Come-hither CBDCs (central bank digital currency)

Isaiah Yap

Are CBDCs really just fiat?

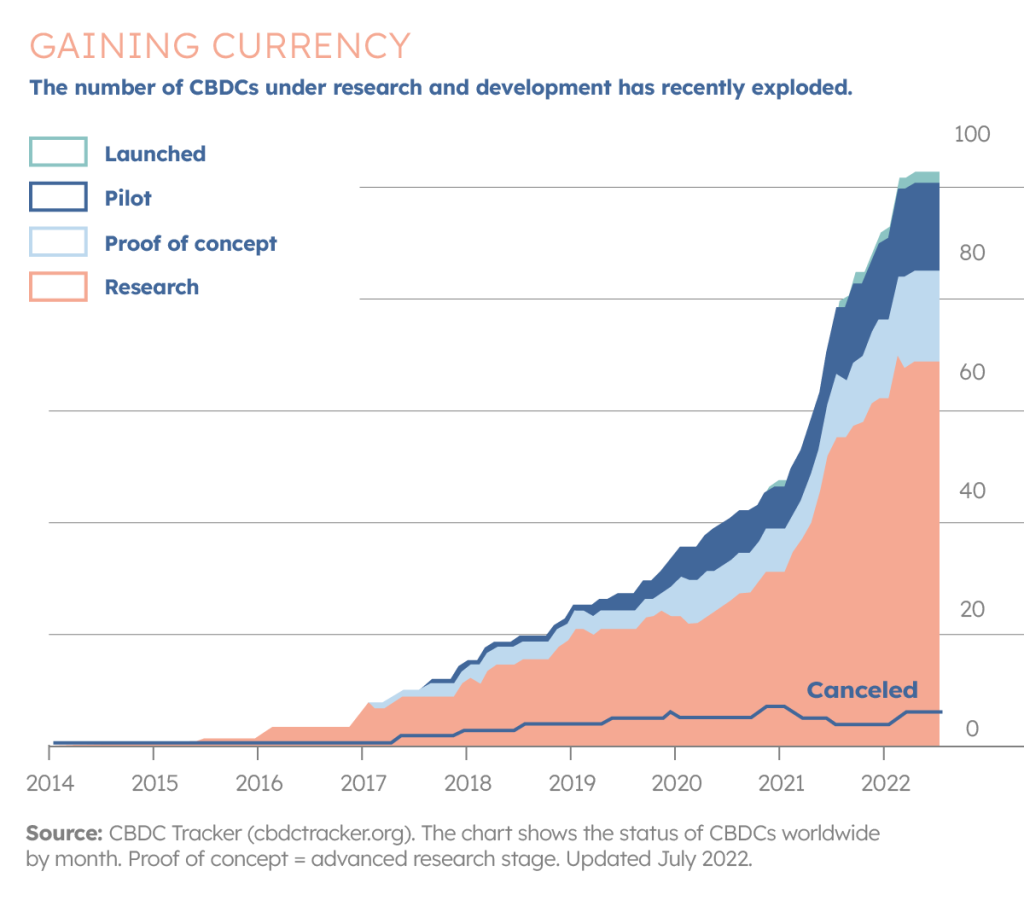

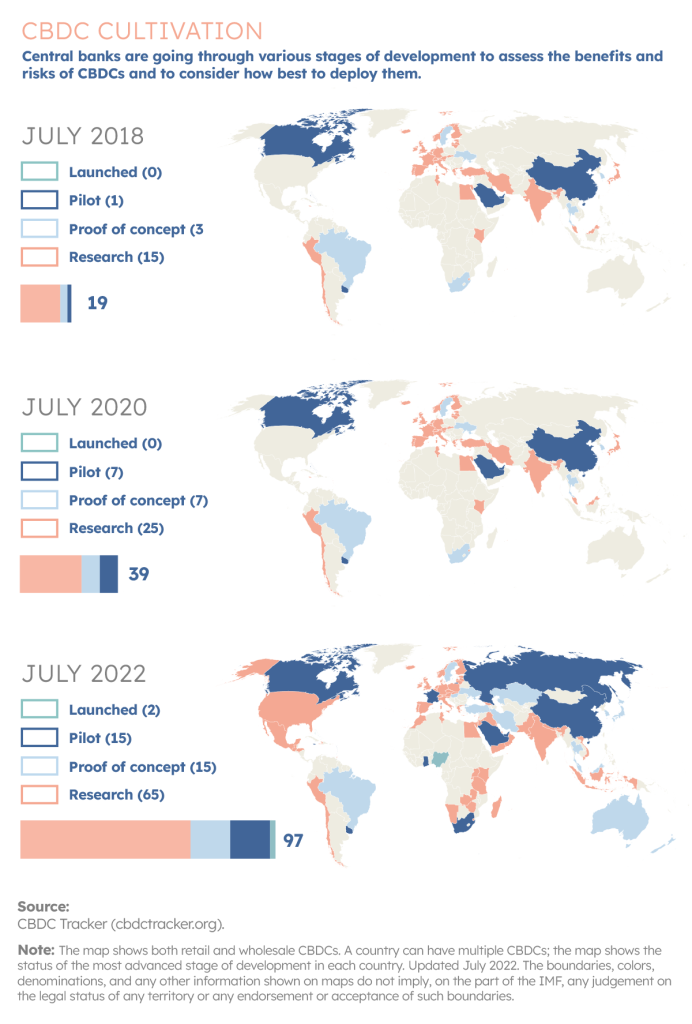

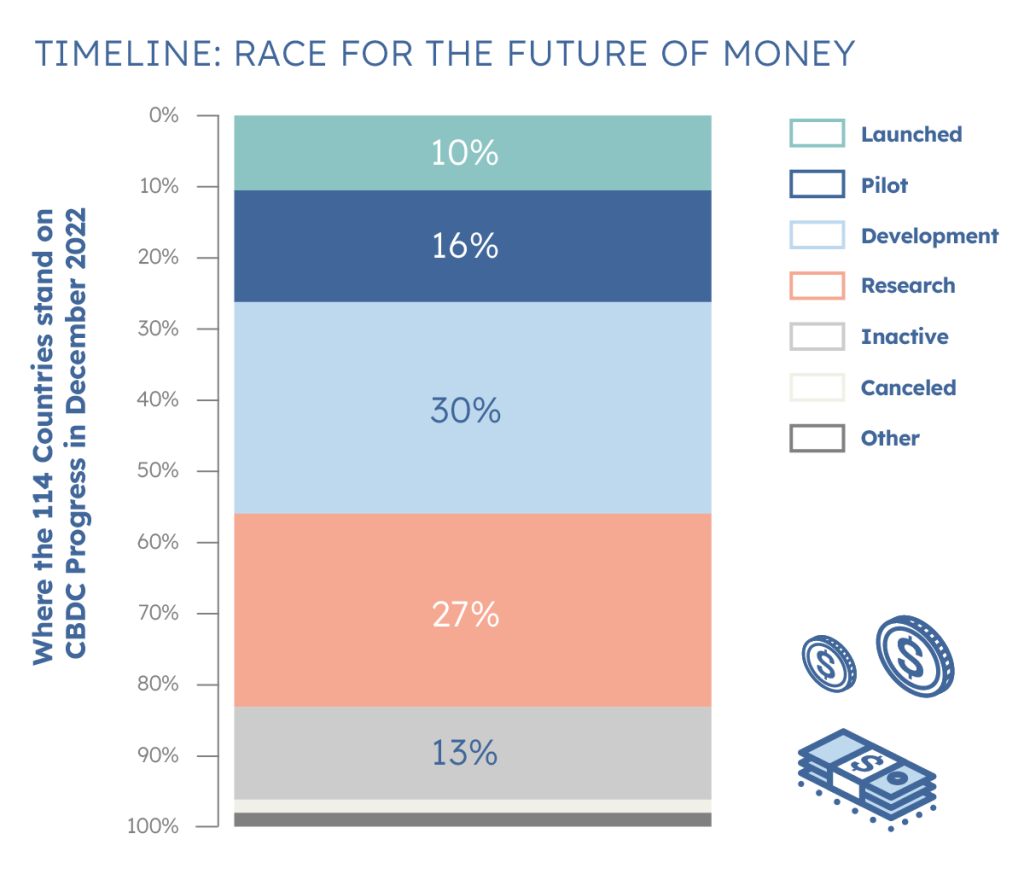

After a tumultuous 2022 for crypto, it seems everyone’s awaiting a new Fawkes to rise from the ashes. Interestingly, the one concept that has endured has been that of the Central Bank Digital Currency – CBDC in short and not to be confused with CBD of course. As of July 2022, there were 97 countries who are at least researching the usage of CBDCs.

CBDC is a digital token issued by a central bank and bears similarities to stable coins. The value of a CBDC is pegged to the value of the country’s fiat currency, but issued and fully backed by a central bank. The concept of a central bank backing a currency has its roots in history, dating way back to Nixon and the gold window, but has evolved in ways vastly different from then.

Now, CBDC sounds similar to fiat, no? Both are digital, both controlled and issued by the central bank and both intended for wider circulation as an accepted payment and held with banks. It seems that the only difference between CBDCs and fiat is that while fiat is backed by the central bank, it remains on the liabilities side of a commercial bank. On the other hand, CBDCs can be direct liabilities of the central bank. Might be time to dive in and see if this is really the case?

Why CBDCs?

Prima facie, CBDCs offer an edge over fiat:

- Allows for easier monitoring by the central bank and more efficient financial transactions, including cross-border transactions.

- Offers an alternative to accessing or using fiat in remote areas – your PIN-secured mobile under the pillow instead of hard cash;

- Electronic cash is king – the only really stable form of electronic money compared to even stablecoins

- Allows for the implementation of Purpose-Bound Money (more applicable to Singapore)

All of the above reasons explain why central banks are exploring CBDCs, for whom CBDCs offer a foothold into the digital currency space while dealing with the attendant AML risks. More importantly, CBDCs allow central banks to tackle the growing risk of a burgeoning shadow banking system over which they have little regulatory control. A secondary reason for central banks to explore the CBDC route, has been to possibly allow a more direct lever into controlling money supply. Since the GFC and more recently in the pandemic, central banks have been shifting their emphasis away from controlling money supply through commercial banks and directly into the real economy. By sidestepping the traditional money-multiplier-loan-book of commercial banks – though not in a significant way – central banks no longer have to deal with a reluctance to lend or misdirection of money supply away from the real economy into complex WMDs securities . Instead, CBDCs can allow central banks to directly influence the money supply via manna from (electronic) heaven.

The resistance in the general population to CBDCs, stem largely from social considerations. Speculation is rife that CBDCs allow for local governments to track every dollar from point to point. While not everyone engages in money laundering, almost everyone would like some privacy as to where they spend their money. Concerns over a big brother/nanny state controlling every aspect of an individual’s economic life are not to be dismissed given the flippant nature of regimes across the world now. Another aspect, would be the oft forgotten understanding that CBDCs rely on a digitally savvy user base – one which often precludes the older segment of a population. In this age of digitalisation, taking away the comforting feeling of cold hard cash could be the last straw for a population fatigued from dealing with increasingly realistic scams, spotty data coverage, hundreds of passwords and endless 2FAs.

Do we actually need CBDCs?

So, if not CBDCs, what then? Obviously, we could stick to fiat for now, which is the case for many countries including Singapore, with MAS stating the use of CBDCs is “not compelling for now”. Looking at it from a consumer standpoint, fund transfers are already quick and seamless between users from different banks through new technological applications such as PayNow and Paylah. Even countries such as China, which has already crossed 100B Yuan in CBDC usage, Alipay and WeChat Pay have already been deeply entrenched for nearly a decade in the wider population regardless of location and age.

There has also been reports that have said that consumers in China have shown little enthusiasm for their country’s CBDCs which many suspect was devised to curb the undisputed dominance of Alibaba and Tencent over traditional banks. The thought of PBOC having to deal with the two software and financial behemoths to control money supply is a chilling one. With CBDCs offering an alternative to traditional e-payments, the government may have to legally dictate that their solution remains the best, but why kill its own payment sector just for a solution that is similar in nature and usage?

Furthermore, CBDCs do not address the key risk of any fiat system – that central banks have superior wisdom in managing the economy without resorting to printing and devaluation.

Progress on inclusion of CBDCs

How far along is the world in their adoption of CBDCs? CBDCs may not be that far into the future as many may think. According to the Atlantic Council of the United States, 20 countries are going to be taking significant steps in 2023, where countries like Thailand, South Korea and Australia amongst others will be looking to begin or to continue their pilot testing of their CBDCs. The European Union is likely to start a pilot next year as well. Even Singapore is exploring the use of CBDCs, albeit cautiously.

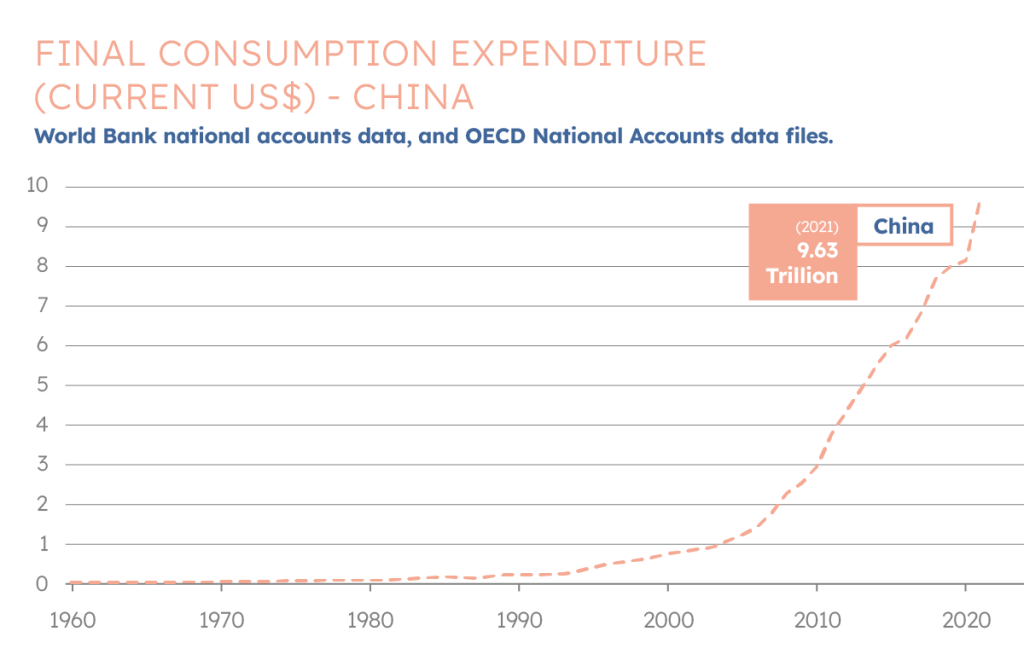

Furthermore, as previously stated, there is already a working solution of CBDCs in one of the biggest economies in the world, China. Their CBDC trial has been ongoing since 2020, and total spending has surpassed 100 billion yuan. Although this is an inconsequential proportion of China’s total consumer spending (about 1%), it nevertheless shows promise that one of the biggest economies with an already digital payment savvy population with such diverse regions can find practical applications for the CBDC.

Unfortunately, as advanced China may be in terms of fintech, the fact that they are spearheading the CBDC effort has many sceptical of the real motives behind the push. Many have cited China’s human rights track record and hard-handedness during the pandemic as a theory that CBDCs are merely surveillance tools for governments.

The jury is out for CBDCs. It runs against the raison d’être for decentralised crypto or stablecoins, but provides the issuer of last resort comfort that these lack. As a digital payment solution, it makes even less sense given the strong incumbents and ongoing efforts to streamline and secure existing platforms. This then begs the question as to whether there is really a need for CBDCs. There’s less doubt as to implementation, but the question is which will you choose when the time comes for practical usage.

Disclaimer

Please refer to our terms and conditions for the full disclaimer for Stoic Capital Pte Limited (“Stoic Capital”). No part of this article can be reproduced, redistributed, in any form, whether in whole or part for any purpose without the prior consent of Stoic Capital. The views expressed here reflect the personal views of the staff of Stoic Capital. This article is published strictly for general information and consumption only and not to be regarded as research nor does it constitute an offer, an invitation to offer, a solicitation or a recommendation, financial and/or investment advice of any nature whatsoever by Stoic Capital. Whilst Stoic Capital has taken care to ensure that the information contained therein is complete and accurate, this article is provided on an “as is” basis and using Stoic Capital’s own rates, calculations and methodology. No warranty is given and no liability is accepted by Stoic Capital, its directors and officers for any loss arising directly or indirectly as a result of your acting or relying on any information in this update. This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.