goods likely contributed, too, as sales of goods took a hit reducing demand for industrial spaces. The lack of rental income or sales from commercial real estate will affect landlords and their ability to service their loans. The high interest rates are not helping either. This seems eerily familiar.

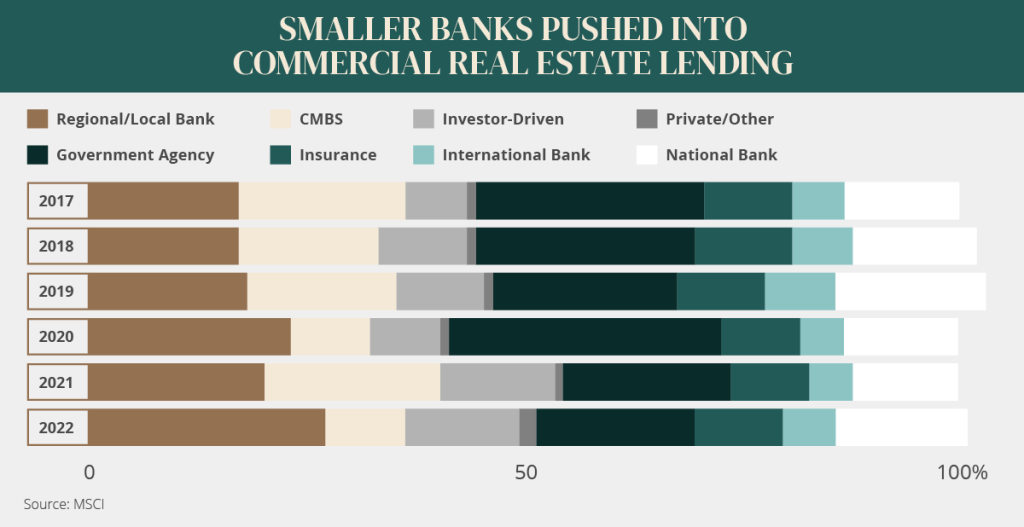

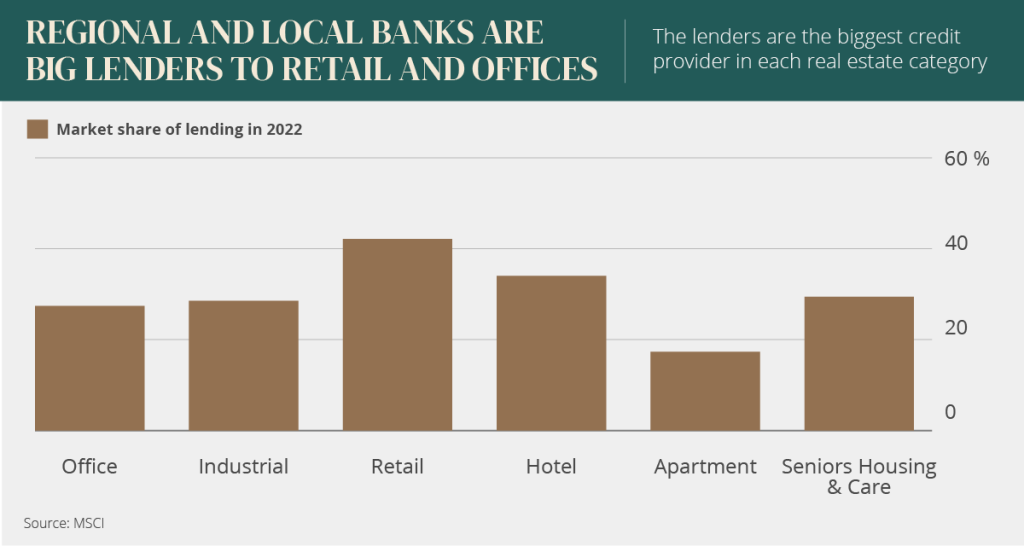

The banking side, on the other hand, has had some major scares. The collapse of Silicon Valley Bank, the seizure of Signature Bank, the sale of First Republic and the bailout of Credit Suisse have got people wondering if they are better off hiding their money under their mattresses. What’s worrying is that regional and local US banks seem to be significant lenders in the commercial real estate space as seen below.

With almost USD1.5 trillion of US commercial real estate debt coming due for repayments before the end of 2025, will we see history repeat itself?

Only time will tell. But one hopes that the banks have learnt from the 2008 crisis and have implemented more stringent lending standards which should provide some extra protection this time around. No doubt it is still a precarious situation, but we believe that should it happen, the impact would be less devastating as things seem more optimistic in Asia. For now, markets are cyclical and if you have the risk appetite as well as the patience for it, perhaps it is worth taking a look at US commercial real estate.

Disclaimer

Please refer to our terms and conditions for the full disclaimer for Stoic Capital Pte Limited (“Stoic Capital”). No part of this article can be reproduced, redistributed, in any form, whether in whole or part for any purpose without the prior consent of Stoic Capital. The views expressed here reflect the personal views of the staff of Stoic Capital. This article is published strictly for general information and consumption only and not to be regarded as research nor does it constitute an offer, an invitation to offer, a solicitation or a recommendation, financial and/or investment advice of any nature whatsoever by Stoic Capital. Whilst Stoic Capital has taken care to ensure that the information contained therein is complete and accurate, this article is provided on an “as is” basis and using Stoic Capital’s own rates, calculations and methodology. No warranty is given and no liability is accepted by Stoic Capital, its directors and officers for any loss arising directly or indirectly as a result of your acting or relying on any information in this update. This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.