2023: A Year of Turmoil in the Commodities Market

Angel T.

The commodities market experienced a turbulent year in 2023, marked by unprecedented supply disruptions, escalating geopolitical tensions, and a looming global economic slowdown. As a result, commodity prices exhibited extreme volatility, swinging from record highs to multi-year lows.

Key Factors Shaping the Commodities Market

Several factors played a crucial role in shaping the trajectory of the commodities market in 2023:

Supply Disruptions: The war in Ukraine and extreme weather events such as droughts and floods severely disrupted the flow of commodities across the globe. These disruptions resulted in shortages of essential goods and significant price spikes.

Geopolitical Tensions: The ongoing war in Ukraine, escalating tensions between the United States and China, and political instability in various regions of the world created a climate of uncertainty and risk, further impacting commodity prices.

Global Economic Slowdown: Fears of a global economic slowdown, driven by rising inflation, interest rate hikes, and slowing economic growth in major economies, weighed on commodity demand, leading to price corrections in certain sectors.

Major Commodity Price Movements

The S&P GSCI Ends January with Mixed Performance

The 24 individual commodities that make up the S&P GSCI finished January with divergent performance, reflecting the uncertain outlook for inflation. The major news in the energy complex was the S&P GSCI Natural Gas dropping 34.22% in January due to a small inventory glut, as Europe stocked up on natural gas in excess of expectations. This echoed the uncertain path forward regarding inflation expectations.

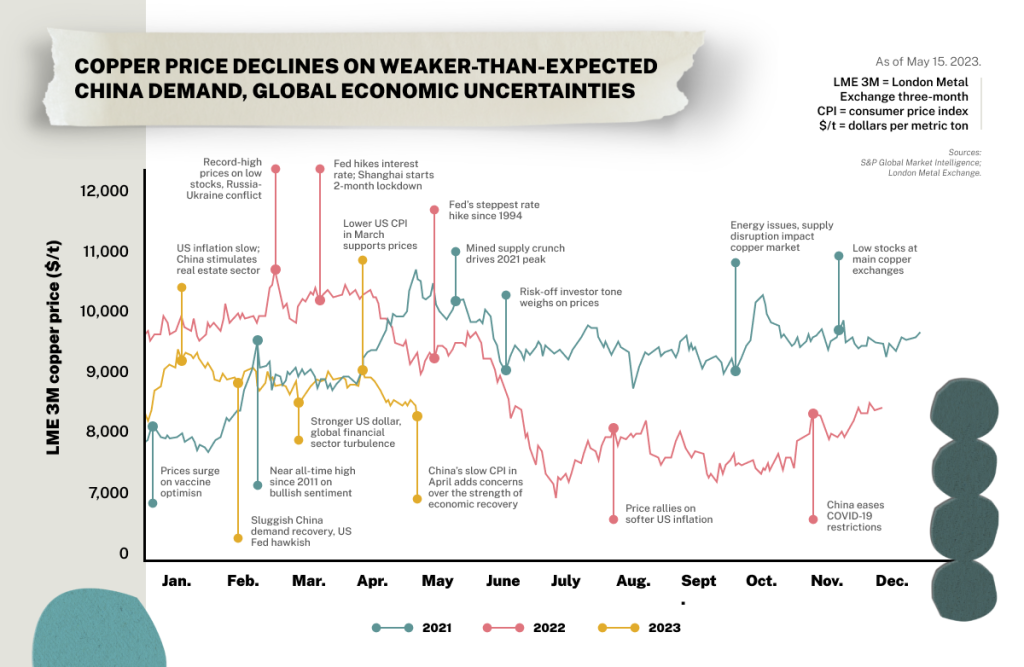

Copper Prices Drop on Demand Weakness and Bearish Sentiment

The London Metal Exchange three-month (LME 3M) copper price fell from $9,086 per metric ton on April 14, 2023, to $8,275 per metric ton on May 12, 2023. This decline was attributed to global copper demand weakness and bearish market sentiment stemming from a further hike in US interest rates in May and the slowest consumer price index growth in China since the beginning of 2021.

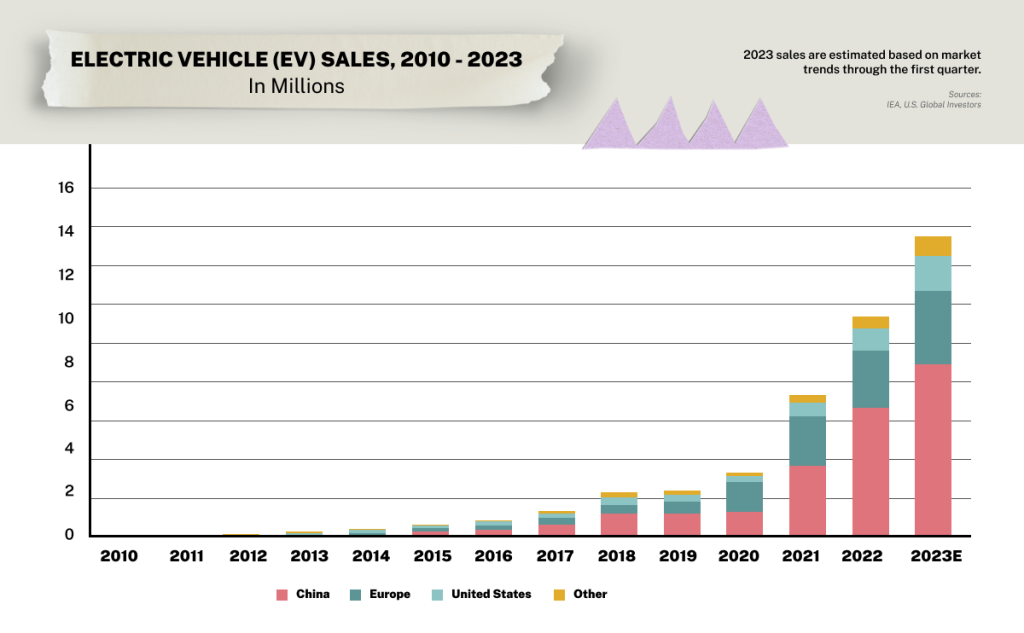

Lithium Surges Amidst EV Boom While Other Commodities Falter

In the first half of the year, lithium emerged as the star performer among commodities, registering an impressive 10.81% gain, making it one of only two commodities to achieve positive returns during the six-month period. Gold was the other commodity to buck the trend. The remaining commodities tracked by the index all lost ground during the six-month period, mirroring a slowdown in global manufacturing activity and a disappointing rebound in China’s economy.

Lithium’s stellar performance can be attributed to the surge in electric vehicle (EV) sales. First-quarter EV sales paint a promising picture for the market, with global sales projected to reach approximately 14 million vehicles by the end of the year. This would represent a robust 35% increase from 2022, propelling the global electric sales share to around 18%, according to the International Energy Agency (IEA).

Grain and Rice Prices Set for an Upturn

In July 2023, Russia’s suspension of the Black Sea grain deal, which facilitated Ukrainian grain exports via sea routes, casted a shadow over global grain and oilseed exports. The termination of the deal, coupled with damaged seaport infrastructure, is poised to strain exports from the region, potentially triggering a price rally in grains and oils.

Furthermore, rice price projections are skewed towards the upside due to trade curbs implemented by India, a country responsible for nearly 40% of global rice exports. In August 2023, in an effort to curb domestic food inflation, India imposed a 20% export duty on non-Basmati parboiled rice, following a ban on non-Basmati white rice exports in July. As a consequence, the US Department of Agriculture anticipates a decline of over 4% in global rice supply year-over-year in 2023.

China’s Faltering Economy Casts a Shadow Over Global Commodities

China’s stuttering economy, characterized by a sharp deterioration in economic activity and credit flows, poses a significant threat to global commodities demand, jeopardizing Beijing’s modest growth targets. While commodities have so far weathered the economic downturn better than other asset classes, fueled by rising fuel consumption in the wake of pandemic-related restrictions and expectations of government stimulus measures, the overall outlook remains concerning.

Traders grappled with a protracted crisis in China’s property market, deflationary pressures, weak export performance, and a depreciating yuan. The government’s strategic shift towards a consumption-driven economy, while beneficial for fuel and food demand, dampened demand for construction-related metals, a hallmark of the old economy.

Orange Juice Prices Surge to Record Highs Amidst Supply Shortages

Orange juice, a staple breakfast beverage, has been steadily climbing over the past few months, reaching an all-time high in 2023. This price increase mirrors the trend of rising prices for other major grocery store items, such as raw sugar and cocoa, even as inflation shows signs of easing.

The surge in orange juice prices is primarily attributed to a combination of factors that have severely impacted orange production in major citrus-growing regions. Hurricanes and inclement weather in Florida, the United States’ primary orange juice producer, ravaged the crop last year, reducing it to its lowest level in nearly eight decades. A late freeze at the end of 2022 further caused extensive damage to the remaining orange trees.

The U.S. Department of Agriculture (USDA) has estimated that Florida’s orange production for 2023 will be around 15.9 million boxes, a staggering 70% decline from the 2020-2021 season. This significant drop in supply has inevitably driven up orange juice prices.

Compounding the issue are supply constraints from other major orange juice exporters, such as Brazil and Mexico. These countries have also revised their production estimates downwards due to crop challenges stemming from unseasonably warm weather.

Impact on Consumers and Businesses

The volatility in the commodities market had a significant impact on consumers and businesses worldwide. Consumers faced higher prices for essential goods such as food, fuel, and transportation, straining their household budgets. Businesses, particularly those in manufacturing and transportation industries, were also affected by rising input costs, impacting their profitability and operational efficiency.

Conclusion

2023 was a tumultuous year for the commodities market, characterized by unprecedented challenges and extreme price volatility. As we look ahead, the path for commodities remains uncertain, shaped by a complex interplay of global factors. Understanding and navigating these dynamics will be crucial for investors, businesses, and policymakers alike.

Disclaimer

Please refer to our terms and conditions for the full disclaimer for Stoic Capital Pte Limited (“Stoic Capital”). No part of this article can be reproduced, redistributed, in any form, whether in whole or part for any purpose without the prior consent of Stoic Capital. The views expressed here reflect the personal views of the staff of Stoic Capital. This article is published strictly for general information and consumption only and not to be regarded as research nor does it constitute an offer, an invitation to offer, a solicitation or a recommendation, financial and/or investment advice of any nature whatsoever by Stoic Capital. Whilst Stoic Capital has taken care to ensure that the information contained therein is complete and accurate, this article is provided on an “as is” basis and using Stoic Capital’s own rates, calculations and methodology. No warranty is given and no liability is accepted by Stoic Capital, its directors and officers for any loss arising directly or indirectly as a result of your acting or relying on any information in this update. This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.