Housing. Resilience or Froth.

Isaiah Yap

Inflation. Or rather, inflation and rate hikes. Sometimes we wonder if it wasn’t brought on by geopolitics – inflation that is. Central banks around the world, with the exception of China have been drastically tightening, led in no doubt by the Fed. Singapore has been no exception, but given the role of the USD in the global economy, most countries including ourselves are on a de facto peg. Previously, we rambled aloud about the effect of interest rate hikes (The Domino Effect of US Interest Rate Hikes – Stoic Capital). 6 months later, key indicators are treading into worrying levels.

Monetary policy

Interest rates are but one of the monetary policy tools used by the Fed. More ingenious ways have emerged since the GFC back in 2008, and the injection and withdrawal of liquidity into the monetary/financial system has become more convoluted, blurring the lines between fiscal and monetary policy. Hence the evolution of acronyms – QE, QT, etc – and more recently, pivot.

Anyway, simplistically speaking, interest rates determine the cost of funds for both businesses and individuals. Hiking rates drives up the cost of borrowing, as does the expectations of future hikes which subtly influence future borrowing decisions. By doing so, the Fed controls both money supply and credit cost in moderating the US economy, albeit with the usual monetary policy time lag. The impact reverberates through the global economy.

At the most recent Federal Open Market Committee (FOMC) press conference on November 2, Jerome Powell, the chairman of the Federal Reserve, voiced the Committee’s strong commitment to returning inflation to its 2% objective. Market expectations of a pivot were dashed, and the reality sank in – the Fed was determined not to lose credibility with a lip service pause followed by aggressive cuts.

“Today, the FOMC raised our policy interest rate by 75 basis points, and we continue to anticipate that ongoing increases will be appropriate.

Let me say this, it is very premature to be thinking about pausing. So people, when they hear lags, they think about a pause. It’s very premature in my view to think about or be talking about pausing our rate hike. We have a ways to go, our policy, we need ongoing rate hikes to get to that level of sufficiently restrictive.“

From Jerome Powell, Chairperson of the Federal Reserve, 2nd November 2022 Press Conference for the FOMC.

Conversely, a dip in CPI readings last week renewed hopes of a Fed pivot, triggering a violent knee jerk rally which had all the signs of severely stressed market conditions. But now that the magnitude of successive hikes have brought absolute interest levels back to or exceeding GFC levels, surely the impact from such high absolute levels is non-trivial. Even if the Fed paused for the lagged impact to come through, what lies ahead seems bleak.

Key Indicators have turned South

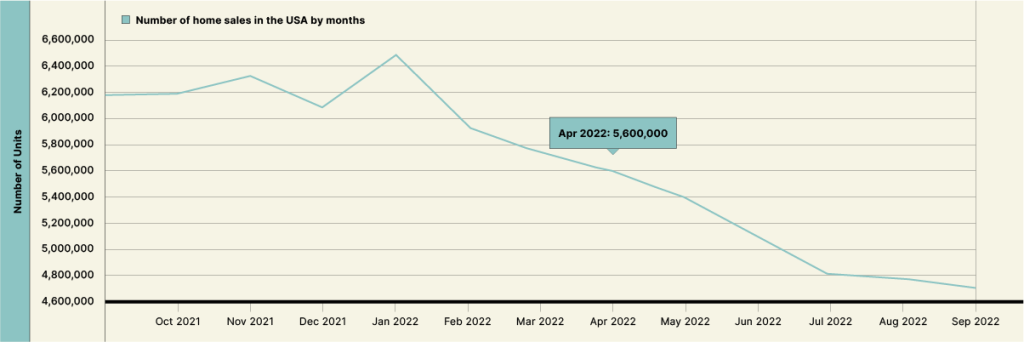

Based on Federal Reserve Economic Data (FRED), existing home sales have fallen from 5.61 million in Apr 2022 to 4.71 million units in Sep 2022, a 16% drop in five months.

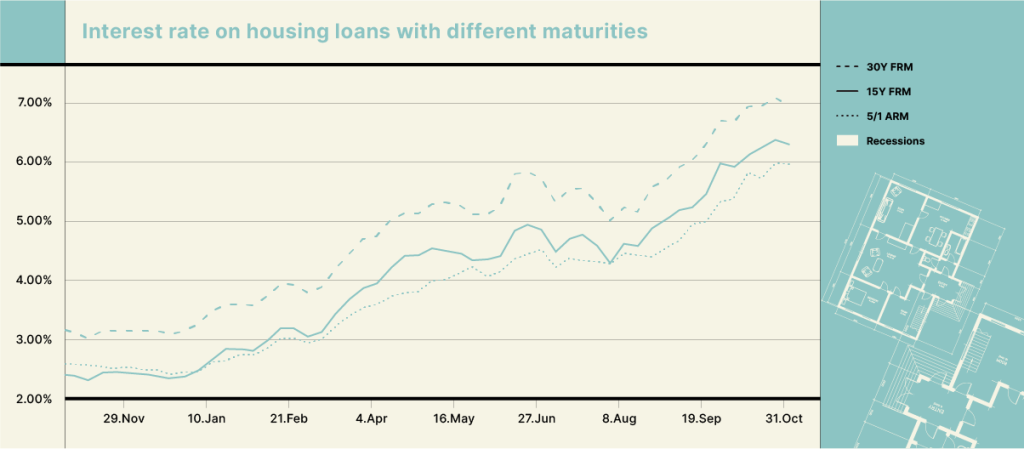

In the US, Freddie and Fannie were chartered to support the U.S. housing finance system and to help ensure a reliable and affordable supply of mortgage funds across the country. Each week, Freddie Mac surveys lenders on the rates and points for their most popular 30-year fixed-rate, 15-year fixed-rate and 5/1 hybrid amortising adjustable-rate mortgage products. The survey is based on first-lien prime conventional conforming home purchase mortgages with a loan-to-value of 80 percent. The adjustable-rate mortgage (ARM) products are indexed to U.S. Treasury yields and lenders are asked for both the initial coupon rate and points as well as the margin on the ARM products. Freddie Mac’s data shows both fixed-rate mortgages (FRM) and adjustable-rate mortgages (ARM) have been inching upwards to a 10-year high on the week ending Oct 26, 2022 with the 30-yr FRM at 7.08%, 15-yr FRM at 6.36% and 5/1-yr ARM at 5.96%.

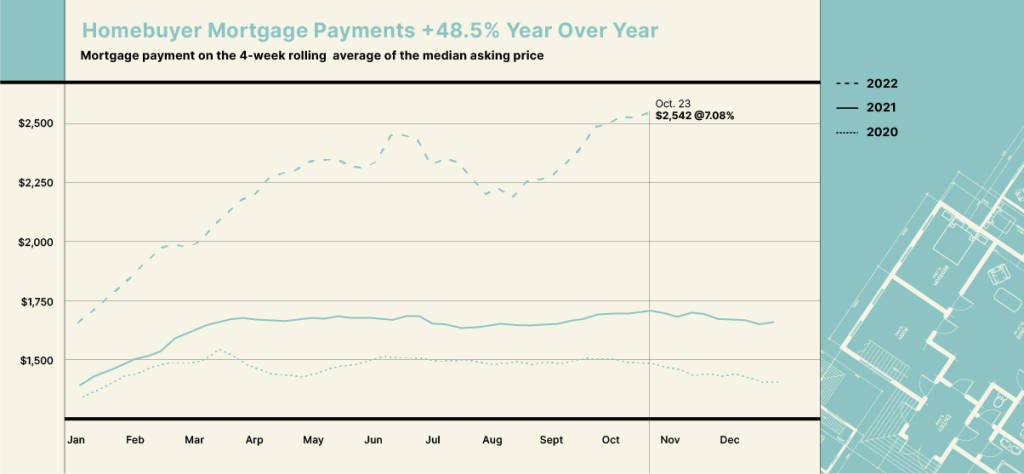

One can conjecture that rate hikes have had a discernible impact on housing sales with housing loan affordability drastically reduced from the jump in mortgage rates. To illustrate, existing homeowners with an adjustable-rate mortgage would have seen their mortgage payments increase by 48.5% YoY, hitting a high of USD 2,542 per month as of October 23. Enough for many to pause for thought before entering the housing market (in the US of course, no such pause in Singapore).

Now what?

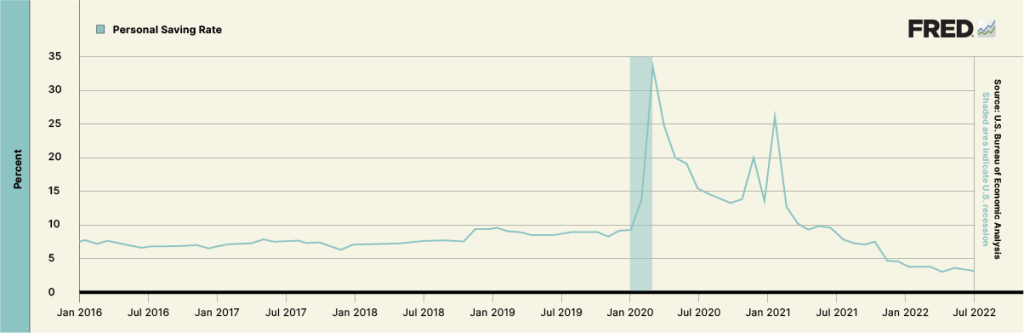

It’s been 9 months since the Fed embarked on its rate hike cycle, and the S&P 500 has dropped by more than 15%. US personal savings rates hit a new low of 3.1% in September 2022 following the initial spike from Covid checks issued back in 2020. US credit card debt has ballooned from USD 846 billion in April 2022 to USD 963 billion as of October 28, 2022. To cap it all off, wage growth has lagged inflation.

With all signs pointing to a recession (in the US only, never Singapore of course), it’s amazing that market positioning and sentiment has remained so resiliently optimistic. The property market in Singapore is a case in point – exhibiting phenomenal divergence in transactions, price and rental rates. Something we’ll delve into in our subsequent articles.

Conclusion

It looks bleak enough in the US, but surely Singapore is insulated some say? We are starting to see some disturbing parallels with the early days of Covid when it was then classified as a uniquely “China problem” – a fallacy swiftly disproved in the following months, lasting years. As we continue to be plagued by urban myths of Chinese billionaire covid refugees flooding into the physical asset market here sweeping up anything within the “affordable range of 8 figures”, we remain ignorantly unconvinced by the rosy outlook but tread cautiously as we navigate a structurally different daily-market-sentiment-driven landscape.

Disclaimer

Please refer to our terms and conditions for the full disclaimer for Stoic Capital Pte Limited (“Stoic Capital”). No part of this article can be reproduced, redistributed, in any form, whether in whole or part for any purpose without the prior consent of Stoic Capital. The views expressed here reflect the personal views of the staff of Stoic Capital. This article is published strictly for general information and consumption only and not to be regarded as research nor does it constitute an offer, an invitation to offer, a solicitation or a recommendation, financial and/or investment advice of any nature whatsoever by Stoic Capital. Whilst Stoic Capital has taken care to ensure that the information contained therein is complete and accurate, this article is provided on an “as is” basis and using Stoic Capital’s own rates, calculations and methodology. No warranty is given and no liability is accepted by Stoic Capital, its directors and officers for any loss arising directly or indirectly as a result of your acting or relying on any information in this update. This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.