Riding the Lumber Wave: Navigating the World of Lumber Futures

Senyi

Lumber, also known as timber, is wood that has been processed into beams and planks, a stage in the process of wood production. It is primarily used for construction and furniture-making due to its strength, workability, and natural aesthetic. There are two types of lumber, hardwood and softwood. Softwood Lumber is derived from coniferous trees such as pine, spruce, fir, cedar, and redwood. Softwood trees are generally faster-growing, making them more readily available and less expensive. Commonly used for framing in construction, flooring, and furniture. Hardwood Lumber comes from deciduous trees like oak, maple, cherry, walnut, and mahogany. Hardwood trees typically grow slower and are denser than softwoods, making them more expensive. They are preferred for high-quality furniture, flooring, cabinetry, and finishes due to their durability and attractive grain patterns.

Lumber futures, like most other commodities futures contracts, were borne out of a need to hedge price risks in the physical commodities market. The lumber futures contract was first introduced into the Chicago Mercantile Exchange in Oct 1969. The contract specifications have met with little change over the years – delivery of 2×4’s of random length from 8-20 feet by railcar from a producing mill to a destination within the Chicago Switching District. Each delivery unit will be of 27,500 board feet, and contain lumber produced from and grade stamped Hem Fir, Douglas Fir, Fir Larch or Spruce Pine Fir – i.e. primarily softwood.

As lumber futures are financial contracts obligating the buyer to purchase, and the seller to sell, a specific amount of lumber at a predetermined price at a future date, the contracts trade for 7 months – Jan, Mar, May, Jul, Sep and Nov on the CME. Since inception in 1969 the contract has evolved from a niche hedging tool to a broad based market participation hedging tool. Its history is marked by periods of growth, technological advancements, and significant volatility driven by various macroeconomic factors and dynamics. Trading has been largely range bound since inception between the highs of 400s and the lows of 200s. Prima facie, price action appears correlated with not just business and housing cycles, but also micro-supply and demand factors. It was not only until the recent decade did volatility begin to increase dramatically, with the first signs emerging in 2018 when lumber prices went into the highs of 600s. And it was only following the pandemic did social media coverage reach a feverish pitch as the flood of memes of millionaire lumberjacks and million dollar wood cabins trickled into mainstream media as lumber prices tested almost 1000 in 2020 and 1600s in 2021.

The frenzy over lumber prices has led to a significant change in how lumber futures are traded. A new lumber future began trading on August 8, 2022, replacing the older one. This new contract is smaller, featuring a size of 27,500 board feet. According to the CME, it aligns better with evolving production patterns, enhancing its effectiveness as a risk management tool. The delivery location has also been updated to the Chicago Switching District, moving away from the former British Columbia location, facilitating broader market participation from mills in both western and eastern regions. Additionally, the new lumber futures contracts are sized at a single truckload, allowing for more customised risk management strategies.

While the frenzy over lumber prices has died down and with prices a plank below 500, will we ever revisit the highs driven by a recovery of China’s housing market looming rate cuts? With the easing of home buying restrictions in major Chinese cities and the issuance of the one trillion yuan special government bond, the Chinese housing market has shown signs of a slow recovery. This could bode well for lumber demand, which saw China’s imports of sawn wood increase in 2023 and 2024. (Yoy numbers for 2019: 0.2% rough, 1.4% sawn, 2020: 0.9% rough, -8.3% sawn, 2021: 6.9% rough, -14.1% sawn, 2022: -31.3% rough, -7.1% sawn, 2023: -8.7% rough, 10.7% sawn, 2024: May cumulative -2.1% rough, 0.1% sawn.

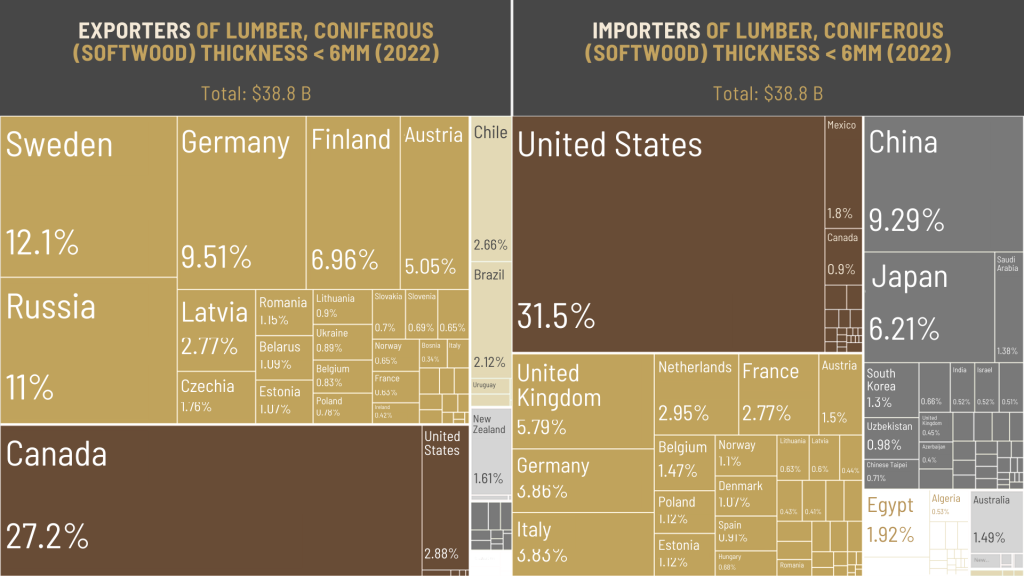

We conjecture that the US import value of lumber may mask the value of cross-border imports from Canada, leaving North Asia as the top importer of lumber. A housing recovery in China and Japan, would likely have significant impact on the lumber market in the coming years.

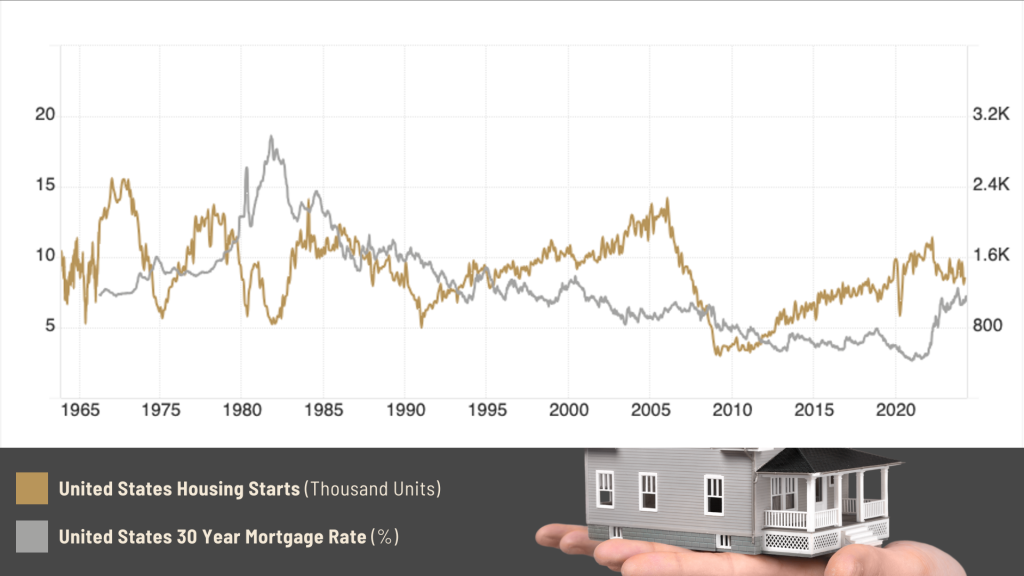

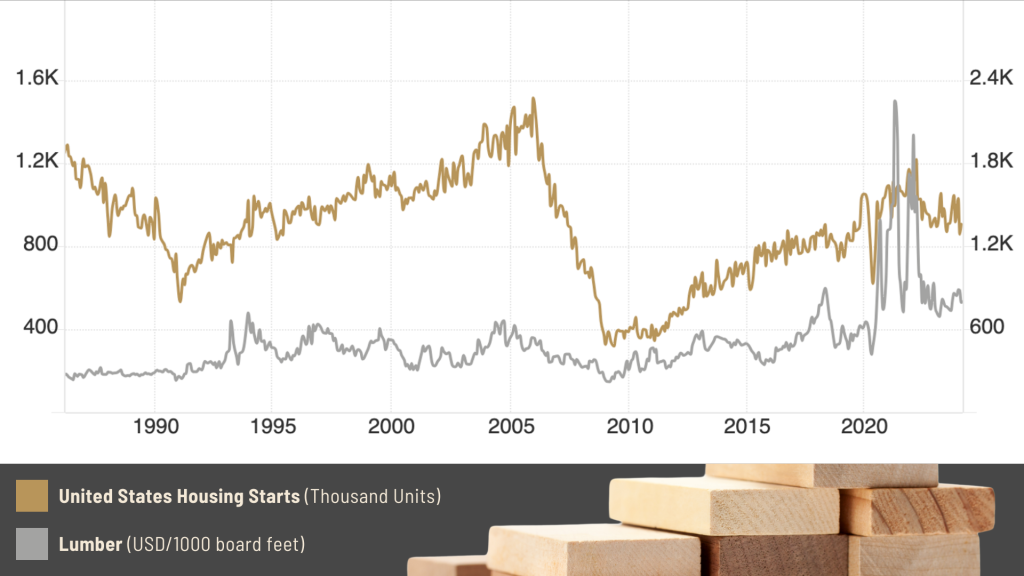

Where rate cuts are concerned, the CME Fedwatch implies a rate cut as early as Sep 2024 and 100-125bps by Sep 2025. Historical data fails to show a compelling relationship between lower 30-year mortgage rates and increased housing starts, even when assuming an absence of recessionary pressures, which suggests other possible factors at play other than housing market activity. The relationship between lumber prices and housing starts has also weakened over the years, possibly with the increasingly modularisation of construction and the introduction of new technologies.

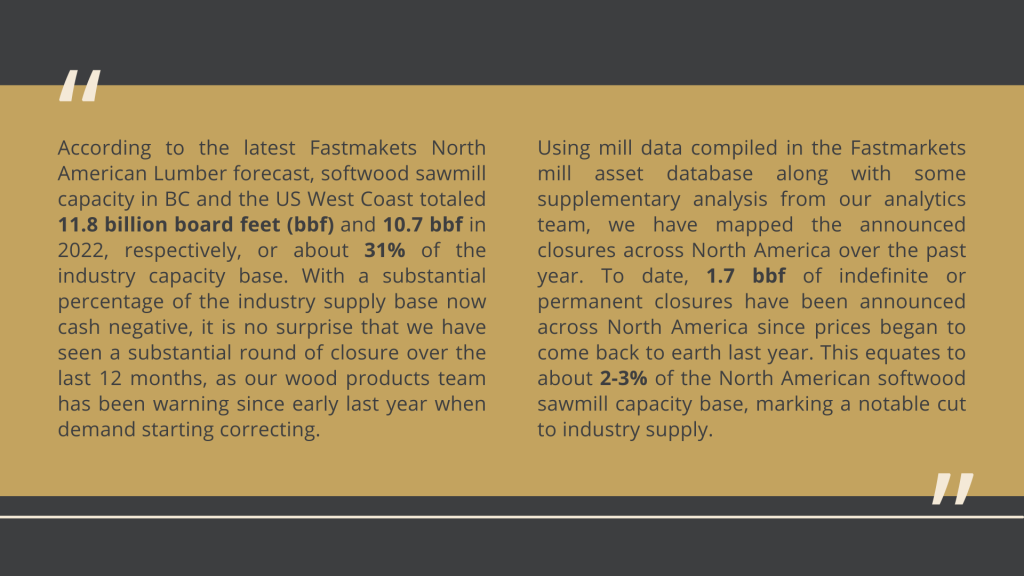

Furthermore, rising production costs are forcing major timber companies to make difficult decisions, including reducing timber processing capacity and enforcing strict cost-cutting measures to avoid potential losses. These increased expenses are driven by several factors, such as higher labour costs, escalating transportation and logistics expenses, and growing maintenance costs for machinery. It is no wonder that several mills are currently operating at a loss. “Many producers are operating below the cash flow break-even point. They can do this for a while, but not indefinitely,” said Weyerhaeuser CEO Devin Stockfish at the New York investor conference on June 4, 2024.

This challenging landscape is reflected in the financial performance of the top softwood lumber producers, where only one out of the four reported a positive net income. Specifically, West Fraser records a net income of -90 million USD TTM, Weyerhaeuser demonstrates resilience with a net income of +802 million USD TTM, while Interfor and Canfor struggle with net incomes of -298.4 million CAD TTM and -248.6 million CAD TTM respectively.

As Canada stands as the leading exporter of softwood lumber, accounting for 27.2% of the global market value in 2022, any reduction in sawmill capacity in key regions like British Columbia is poised to tighten supply dynamics. This anticipated decrease in supply levels is expected to exert upward pressure on prices, further accentuating the challenges faced by timber companies amidst the prevailing economic conditions.

In summary, the trajectory of lumber futures from their inception as a specialised risk management instrument to their contemporary status as a broad based market participation tool underscores the dynamic evolution of the market. The macroeconomic factors appear supportive of a recovery in lumber prices, key of which remain the outlook for China’s housing sector and Fed rates. Escalating production costs may help buttress a floor for lumber prices, below which the supply response could be significant. Therefore, we remain somewhat sanguine on lumber prices into the 2H 2024.

References

- https://oec.world/en/profile/hs/lumber-coniferous-softwood-thickness-6-mm?yearSelector1=2020

- https://tradingeconomics.com/united-states/30-year-mortgage-rate

- https://tradingeconomics.com/united-states/housing-starts

- https://forisk.com/blog/2024/02/20/top-10-north-american-and-u-s-lumber-producers-2023/

- https://finance.yahoo.com/quote/WFG/financials

- https://finance.yahoo.com/quote/WY/financials

- https://finance.yahoo.com/quote/IFP.TO/financials

- https://finance.yahoo.com/quote/CFP.TO/financials

- https://www.fastmarkets.com/insights/sawmill-capacity-closures-reshape-us-lumber-supply/

Disclaimer

Please refer to our terms and conditions for the full disclaimer for Stoic Capital Pte Limited (“Stoic Capital”). No part of this article can be reproduced, redistributed, in any form, whether in whole or part for any purpose without the prior consent of Stoic Capital. The views expressed here reflect the personal views of the staff of Stoic Capital. This article is published strictly for general information and consumption only and not to be regarded as research nor does it constitute an offer, an invitation to offer, a solicitation or a recommendation, financial and/or investment advice of any nature whatsoever by Stoic Capital. Whilst Stoic Capital has taken care to ensure that the information contained therein is complete and accurate, this article is provided on an “as is” basis and using Stoic Capital’s own rates, calculations and methodology. No warranty is given and no liability is accepted by Stoic Capital, its directors and officers for any loss arising directly or indirectly as a result of your acting or relying on any information in this update. This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.