Australian Agriculture Under Siege: Drought Hammers Wheat and Cotton Production

Angel T.

Australia, renowned for its vast agricultural prowess, is facing a formidable foe – a relentless drought that is wreaking havoc on its wheat and cotton sectors. The country’s October rainfall was a mere 65% of the 1961–1990 average, marking the driest October since 2002.

Its agriculture sector is feeling the pinch, as expected drier conditions will cause crop production to fall from record levels in 2022–23.

Wheat: A Staple Grain in Australia’s Agricultural Landscape

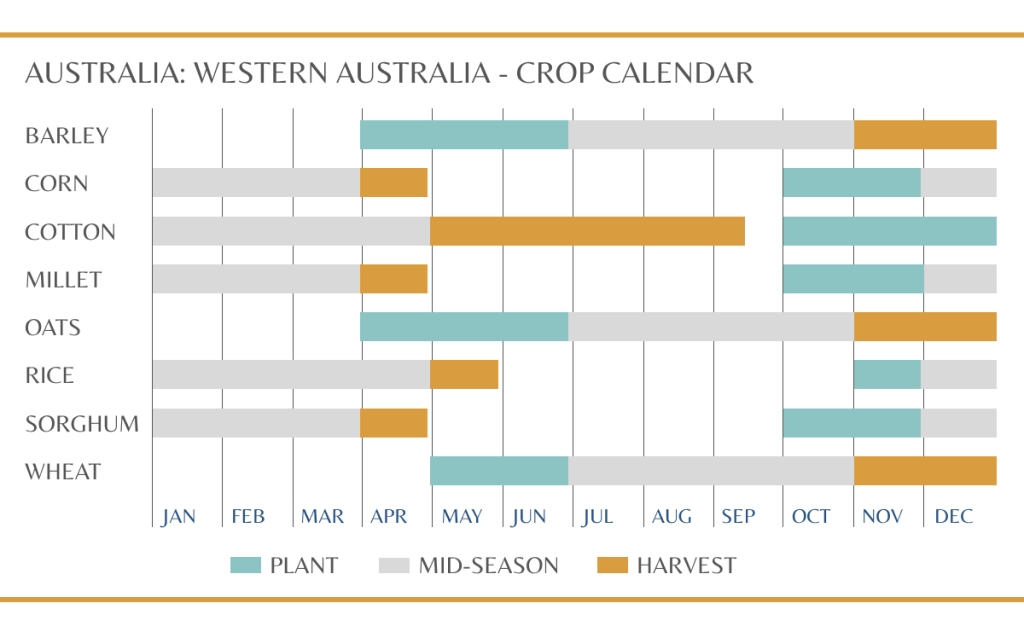

Wheat stands as a cornerstone of Australia’s agricultural production, accounting for the majority of the country’s grain output. The Australian wheat crop cycle begins in April with harvest around November depending on weather conditions. This versatile cereal serves as a crucial ingredient in various food staples, including bread, noodles, and pasta. Despite producing just 3% of the world’s wheat, Australia plays a significant role in global wheat trade, claiming 10-15% of the world’s annual global wheat trade.

Wheat Production Suffers a Significant Blow

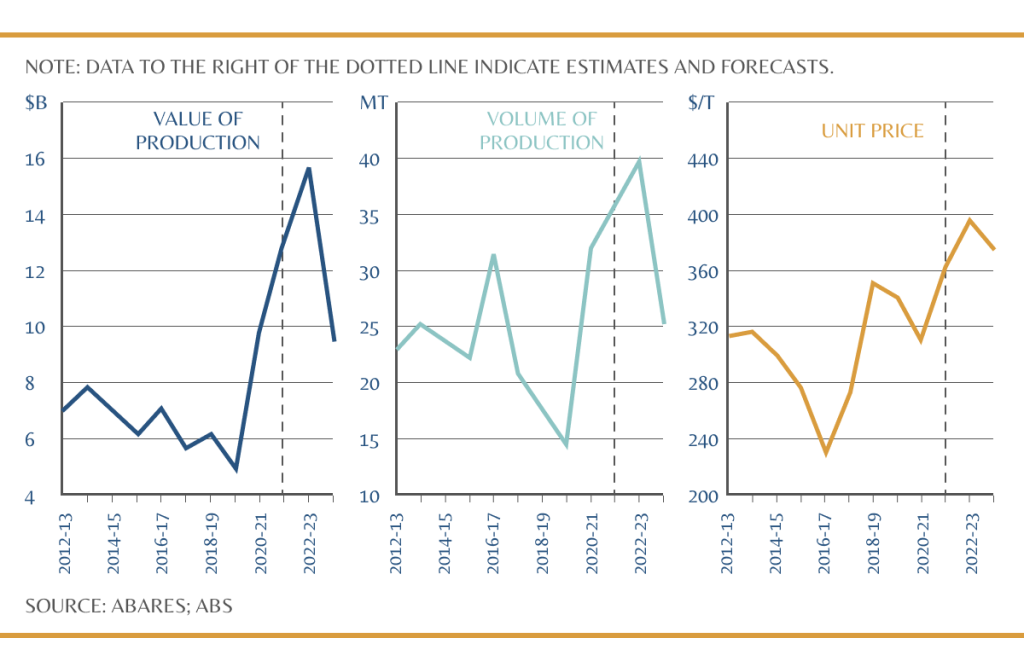

Australia’s wheat production is expected to plummet by 36% YoY to 25.4 million tonnes in 2023–24, around 4% below the 10-year average of 26.4 million tonnes. This substantial decline is anticipated to translate into reduced wheat exports, with volumes declining 40% YoY to 19 million tonnes in 2023–24.

The financial implications of this production slump are equally concerning. The gross value of Australian wheat production is projected to nosedive by 39% to $9.5 billion in 2023–24, a significant drop from the 2022–23 record value of $16.7 billion. This largely reflects a slight downwards revision in wheat production volumes due to lower-than-expected winter rainfall in some regions.

Source: ABARES; ABS

Australian Wheat Export Prices Expected to Dip Amidst Easing Global Supply Concerns

The Australian wheat export price (Australian Premium White) is projected to decline by 6% in 2023–24, averaging around $490 per tonne. This downward trend mirrors a global easing of supply uncertainty following the northern hemisphere harvest, which has alleviated some of the pressure on wheat prices.

Despite the anticipated price dip, Australian wheat exporters are still expected to enjoy relatively high export values. This is attributed to the record-breaking production levels achieved in 2022–23, which have resulted in ample exportable supplies. Additionally, the relatively high prices forecast for 2023–24 are expected to further bolster export values.

Major Asian markets continue to dominate Australian wheat exports, accounting for the largest share of both value and volume. These markets, particularly China, are expected to remain key destinations for Australian wheat in the coming years.

Cotton Farms in Australia

Cotton is a major agricultural commodity in Australia, playing a significant role in the country’s economy and contributing to global textile production. The industry is characterized by its focus on sustainability, water efficiency, and high-quality cotton fibers.

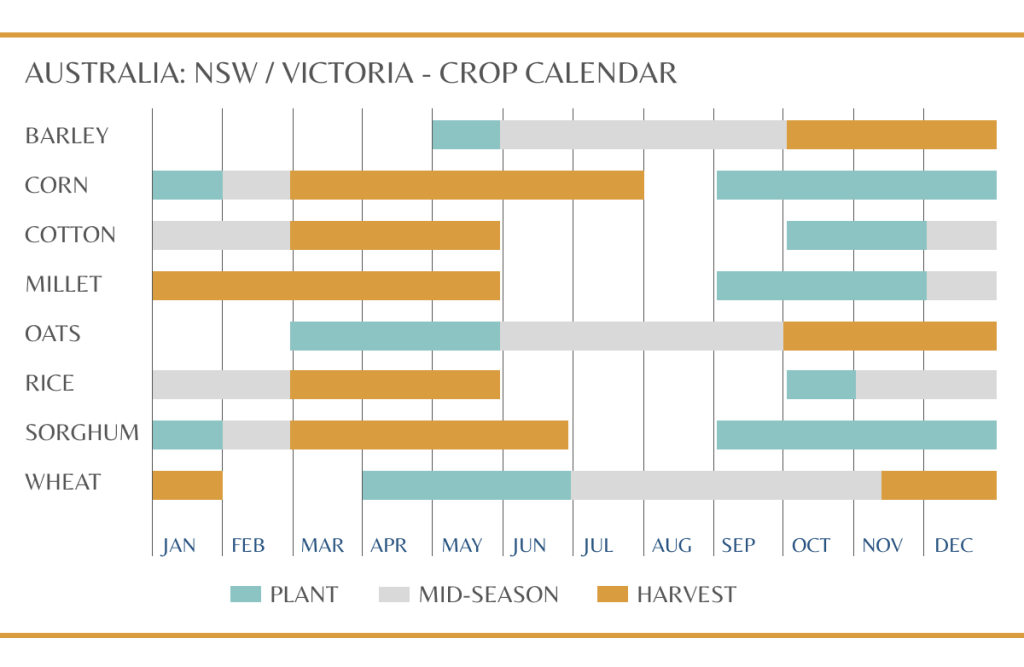

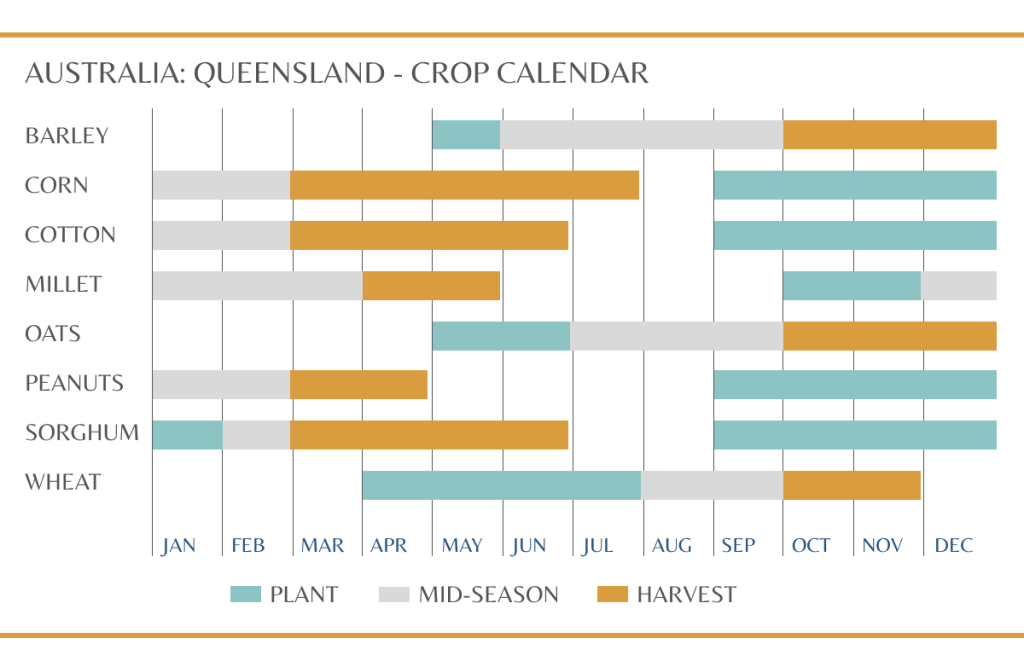

Cotton is primarily grown in New South Wales and Queensland, with the majority of production concentrated in the Darling Downs, Gwydir Valley, and Namoi Valley regions. These areas offer favorable climate conditions and fertile soils suitable for cotton cultivation.

With family farms at the heart of the industry, approximately 90% of Australia’s cotton businesses are family farms, highlighting the strong family-oriented nature of the industry. These families have a deep-rooted connection to the land and a commitment to sustainable cotton production practices.

Cotton Production Faces a Bleak Outlook

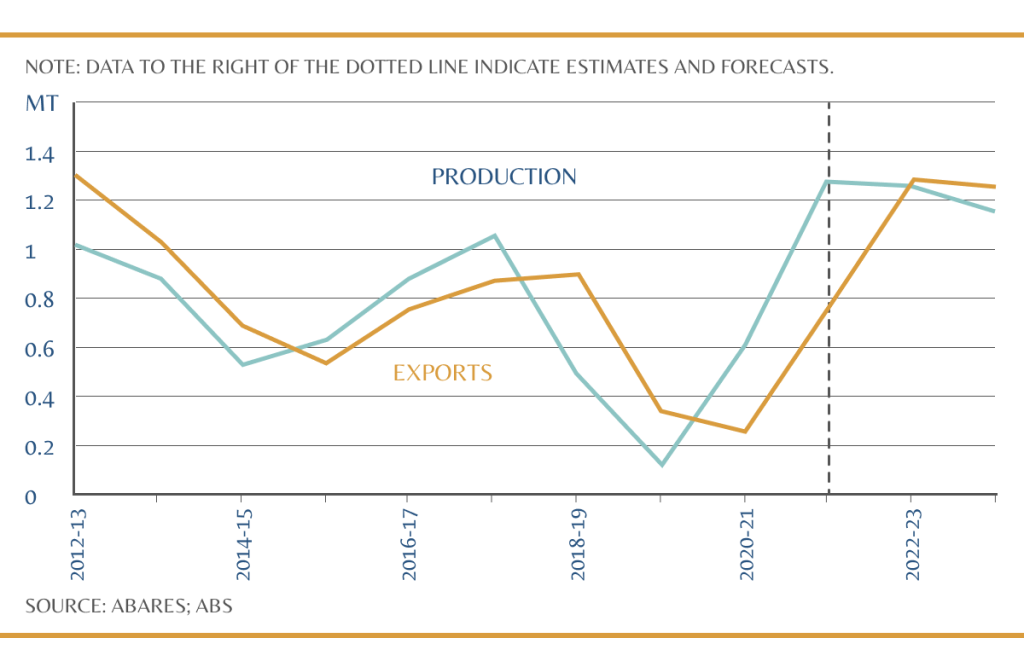

The cotton sector is not immune to the drought’s devastating grip. Australian cotton production is forecast to diminish by 8% to 1.2 million tonnes (or 5 million bales) in 2023–24, a direct consequence of the drier climate conditions that are expected to curtail the area planted to cotton.

This production decline is bound to have a ripple effect on the cotton industry’s financial performance. The gross value of cotton production is poised to tumble to $3.2 billion in 2023–24, an 8% dip from an estimated $3.5 billion in 2022–23.

Global cotton prices are expected to increase by 2% to an average of US103 cents per pound in 2023–24, driven by expected higher consumption and lower production. Despite the anticipated increase in global cotton prices, the impact of lower production volumes is expected to outweigh the price gains.

Source: ABARES; ABS

Export Outlook

Despite the reduced cotton production, high closing stock levels from 2022–23 are expected to keep export volumes relatively high. Cotton export volumes are forecast to fall by a mere 3% to 1.26 million tonnes in 2023–24, still marking the second-highest export volume on record with a 13% market share of the global export market. Strong demand from importing countries such as Vietnam, Indonesia, and India is anticipated to underpin export volumes.

Looking Ahead: A Challenging Path

Australia remains particularly susceptible to the vagaries of El Nino/La Nina, with significant impact on the export supply markets. With the wheat harvest in view, a watchful eye needs to be kept on wheat prices as risk remains to the upside. There’s still some wriggle room for cotton, but persistent soil moisture deficits are increasingly an issue for the 2024 crop.

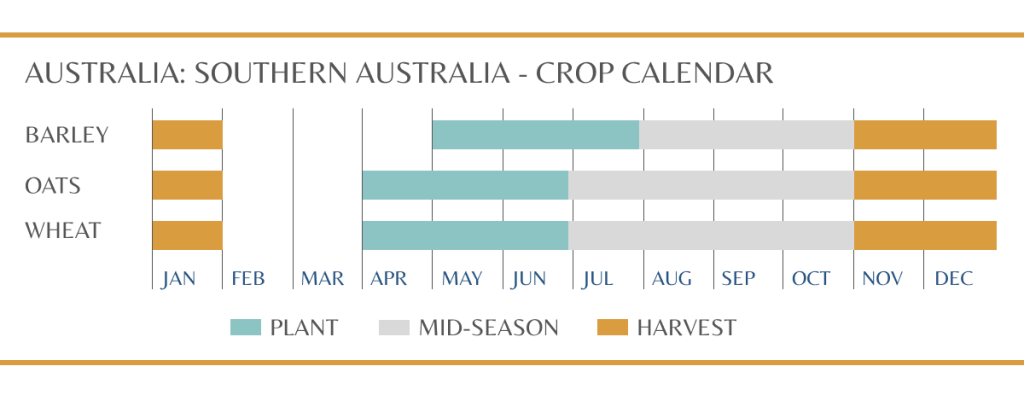

Crop Calendars for Australia

Disclaimer

Please refer to our terms and conditions for the full disclaimer for Stoic Capital Pte Limited (“Stoic Capital”). No part of this article can be reproduced, redistributed, in any form, whether in whole or part for any purpose without the prior consent of Stoic Capital. The views expressed here reflect the personal views of the staff of Stoic Capital. This article is published strictly for general information and consumption only and not to be regarded as research nor does it constitute an offer, an invitation to offer, a solicitation or a recommendation, financial and/or investment advice of any nature whatsoever by Stoic Capital. Whilst Stoic Capital has taken care to ensure that the information contained therein is complete and accurate, this article is provided on an “as is” basis and using Stoic Capital’s own rates, calculations and methodology. No warranty is given and no liability is accepted by Stoic Capital, its directors and officers for any loss arising directly or indirectly as a result of your acting or relying on any information in this update. This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.